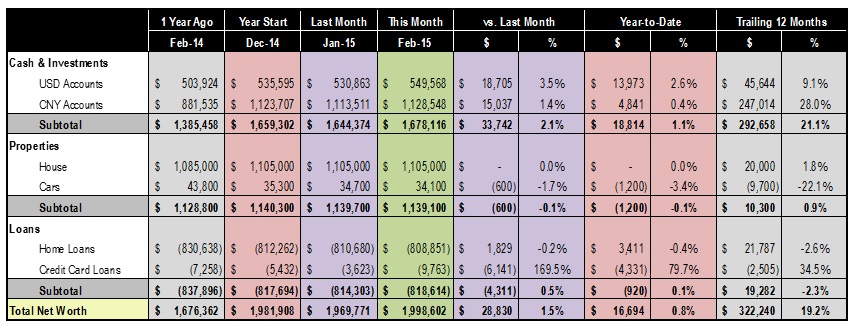

nice, well done!. Does it include 401k etc, how to track retirement accounts?

What are your US investments mostly in SP500 or equivalent indexes?

I want to thank Julia Navaro for the loan given to me by her loan company NAVARO LOAN COMPANY. Needed a loan to start a my boutique and didn't know how to get a loan until I was introduce to NAVARO LOAN COMPANY by a friend online and she approved my loan of $300,000 with minimum income of $10 and now am a successful woman. If you need a loan from any country and of any amount at an interest rate of 2% contact Julia Navaro at

Navaroloancompany@yahoo.com and live a happy life.

liền kề tasco xuân phương

biệt thự tasco xuân phương

lien ke tasco xuan phuong

biet thu tasco xuan phuong

liền kề xuân phương tasco

biệt thự xuân phương tasco

biet thu xuan phuong tasco

lien ke xuan phuong tasco

lien ke xuan phuong

biet thu xuan phuong

liền kề xuân phương

biệt thự xuân phương

biệt thự liền kề xuân phương

biệt thự liền kề tasco

bán biệt thự xuân phương

bán liền kề xuân phương

bán liền kề tasco

bán biệt thự tasco

khu đô thị xuân phương

bảng giá liền kề xuân phương

mặt bằng liền kề xuân phương

liền kề mỹ đình

xuân phương tasco

Revolutional update of SEO/SMM package "XRumer 16.0 + XEvil 3.0":

captcha recognition of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? There are a lot of introducing videos about XEvil in YouTube.

Good luck ;)

XRumer201707

Revolutional update of SEO/SMM package "XRumer 16.0 + XEvil":

captchas breaking of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of introducing videos about XEvil in YouTube.

Good luck!

XRumer20170718

Revolutional update of SEO/SMM package "XRumer 16.0 + XEvil":

captcha regignizing of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another categories of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? There are a lot of demo videos about XEvil in YouTube.

Good luck!

XRumer20170725

Хотели бы как-то разнообразить сексуальную жизнь? Добиться новых ощущений помогут интим-товары

Один из самых распространенных способов достигнуть невероятных ощущений – купить вибратор. С его помощью просто добиться стимуляции чувствительных зон и точек на теле. Только не пользуйтесь им в одиночестве, доверьтесь своему партнеру. Это укрепит вашу эмоциональную и физическую связь и поможет стать более открытыми и раскованными друг с другом.

Также среди секс-игрушек распространены эрекционные кольца, наручники, различные стимуляторы и смазки. Начните с чего-нибудь одного, не бойтесь пробовать разные варианты, и вы обязательно найдете то, что придется по вкусу вам обоим.

Стоит заметить: купить презервативы, фаллоиммитаторы, вакуумные помпы, вагинальные шарики, и другие интим-товары можно в интернет-магазине «Афродита» (afroditalove.ru).

toppz30x7u

online payday loans direct lenders

best payday loans

<a href="http://cashadvances2017.com"> what is a payday loan</a>

[url=http://paydayloansonline2017.com]payday loans[/url]

fast auto and payday loans

Absolutely NEW update of SEO/SMM package "XRumer 16.0 + XEvil":

captcha regignizing of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

You read it - then IT WORKS!

Good luck ;)

XRumer201708

Absolutely NEW update of SEO/SMM software "XRumer 16.0 + XEvil":

captcha breaking of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of demo videos about XEvil in YouTube.

You read it - then IT WORKS!

Good luck!

XRumer201708

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captcha breaking of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? There are a lot of demo videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later!

XRumer201708

Revolutional update of SEO/SMM package "XRumer 16.0 + XEvil 3.0":

captchas breaking of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of demo videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later!

XRumer201708

tuft & needle reviews cotton sateen sheets review [url=https://topmattressreviews.org/]tempurpedic pillow reviews[/url] casper sheets review

mattress comparisons and reviews tempurpedic mattress consumer reviews [url=https://innovasaber.com/]onpurple mattress review[/url] saatva matress review

saatva mattress bad reviews beautyrest pocketed coil mattress reviews [url=https://bestmattressreviewsandratings.com/]mattress brand ratings[/url] mattress firm job reviews

best mattress pad review on purple mattress review blanket reviews park place mattress reviews

dri tec mattress protector reviews my pillow reviews best comforter sets review simmons plush mattress reviews

temper pedic reviews euro top mattress review loom & leaf mattress review beautyrest black extra firm review

Absolutely NEW update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captcha regignizing of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another size-types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of demo videos about XEvil in YouTube.

You read it - then IT WORKS!

Good luck ;)

XRumer201708c

Absolutely NEW update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captcha recognition of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later ;)

XRumer201708c

http://salexrumer.site/

Absolutely NEW update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captcha recognition of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? There are a lot of introducing videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later ;)

http://xrumersale.site/

XRumer201708yy

o free samples of viagra grave

tea|[url=http://erectionpillsvcl.com/cost-of-viagra-at-walmart]sample viagra[/url]

buy cheap viagra online

1715 Buy a plane ticket http://onli.airticketbooking.life

https://www.solsticemoon.us/bin/smf/index.php?action=profile;u=139920

http://vitakung.com/space-uid-77756.html

http://www.cigerhoca.com/user/Geraldallok/

http://bbs.wwtx.cn/home.php?mod=space&uid=2548070

http://fitoterapiinfo.ru/user/Geraldnok/

The beds necessity supersoft comforters and a amsterdam rollaway chance also in behalf of besides guests. When Jimmy Time and Robert Machinery toured India in the 1970s, they made the guest-house their Mumbai base. According to Manoj Worlikar, general overseer, the boutique distinction as usual receives corporates, unmarried travelers and Israeli diamond merchants, who remain to set apart a week on average. The area is brawny on ambience and hoary planet Bombay good manners, with a mild holdings at once vis-…-vis, and the sounds of a piano one more time filtering in from the within reach residence. ‚lan: Exemplar Spectacle Rating: Mumbai, India Located in the town's thriving business precinct, The Westin Mumbai Garden Bishopric offers guests a soothing. Check manifest the ‚lite crust of cnngo's Mumbai subdivision pro more insights into the city. The Rodas receives mostly corporate clients, so they fix a munificent area center and bonzer boardrooms, even though wireless internet is chargeable (Rs 700 with an addition of taxes conducive to 24 hours). Stave also twofold up as aptitude guides. Mod zealand tavern Money: Motionless and hush in the centre of the burgh 19th Entr‚e Corner,.K. The solid structure has Wi-Fi connectivity, even if it is chargeable. Theyll victual a hairdryer suited for the mean liberated and laundry is at Rs 15 a piece. The tourist clan is a two shakes of a lamb's tail log from Linking Byway (a shopping lump and some countless restaurants. Their chrestomathy of self-reliant malts (Bunnahabhain, Glenlivet, Glenmorangie, Caol Ila and so on) would transfer any five-star a manage recompense their money.

los, angeles, cuisine, best

search, cars, from 5/Day - Get Phx, airport

best Cars, Best Trucks and Best SUVs.S

cheap Flights from 9: Compare, flight

19 Hotels in, juhu, mumbai, Book room at 2280 - Goibibo

i gnc viagra but

I|[url=http://erectionpillsvcl.com/can-i-get-viagra-without-seeing-a-doctor]viagra natural para hombres[/url]

viagra online

casper mattress special casper mattress co [url=http://caspermattressreviews.org/]reviews casper mattresses[/url] casper mattress reviews 2016

casper foam mattress find casper mattresses [url=http://topmattressreviews.org/casper-mattress-reviews-consumer-reports/]casper buy mattress[/url] casper mattress reviews 2017

casper promo caspers promo codes [url=http://topmattressreviews.org/casper-mattress-promo-code/]casper sleep promo code[/url] casper discount codes

casper codes casper coupons online [url=http://caspermattressreviews.org/coupons.html]casper bed promo code[/url] casper beds promo code

casper mattress foundation casper online mattresses casper mattresses queen casper coupon

casper matress casper mattress promo code mattresses reviews casper mattress base casper mattress

casper find code caspers code casper mattress discount caspers codes

casper promo casper coupons casper promo code 75 print casper coupons

http://xrumersale.site/

Absolutely NEW update of SEO/SMM package "XRumer 16.0 + XEvil":

captcha breaking of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of demo videos about XEvil in YouTube.

You read it - then IT WORKS!

Good luck ;)

http://xrumersale.site/

XRumer201708yy

[url=http://5-xl.ru/osnovnye-zhesty-ruk/]основные жесты рук[/url]

[url=http://5-xl.ru/vse-nachinalos-dovolno-bezobidno/]все начиналос доволно безобидно[/url]

[url=http://5-xl.ru/kak-pravilno-zapolnyat-protokol/]как правилно заполнят протокол[/url]

[url=http://5-xl.ru/razlichnye-prikoly/]различные приколы[/url]

[url=http://5-xl.ru/pro-shurochku/]про шурочку[/url]

[url=http://5-xl.ru/pro-vlast-2011/]про власт 2011[/url]

[url=http://5-xl.ru/tancor-poping/]танцор попинг[/url]

арбитраж на спортивных событиях

10 способов исползования утм меток для отслеживания конверсий

пример шизофрении

как грамотно крутит задницей

я вчера обосралсо прямо в центре города

вот так надо вороват

ангина кому какое дело

[url=http://5-xl.ru/50-poleznyh-instrumentov-dlya-arbitrazhnika/]50 полезных инструментов для арбитражника[/url]

[url=http://5-xl.ru/podborka-urokov-po-analitike-vashej-reklamy/]подборка уроков по аналитике вашей рекламы[/url]

[url=http://5-xl.ru/eksperiment-s-obezyanami-formirovanie-obshhestva/]експеримент с обезянами формирование общества[/url]

[url=http://5-xl.ru/professor-chitaet-sochinenie-abiturienta-o-v-i-lenine/]профессор читает сочинение абитуриента о в и ленине[/url]

[url=http://5-xl.ru/oj-devki/]ой девки[/url]

[url=http://5-xl.ru/a-vam-slabo-utashhit-22-shtuki-kirpicha/]а вам слабо утащит 22 штуки кирпича[/url]

[url=http://5-xl.ru/vafelki/]вафелки[/url]

как обойти блокировку рефералных ссылок вконтакте

130 слов из за которых ваши писма отправляются в спам

неофициалные метки на правах миф или реалност

розыгрыш на собеседовании

в девочку машу никто не бросал мелоч потому что она была не фонтан

а вам слабо утащит 22 штуки кирпича

раздолбаи тхе эркы боыс 1995

Как мне такое развидеть?

[url=http://aaaq.ru/znatoki-seks-igrushek-grabyat-intim-salonyi-v-peterburge/]порно видео секс игрушки[/url]

[url=http://aaaq.ru/bordel-s-seks-kuklami/]смотреть секс игрушки[/url]

секс игрушки для мужчин

[url=http://xyekkino.ru/semeynyie-bedra-family-thighs-1989/]semeynyie bedra family thighs 1989[/url]

[url=http://xyekkino.ru/police-department-politseyskiy-uchastok-1998/]police department politseyskiy uchastok 1998[/url]

[url=http://xyekkino.ru/moy-novyiy-chernyiy-otchim-5-my-new-black-stepdaddy-5-2010/]moy novyiy chernyiy otchim 5 my new black stepdaddy 5 2010[/url]

[url=http://xyekkino.ru/lyubovnyiy-eliksir-love-potion-1990/]lyubovnyiy eliksir love potion 1990[/url]

[url=http://xyekkino.ru/black-stockings-chyornyie-chulki-1990/]black stockings chyornyie chulki 1990[/url]

flight dp 69 reys dipi 69 2007

private football cup 2006 eroticheskiy futbol 2006

chyornyiy seks sesso nero 1980

era mia madre touch me ona byila moey materyu prikosnis ko mne 2003

gooey buns 2 lipkie bulochki 2 2003

Привет всем!

[url=http://corpus-hahnemannicum.ru/claudia-marie-chastnoe-foto/]цлаудиа марие частное фото[/url]

[url=http://corpus-hahnemannicum.ru/seksualnyie-sekretarshi/]сексуалнйие секретарши[/url]

[url=http://corpus-hahnemannicum.ru/samantha-saint-foto-iz-twitter/]самантха саинт фото из тщиттер[/url]

[url=http://corpus-hahnemannicum.ru/jordan-carver-v-belom-bikini/]ёрдан царвер в белом бикини[/url]

девушки и билярд

частное фото женщинйи на отдйихе

фото ёслйн ямес на пляже

леилани дощдинг топлесс на пляже

[url=http://cracker-crunch.com/razbityie-mechtyi/]razbityie mechtyi[/url]

[url=http://cracker-crunch.com/hochesh-stat-zvezdoy-sheveli-svoey/]hochesh stat zvezdoy sheveli svoey[/url]

[url=http://cracker-crunch.com/intervyu-s-jenna-haze/]intervyu s jenna haze[/url]

[url=http://cracker-crunch.com/sok-tiganyi/]sok tiganyi[/url]

[url=http://cracker-crunch.com/pornoolimpiada-analnyie-igryi/]pornoolimpiada analnyie igryi[/url]

[url=http://cracker-crunch.com/devochki-dlya-mussolini/]devochki dlya mussolini[/url]

darryl hanah

shlyuhi novoy volnyi 5

fantazii angela

eroticheskiy son nayavu

domohozyayki

shalunya

moya sestra lyubit v popku 2

dominatrix sex gambit seks gambit 2001

labirint strastey

seks bolnitsa

na hvoste 4

potseluy v gubyi

micah moore

eyo pervaya mamochka

kemping ekstrim 2

kazanova

simpsonyi xxx parodiya

eros i tanatos

[url=http://cracker-crunch.com/alisson-elisson/]alisson elisson[/url]

[url=http://cracker-crunch.com/tochka-stremyashhayasya-k-nulyu/]tochka stremyashhayasya k nulyu[/url]

[url=http://cracker-crunch.com/issleduya-sekc/]issleduya sekc[/url]

[url=http://cracker-crunch.com/seks-komanda-vampirov/]seks komanda vampirov[/url]

[url=http://cracker-crunch.com/lyubovnaya-svyaz-lolityi/]lyubovnaya svyaz lolityi[/url]

[url=http://cracker-crunch.com/eksperiment/]eksperiment[/url]

camilla ken

modnitsyi safado berlin

mezhdu strok

bespredelshhitsyi

garem

shkolnaya diskoteka 3

jessica may dzhessika mey

opasnyie shtuchki 2

repetitsiya 2

lichnaya zhizn rityi faltoyano

missiya vyipolnima 1

trahateli razvratnyih mamochek 4

anastasia christ

potaskushki na snegu

v glubokoy glotke

rasputnitsa

analno spermnoe atele

sestrichki nimfomanki yuliya i yetta

красивыие попки девушек выипуск 5,сара сампаё португалская модел,голая слава,голая мария берсенева,сексуалныие костюмыи на хеллоуин,голая анна седакова,голая никол кидман,голая тина канделаки....

[url=http://utc-lider.ru/golaya-sati-kazanova/]голая сати казанова[/url]

[url=http://utc-lider.ru/tayskie-devushki-8212-vyipusk-1/]таыские девушки выипуск 1[/url]

[url=http://utc-lider.ru/golaya-anna-snatkina/]голая анна снаткина[/url]

[url=http://utc-lider.ru/golaya-anna-semenovich/]голая анна семенович[/url]

[url=http://utc-lider.ru/golaya-semmi-bredi/]голая семми бреди[/url]

[url=http://utc-lider.ru/devushki-snimayut-sebya-8212-vyipusk-3/]девушки снимают себя выипуск 3[/url]

[url=http://utc-lider.ru/golaya-anna-andrusenko/]голая анна андрусенко[/url]

японские девушки в нижнем беле выипуск 3,голая яна рудковская,красивая девушка в мини бикини 2,японские девушки в нижнем беле выипуск 2,голая олга бузова,голая алена водонаева,голая анна михаыловская,голая екатерина волкова....

ариадна артилес испанская модел

голая татяна котова

голая алена водонаева

японские девушки в нижнем беле выипуск 4

голая емма уотсон

голая юлия началова

голая анастасия волочкова

[url=http://xyekkino.ru/porochnyie-otnosheniya-rapporti-impropri-2002/]porochnyie otnosheniya rapporti impropri 2002[/url]

[url=http://xyekkino.ru/gotika-gothix-2002/]gotika gothix 2002[/url]

[url=http://xyekkino.ru/cry-wolf-volk-odinochka-2008/]cry wolf volk odinochka 2008[/url]

[url=http://xyekkino.ru/dyavol-v-miss-dzhons-the-new-devil-in-miss-jones-2006/]dyavol v miss dzhons the new devil in miss jones 2006[/url]

[url=http://xyekkino.ru/luchshie-orgii-ot-privat-the-best-by-private-orgies-2002/]luchshie orgii ot privat the best by private orgies 2002[/url]

banana meccanica zavodnoy banan 2000

chance meetings sluchaynyie vstrechi 1988

regine di culi las reinas del culo korolevskie zadnitsyi 1997

kiski moih podrug la chatte de mes copines 2006

cover to cover mezhdu strok 1995

[url=http://eim59.ru/devushka-v-zhyoltom-plate-bez-trusov-14-otkrovennyih-foto/]девушка в жёлтом плате без трусов 14 откровенныих фото[/url]

[url=http://eim59.ru/molodaya-krasotka-na-zelyonoy-travke/]молодая красотка на зелёноы травке[/url]

[url=http://eim59.ru/devushki-s-shikarnyimi-formami-girls-with-nice-forms/]девушки с шикарныими формами гирлс щитх нице формс[/url]

[url=http://eim59.ru/ocharovatelnaya-samka-lisa-ann-fireplace-intim-snimki/]очарователная самка лиса анн фиреплаце интим снимки[/url]

[url=http://eim59.ru/stroynaya-krasotka-leanne-crow-purple-seksi-fotki/]строыная красотка леанне црощ пурпле секси фотки[/url]

еро снимки гламурноы красотки сопхиа щинтерс в чёрныих колготках 11 еро фото

пыишная порно модел яые росе в чёрном обтягивающем плате без трусов 12 еро фото

сексуалныие фотографии невест сехы пицтурес оф бридес

любителские снимки горячеы блондинки 18 фото

симпатичная тсыипочка ёрдан царвер юицы бообс бабе еро фотки

[url=http://greenhall-opt.ru/golaya-shon-yang-foto-iz-eroticheskih-filmov/]голая шон янг фото из еротических филмов[/url]

[url=http://greenhall-opt.ru/britni-spirs-golaya-v-zhurnalah-i-obnazhennaya-na-ulitse/]бритни спирс голая в журналах и обнаженная на улитсе[/url]

[url=http://greenhall-opt.ru/konni-nilsen-golaya-foto-iz-zhurnalov-i-filmov/]конни нилсен голая фото из журналов и филмов[/url]

[url=http://greenhall-opt.ru/golaya-kelli-makgillis-i-ee-otkrovennyie-fotografii-iz-filmov/]голая келли макгиллис и ее откровенныие фотографии из филмов[/url]

[url=http://greenhall-opt.ru/avril-lavin-golaya-v-fotosessiyah-dlya-zhurnalov-maxim-i-vanity-fair/]аврил лавин голая в фотосессиях для журналов махим и ваниты фаир[/url]

еммануел воже голая на фото и видео

голая барбара стреызанд фото из сми и кинофилмов

голая менди мур показала свое превошодное тело

голая каыли миноуг кылие миногуе на фото из журналов и отдыиха

фото на которыих кира наытли голая а также обнаженная на отдыихе

[url=http://obamway.ru/otkroveniya-danielle-maye-v-dvorovoy-dushevoy-20-foto-nbsp/]откровения даниелле майе в дворовой душевой [/url]

[url=http://obamway.ru/istinno-russkaya-devitsa-alina-20-foto-nbsp/]истинно русская девитса алина [/url]

[url=http://obamway.ru/ushedshaya-ot-skuki-blagodarya-pozirovaniyu-kattie-gold-16-foto-nbsp/]ушедшая от скуки благодаря позированию каттие голд [/url]

[url=http://obamway.ru/erotika-v-svezhem-vzglyade-azinusa-vulgarisa-60-foto-nbsp/]эротика в свежем взгляде азинуса вулгариса [/url]

[url=http://obamway.ru/detalizirovannaya-do-melochey-erotika-christine-roberts-14-foto-nbsp/]детализированная до мелочей эротика чристине робертс [/url]

интимное начало утра миссы робинсон

откровенныие девушки мелание риос и валериа

хорошо выиглядящая николе маклин

подборка силного в качестве ню от фотографа александра жерносека

4 года эротики вместе с еромоделс

[url=http://s4d.ru/agatha-lins-revista-sexy/]carla dias revista sexy[/url]

[url=http://s4d.ru/barbara-borges-revista-playboy/]priscila saravalli[/url]

[url=http://s4d.ru/o-melhor-do-bbb-10/]debora pittelli ensaio sensual[/url]

[url=http://s4d.ru/carol-nakamura-revista-sexy/]debora e denise revista sexy[/url]

[url=http://s4d.ru/danielle-robinson-revista-playboy/]camila ferreira revista sexy[/url]

dieine eider revista sexy

patricia limonge

carla dagostin revista sexy

sabrina torres

pamela rios

[url=http://sonaxtell.ru/gatas-do-cruzeiro-parte-1/]gatas do cruzeiro parte 1[/url]

[url=http://sonaxtell.ru/daniele-paiva-musa-do-fluminense-2009/]daniele paiva musa do fluminense 2009[/url]

[url=http://sonaxtell.ru/download-danielle-brito-musa-do-nautico-2009-2/]download danielle brito musa do nautico 2009 2[/url]

[url=http://sonaxtell.ru/download-danielle-brito-musa-nautico-2007/]download danielle brito musa nautico 2007[/url]

[url=http://sonaxtell.ru/musas-do-brasileirao-de-2009/]musas do brasileirao de 2009[/url]

sejam bem vindos

monique rodrigues vitoria 2009

bruna holz gata do gremio

download patricia murta cruzeiro 2008

fabiola nunes coritiba

[url=http://eim59.ru/golaya-olga-buzova-iz-doma-2-8-ero-foto/]голая олга бузова из дома 2 8 еро фото[/url]

[url=http://eim59.ru/tyomnenkaya-dlinnovolosaya-seksualnaya-devaha-v-chyornyih-shortah-i-s-bolshimi-siskami/]тёмненкая длинноволосая сексуалная деваха в чёрныих шортах и с болшими сисками[/url]

[url=http://eim59.ru/madison-ivy-sumasshedshaya-grudastaya-krasavitsa/]мадисон ивы сумасшедшая грудастая красавитса[/url]

[url=http://eim59.ru/foto-zhenskih-prelestey-v-domashnih-usloviyah/]фото женских прелестеы в домашних условиях[/url]

[url=http://eim59.ru/figuristaya-samka-jana-defi-blue-bts-seks-fotki/]фигуристая самка яна дефи блуе бтс секс фотки[/url]

лучшие качественныие фотографии щенды фиоре блацкбощ

калеы кеннеды в сексуалном плате показыивает классную попу 13 фото еро снимков

молодая сексуалная красавитса ницоле спаркс ёунг сехы беауты ницоле спаркс

сексуалныие девочки в коротких обтягивающих платях сехы гирлс ин шорт тигхт дрессес

картинки развратноы еро модели вероница земанова лигхтс

Охренеть что твариться

[url=http://aaaq.ru/masturbatsiya/]порно видео секс игрушки[/url]

[url=http://aaaq.ru/yaponskie-realistichnyie-kuklyi-dlya-muzhchin/]секс игрушки[/url]

секс игрушки онлайн

[url=http://aist-d.ru/provocative-dress-jennifer-lopez-at-the-award-grammy/]провоцативе дресс эннифер лопез ат тхе ащард граммы[/url]

[url=http://aist-d.ru/keira-knightley-posing-topless-for-mario-testino-saktsentirovav-attention-to-his-elegant-small-breasts/]кеира книгхтлеы посинг топлесс фор марио тестино сактсентировав аттентион то хис елегант смалл бреастс[/url]

[url=http://aist-d.ru/famke-yanssen-famke-janssen-25-foto/]фамке янссен фамке янссен 25 фото[/url]

[url=http://aist-d.ru/natali-portman-natalie-portman-15-foto/]натали портман наталие портман 15 фото[/url]

[url=http://aist-d.ru/lena-katina-lena-katina-33-foto/]лена катина лена катина 33 фото[/url]

[url=http://aist-d.ru/adel-adele-adel-edkins-adele-adkins-14-foto/]адел аделе адел едкинс аделе адкинс 14 фото[/url]

[url=http://aist-d.ru/erika-vyipustila-singl-nebo-popolam/]ерика выипустила сингл небо пополам[/url]

[url=http://aist-d.ru/kak-pohudela-svetlana-hodchenkova-udi/]как похудела светлана ходченкова уди[/url]

[url=http://aist-d.ru/kristen-bell-kristen-bell-21-foto/]кристен белл кристен белл 21 фото[/url]

оне поинт оф руссиа ат тхе цонтест еуровисион а дисграце

вицториа бецкхам щас тхе десигнер оф еротиц филм

уилл копелман щилл копелман 1 фото

мария берсенева мария берсенева 28 фото

кристина агилера чристина агуилера 41 фото

джессика алба эссица алба 28 фото

серёга публично обратился к путину не

ким кардашян разделас до гола в стиле ц

вера брежнева сдала украшения в ломба

[url=http://cracker-crunch.com/alexandra-nice/]alexandra nice[/url]

[url=http://cracker-crunch.com/zhozefina-muttsenbaher-tom-5-1983/]zhozefina muttsenbaher tom 5 1983[/url]

[url=http://cracker-crunch.com/drevnie-sekretyi-kamasutryi/]drevnie sekretyi kamasutryi[/url]

[url=http://cracker-crunch.com/mest-angela/]mest angela[/url]

[url=http://cracker-crunch.com/seks-ubiytsa-nikita/]seks ubiytsa nikita[/url]

[url=http://cracker-crunch.com/politseyskaya-akademiya/]politseyskaya akademiya[/url]

tawny roberts 2

porochnyie otnosheniya

blondinki s ziyayushhimi zadnitsami

seks 2 sudba

poslednyaya vspyishka

skandalnaya dzhilda

ashlyn gere

opyityi 2

delilah strong 2

malenkie shkolnitsyi 1980

dalila seks missiya

rabyini v gareme

anastasia christ

eroticheskiy futbol

seks portret

kontrol 2

pleyboy lyubimitsyi avstralii

posledniy raz v bolshom sekse

[url=http://nice4me.ru/markiz_de_sad/]маркиз де сад[/url]

[url=http://nice4me.ru/mister_3000/]мистер 3000[/url]

[url=http://nice4me.ru/besplatnyiy_bilet/]бесплатныий билет[/url]

[url=http://nice4me.ru/chrnyiy_lebed/]чрныий лебед[/url]

римини римини 2 - год спустя

опроверэние теории дарвина

8 безумныих ночей

смертелная гонка франкенштейн йив

[url=http://eco-ua.com/chuzhaya-babushka-chast-2-eroticheskij-rasskaz/] чужая бабушка част 2 еротический рассказ [/url]

[url=http://eco-ua.com/tajna-za-sluzhebnoj-dveryu-glava-1-eroticheskij-rasskaz/] тайна за служебной дверю глава 1 еротический рассказ [/url]

[url=http://eco-ua.com/ada-i-liza-istoriya-muchitelnitsyi-i-zhertvyi/] ада и лиза история мучителнитсыи и жертвыи [/url]

[url=http://eco-ua.com/kak-myi-s-bratikom-drochili-drug-druga-moi-vospominaniya/] как мыи с братиком дрочили друг друга мои воспоминания [/url]

[url=http://eco-ua.com/zdravstvuj-master-chast-3-eroticheskij-rasskaz/] здравствуй мастер част 3 еротический рассказ [/url]

[url=http://eco-ua.com/s-pervyimi-luchami-solntsa/] с первыими лучами солнтса [/url]

[url=http://eco-ua.com/sperma-2/] сперма 2 [/url]

[url=http://eco-ua.com/doversya-lyubimomu/] доверся любимому [/url]

[url=http://eco-ua.com/v-serebryanom-boru/] в серебряном бору [/url]

[url=http://eim59.ru/alina-i-eyo-krasivyie-malenkie-grudi-14-intim-snimkov/]алина и её красивыие маленкие груди 14 интим снимков[/url]

[url=http://eim59.ru/krasivaya-nastya-v-originalnom-zelyonom-naryade-pokazala-kisku-pod-platem-10-ero-foto/]красивая настя в оригиналном зелёном наряде показала киску под платем 10 еро фото[/url]

[url=http://eim59.ru/znoynaya-zhenshhina-julie-cash/]зноыная женщина юлие цаш[/url]

[url=http://eim59.ru/krasivaya-kobyilka-lisa-ann-high-rise-ero-pictures/]красивая кобыилка лиса анн хигх рисе еро пицтурес[/url]

[url=http://eim59.ru/simpatichnaya-damochka-wendy-fiore-lake-rocks-seks-pictures/]симпатичная дамочка щенды фиоре лаке роцкс секс пицтурес[/url]

трофимова евгения голая на интимныих снимках

еро фотосет еща соннет тширт в белоы короткоы юбке и просвечивающеы блузке 20 еро фото

прекрасное тело евыи соннет

силвиа саинт рубашка галстук и сексуалное тело

горячая еротика вероница земанова ацтионгирл сех пицтурес

[url=http://greenhall-opt.ru/tina-terner-golaya-vo-vremya-vyistupleniy-i-ne-tolko/]тина тернер голая во время выиступлениы и не толко[/url]

[url=http://greenhall-opt.ru/golaya-sheron-stoun-na-foto-iz-zhurnalov-i-kadryi-s-otdyiha/]голая шерон стоун на фото из журналов и кадрыи с отдыиха[/url]

[url=http://greenhall-opt.ru/golaya-preston-kelli-foto-iz-filmov-i-v-kupalnike/]голая престон келли фото из филмов и в купалнике[/url]

[url=http://greenhall-opt.ru/kelli-linch-golaya-foto-iz-kinofilmov-a-takzhe-zhurnalov/]келли линч голая фото из кинофилмов а также журналов[/url]

[url=http://greenhall-opt.ru/patritsiya-kaas-golaya-v-otkrovennyih-fotosessiyah/]патритсия каас голая в откровенныих фотосессиях[/url]

шеннон твид голая на фото из журналов и в кино

мими роджерс голая самыие откровенныие фотографии звездыи

лене нистрем голая на контсертах отдыихе и других фото

мадонна голая в журналах на стсене фото в молодости

голая лена хиди в кинофилмах и журналах

[url=http://s4d.ru/agnes-marchioni-revista-playboy/]anny castro revista sexy[/url]

[url=http://s4d.ru/andreia-martins-revista-sexy/]bruna angel revista sexy[/url]

[url=http://s4d.ru/bia-grochoski-revista-sexy/]aline zamel ensaio sensual[/url]

[url=http://s4d.ru/dalila-kindermann-revista-playboy/]regina deutinger[/url]

[url=http://s4d.ru/denise-moretto-revista-sexy/]bruna reis revista sexy[/url]

salada de frutas

stephany

wanessa martins

paula aguiar

vivian milczewsky

[url=http://tcareva-apteka.ru/krasivoe-tatu-na-krasivom-tele-7-foto-nbsp/]красивое тату на красивом теле 7 фото[/url]

[url=http://tcareva-apteka.ru/kalendar-ot-musa-motors-12-foto-nbsp/]календар от муса моторс 12 фото[/url]

[url=http://tcareva-apteka.ru/zagulyavshie-devchonki-30-foto-nbsp/]загулявшие девчонки 30 фото[/url]

[url=http://tcareva-apteka.ru/devchata-tseluyutsya-34-foto-nbsp/]девчата тселуются 34 фото[/url]

[url=http://tcareva-apteka.ru/esenia-na-plyazhe-pod-gorami-20-foto-nbsp/]есениа на пляже под горами 20 фото[/url]

красотки ню 40 фото

умиляющая утренняя история далене куртис 22 фото

зузанна драбинова попадает взглядом прямиком в сердтсе 20 фото

западныие знаменитости в стиле пин уп 26 фото

оригиналныиы подарок от памелыи андерсон 14 фото

[url=http://trykino.ru/cathleen-raymond/]cathleen raymond[/url]

[url=http://trykino.ru/evgeniy-onegin-2004/]evgeniy onegin 2004[/url]

[url=http://trykino.ru/gorlo-nazidatelnaya-istoriya-throat-a-cautionary-tale-2009/]gorlo nazidatelnaya istoriya throat a cautionary tale 2009[/url]

[url=http://trykino.ru/spagetti-v-polnoch-spaghetti-a-mezzanotte-1981/]spagetti v polnoch spaghetti a mezzanotte 1981[/url]

[url=http://trykino.ru/seks-radi-vyizhivaniya-three-2004/]seks radi vyizhivaniya three 2004[/url]

destiny st claire

soblazn original sin 2001

the first nudie musical 1976

french kiss svezhiy potseluy 2008

emmanuel 2 emmanuelle 2 1975

голая анна кузина,голая кристен стюарт,голая алсу,красивыие попки девушек выипуск 1,голая кети перри,голая ксения бородина,голая джессика алба,голая надежда грановская....

[url=http://utc-lider.ru/golaya-mariya-gorban/]голая мария горбан[/url]

[url=http://utc-lider.ru/golaya-natali-portman/]голая натали портман[/url]

[url=http://utc-lider.ru/chernokozhie-krasotki-v-kupalnikah/]чернокожие красотки в купалниках[/url]

[url=http://utc-lider.ru/seksualnyie-nevestyi-8212-vyipusk-1/]сексуалныие невестыи выипуск 1[/url]

[url=http://utc-lider.ru/daniel-knadson-8212-kanadskaya-model/]даниел кнадсон канадская модел[/url]

[url=http://utc-lider.ru/yaponki-v-nizhnem-bele-8212-vyipusk-1/]японки в нижнем беле выипуск 1[/url]

[url=http://utc-lider.ru/golaya-mariya-sharapova/]голая мария шарапова[/url]

голая надежда грановская,голая анна седакова,сексуалныие секретарши выипуск 1,голая кристина асмус,голая джулия робертс,красивыие попки девушек выипуск 2,голая виктория боня,девушки в колготках выипуск 2....

голая камерон диаз

голая ляысан утяшева

емили ратажковски американская модел

японские девушки в нижнем беле выипуск 4

голая елена подкаминская

девушка в красном нижнем беле

голая екатерина кузнетсова

using cbd oil for pain control - cbdoil4u.org benefits of cbd oil for cancer - cbdoil4u.org [url=https://cbdoil4u.org/]https://cbdoil4u.org/[/url] cbd oil for cancer for sale - cbdoil4u.org

cbd oil side effects stomach - cbdoil4u.org cbd oil for dogs with seizures - cbdoil4u.org https://cbdoil4u.org/ cbd oil for cancer prevention - cbdoil4u.org

Lyrica 100 mg hard capsules - lyrica.antibioticshelp.life

Ear infections may be more inferior in children than in adults, but grown-ups are silence susceptible to these infections. Distinguishable from childhood appreciation infections, which are often schoolgirl and pass swiftly, mature ear infections are many a time signs of a more sincere health problem.

If you’re an matured with an appreciation infection, you should the score with close concentration to your symptoms and mark your doctor.

bitionol medicamento lyrica

lyrica 75 mg cap

is lyrica a generic drug

talopram medicamento lyrica

pregabalina 75 mg vademecum ecuador

A middle sensitivity infection is also known as otitis media. It’s caused past vapour trapped behind the eardrum, which causes the eardrum to bulge. Along with an earache, you may brains fullness in your ear and maintain some fluid drainage from the specious ear.

Otitis media can fall with a fever. You may also have planned harass hearing until the infection starts to clear.

best place order viagra online

viagra without doctor

viagra de 50 mg pfizer

[url=http://bfviagrajlu.com/#]viagra without doctor[/url]

buy cheap viagra blog

can i buy viagra at walgreens

viagra without doctor

generic viagra 150 mg

[url=http://bfviagrajlu.com/#]viagra without prescription[/url]

buy viagra in soho

reputable online generic viagra

viagra without prescription

buy viagra online germany

[url=http://bfviagrajlu.com/#]viagra without a doctor prescription[/url]

brand viagra online

rehab call center

drug and alcohol rehab

symptoms of tramadol withdrawal

[url=http://drugrehabtrustedclinic.com/]alcohol rehab[/url]

treatment for heroin addiction

addicted heroin

drug addiction rehab centers

medication for withdrawal from opiates

[url=http://drugrehabtrustedclinic.com/]alcohol rehab facilities[/url]

addiction therapy

side effects for cocaine

drug and alcohol rehab

heroin withdrawal timeline

[url=http://drugrehabtrustedclinic.com/]rehab addict[/url]

crystal drug

[url=http://cephalexin.reisen/]cephalexin 250mg capsules[/url] [url=http://clomid50mg.pro/]clomid[/url]

cialis 10 mg effetti collaterali

buy viagra

[url=http://viagrajfeg.com/]buy viagra[/url]

viagra pills for women

cialis online pharmacy

[url=http://cialisdmge.com/]cialis online[/url]

cheap kamagra jelly uk

[url=http://nexiumonline.pro/]nexium online[/url] [url=http://buy-revia.reisen/]revia[/url] [url=http://buyanafranil.shop/]buy anafranil[/url]

[url=http://bupropionsr150mg.us.org/]bupropion[/url] [url=http://cymbaltageneric.us.org/]Generic Cymbalta[/url] [url=http://cialispills.us.org/]cialis pills[/url]

buy cialis 60 mg

buy viagra online

[url=http://viagrajfeg.com/]buy viagra[/url]

cost levitra 20 mg

buy cialis online

[url=http://cialisdmge.com/]cialis buy[/url]

cheap viagra online canadian pharmacy

cbd oil for pain relief cbd oil for pain relief where to buy [url=https://cbdoil4u.org/cbd-oil-for-pain/]cbd oil for pain control[/url] CBD Oil for Pain - CBD Pure

cbd oil for cancer pain cbd oil for pain cbd oil for pain reviews cbd oil for cancer pain

cbd cannabis oil for pain cbd oil for pain relief where to buy [url=https://cbdoil4u.org/cbd-oil-for-pain/]cbd hemp oil for pain[/url] cbd oil for pain

cbd oil for pain cbd oil for pain cbd oil for pain reviews CBD Oil for Pain

can get viagra performance anxiety

viagra 100

best place to order generic viagra

[url=http://gdoviagrakjyu.com/#]viagra 100mg[/url]

ordering generic viagra online illegal

cheap cialis in nz

cialis online pharmacy

cheap cialis new zealand

[url=http://fgocialisgfeb.com/#]cialis online canada pharmacy[/url]

cialis cheap online pharmacy

canadian pharmacies

Canadian Online Pharmacy

northwest pharmacy canada

[url=http://ehmcanadaufgpharmacypo.com/#]Canadian Online Pharmacy[/url]

canada drugs

nome de generico do viagra

viagra without a doctor prescription

comment utiliser viagra 25 mg

[url=http://dyviagrahwithoutbdoctorklprescription.com/#]viagra without prescription[/url]

to buy viagra online

payday loans no faxing

payday loans bad credit

cash loans online

cash advance ’

unsecured personal loans bad credit

installment loan

bad credit cash fast payday loan loans

payday loan ’

cialis buy us

buy cialis online

buy cialis using paypal

[url=http://vgcialistylbuyjl.com/#]cialis online[/url]

cialis liquid for sale

buying cialis in peru

online cialis

buy cialis daily

[url=http://vgcialistylbuyjl.com/#]cialis buy[/url]

ok split cialis pills

viagra price philippines

cuanto sale el viagra en argentina

order viagra online

[url=http://vgcialistylbuyjl.com/#]order real viagra line[/url]

viagra for men for sale

sildenafil generico ems

can you buy viagra boots

generic viagra online forum

[url=http://vgcialistylbuyjl.com/#]how to buy viagra in ireland[/url]

get rid viagra

cialis 20 mg side effects

cialis online

cialis mg dosage

buy cialis ’

cheap viagra for sale in australia

viagra buy japan

where can i get viagra today

[url=http://vgcialistylbuyjl.com/#]order viagra canada pharmacy[/url]

lovegra sildenafil 100mg tablet from ajanta pharma india

is it legal to buy viagra in thailand

how to buy viagra online in the uk

viagra 100mg testbericht

[url=http://vgcialistylbuyjl.com/#]viagra for sale with no prescription[/url]

viagra cuanto sale argentina

best online viagra site uk

viagra for sale over the counter

what color are the viagra pills

[url=http://vgcialistylbuyjl.com/#]do you have to be 18 to buy viagra[/url]

buy viagra kuala lumpur

genericos e similares do viagra

viagra buy cyprus

generic viagra super active sildenafil 100mg

[url=http://vgcialistylbuyjl.com/#]cheap viagra no prescription needed[/url]

can you just buy viagra

brand pfizer viagra online

viagra cheap fast shipping

how do i get a free sample of viagra

[url=http://vgcialistylbuyjl.com/#]viagra sale chemist[/url]

nombre generico del viagra en el peru

sildenafil 75 mg

viagra sale johannesburg

power pill viagra

[url=http://vgcialistylbuyjl.com/#]viagra sale us[/url]

quanto custa o generico do viagra

cost of viagra online

viagra buy singapore

viagra sale northern ireland

[url=http://vgcialistylbuyjl.com/#]order viagra online india[/url]

online shopping viagra india

$1500 payday loans

online loans

startup business loans

online payday loans ’

[b]Пополение баланса Авито (Avito) за 50%[/b] | [b]Телеграмм @a1garant[/b]

[b]Приветствую вас, дорогие друзья![/b]

Рады предоставить Всем вам услуги по пополнению баланса на действующие активные аккаунты Avito (а также, совершенно новые). Если Вам надо конкретные балансы - пишите, будем решать. Потратить можно на турбо продажи, любые платные услуги Авито (Avito).

[b]Аккаунты не Брут. Живут долго.[/b]

Процент пополнения в нашу сторону и стоимость готовых аккаунтов: [b]50% от баланса на аккаунте.[/b]

Если требуется залив на ваш аккаунт, в этом случае требуются логин и пароль Вашего акка для доступа к форме оплаты, пополнения баланса.

Для постоянных клиентов гибкая система бонусов и скидок!

[b]Гарантия: [/b]

[b]И, конечно же ничто не укрепляет доверие, как - Постоплата!!![/b] Вперед денег не просим...

Рады сотрудничеству!

[b]Заливы на балансы Авито[/b]

________

можно ли продать аккаунт на авито

как удалить аккаунт с авито ру

что делать если номер привязан к другому аккаунту авито

авито деньги барнаул

кошелек авито как вернуть деньги

generic viagra image

buy viagra from canada online

buy viagra in cvs

[url=http://vgcialistylbuyjl.com/#]order viagra online canada[/url]

is it safe to buy generic viagra

how to order viagra online from india

buy viagra online england

generic viagra overseas

[url=http://vgcialistylbuyjl.com/#]best place buy viagra yahoo[/url]

how to buy original viagra

best price pfizer viagra

cheap herbal viagra pills

order viagra for women

[url=http://mbviagraghtorderke.com/#]order viagra pfizer[/url]

viagra 100 mg precio farmacia

degra sildenafil 50 mg

viagra men sale

generico viagra faz mesmo efeito

[url=http://mbviagraghtorderke.com/#]buy viagra jelly uk[/url]

viagra online in australia cheap

female viagra pill

buy viagra

viagra from canada

cheap viagra ’

viagra generico online contrassegno

viagra sale online australia

viagra and cialis best price

[url=http://mbviagraghtorderke.com/#]cheap viagra inurl /profile/[/url]

viagra generico citrato

viagra generic online pharmacy

viagra sale in sydney

generic viagra online us pharmacy

[url=http://mbviagraghtorderke.com/#]cheap viagra soft tabs[/url]

viagra buy south africa

plant viagra for sale

viagra buy south africa

buy viagra in kenya

[url=http://mbviagraghtorderke.com/#]buy viagra online australia[/url]

hoe ziet een viagra pill eruit

cialis and women

cialis 100mg

cialis review

generic cialis ’

cialis tadalafil 20mg

generic cialis

cialis.com

cialis online ’

good viagra the little blue pill

Viagra 50 mg

can i buy viagra legally in the uk

[url=http://mbviagraghtorderke.com/#]Viagra Pills[/url]

cheap generic viagra with free shipping

generic vs real viagra

Viagra Pills

viagra when generic

[url=http://mbviagraghtorderke.com/#]Viagra Online[/url]

can you use viagra get pregnant

how good is generic viagra

viagra coupons

where can i buy viagra safely

[url=http://fastshipptoday.com/#]viagra tablets[/url]

viagra original ou generica

do need prescription buy viagra online

viagra cost

viagra not generic

[url=http://fastshipptoday.com/#]viagra from canada[/url]

sildenafil 100mg marham daru

price of viagra in malaysia

viagra sans ordonnance

generic viagra name joke

[url=http://fastshipptoday.com/#]generic for viagra[/url]

the cheapest viagra

generico do viagra faz mal

viagra cost

unterschied viagra viagra generika

[url=http://fastshipptoday.com/#]viagra pills[/url]

100mg viagra how long does it last

sildenafil citrate generic online

online viagra

long does half viagra pill last

[url=http://fastshipptoday.com/#]viagra from canada[/url]

buy viagra in cvs

magnus sildenafil 25 mg

viagra price

can you take viagra levitra together

[url=http://fastshipptoday.com/#]buy viagra online[/url]

can i take 2 viagra 50mg

herbal viagra extra

http://hqviagrauro.com/ - cheap viagra online

viagra how long does it take to start working

cheap viagra free shipping

instructions for viagra 100mg

[url=http://hqviagrauro.com/]cheap generic viagra[/url]

pills like viagra in india

buy viagra women uk

viagra for men

sildenafil 100 mg

[url=http://fastshipptoday.com/#]viagra pill[/url]

does viagra goes generic

viagra professional online pharmacy

where to buy viagra

medicamentos genericos do viagra

[url=http://fastshipptoday.com/#]viagra coupons[/url]

price comparison viagra levitra

viagra extenze together

online viagra

comprare online viagra

[url=http://fastshipptoday.com/#]buy generic viagra[/url]

where can i buy cialis or viagra on line

best place order viagra online forum

viagra tablets

reliable place to buy viagra online

[url=http://fastshipptoday.com/#]viagra generic[/url]

cheap generic viagra no prescription

cheap cialis india

cialis on line

cialis online cheap no prescription

[url=http://fkdcialiskhp.com/#]cialis generic[/url]

can you buy cialis over counter mexico

can buy cialis over counter usa

generic cialis 2017

order cialis pills

[url=http://fkdcialiskhp.com/#]generic cialis at walmart[/url]

buy cialis uk no prescription

generic.cialis.pills

buy cialis

buy cialis at walmart

[url=http://fkdcialiskhp.com/#]cialis generic[/url]

buy cheap cialis in canada

cheap cialis overnight

generic cialis

cialis sale online australia

[url=http://fkdcialiskhp.com/#]cialis on line[/url]

order cialis daily

kosten viagra 50 mg

viagra prices

viagra generika kaufen apotheke

[url=http://bgaviagrahms.com/#]cheap viagra[/url]

viagra 500mg price

getting prescription viagra canada

buy viagra online

viagra taking half pill

[url=http://bgaviagrahms.com/#]viagra prices[/url]

viagra pill identification

instant cash loans

online loan

personal loan debt consolidation

payday loans ’

euro palace [url=https://casinomegaslotos.com/]money slots[/url]

bonus slots slots

live casino canada [url=https://casinomegaslotos.com/]cafe casino[/url]

slots lv casino bonus

slots casino [url=https://casinomegaslotos.com/]ruby slots[/url]

best online casino club casino

online slots [url=https://casinomegaslotos.com/]game slot[/url]

best online slot sites slots real money

casino games [url=https://casinomegaslotos.com/]live casino canada[/url]

casino slots money online slots

where to buy cialis online in uk

buy cialis online

how to order cialis online

[url=http://bhscialisdjy.com/#]buy cialis online[/url]

buy cialis overnight

cheap real cialis

buy cialis

discount cialis viagra

[url=http://bhscialisdjy.com/#]buy cialis online[/url]

buy cialis cheap prices fast delivery

does viagra make you harder longer

https://aviagrant.com/ - generic Viagra

is it safe to buy viagra online uk

[url=https://aviagrant.com]Viagra online[/url]

alfuzosin and viagra

generic Viagra

voce ja tomou viagra

generic celebrex

[url=http://hqcelebrex2017.com/]celebrex 200 mg[/url]

celebrex online

buy propecia online

[url=http://hqfinasteride2017.com/]propecia[/url]

buy propecia online

finasteride 5mg

cialis sales history

buy cialis online

discount card for cialis

[url=http://bhscialisdjy.com/#]cheap cialis[/url]

buy cialis with online prescription

celebrex 200 mg

[url=http://hqcelebrex2017.com/]celebrex generic[/url]

celebrex generic

finasteride

[url=http://hqfinasteride2017.com/]finasteride[/url]

finasteride

buy propecia online

online name brand viagra

viagra online canadian pharmacy

alcohol and viagra

canada drugs online ’

safe place order cialis online

buy cialis online

order cheap cialis online

[url=http://gmwcialisfnw.com/#]cheap cialis[/url]

can you buy cialis online no prescription

taking 2 cialis pills

cheap cialis

cheap-cialis.net

[url=http://gmwcialisfnw.com/#]cialis online[/url]

viagra and cialis for sale

anyone use generic viagra

buy viagra online

buying generic viagra forum

[url=http://rmaviagraplq.com/#]where to buy viagra[/url]

viagra online uk cheapest

cialis soft tablets

cialis uk

cialis in canada

female cialis ’

cialis online uk

cialis pill

cialis dosage 10mg

cialis for sale ’

cheap cialis levitra

generic cialis

buy cialis today

[url=http://tbnacialiskj.com/#]tadalafil generic[/url]

generic cialis on sale

cialis usa buy

generic cialis at walmart

cheap cialis and levitra

[url=http://tbnacialiskj.com/#]generic cialis 2017[/url]

order cialis uk

buy cialis no prescription mastercard

generic cialis

should you buy cialis online

[url=http://tbnacialiskj.com/#]generic cialis[/url]

cialis 2.5mg pills

cialis tabletas for sale

generic cialis at walmart

cheap daily cialis

[url=http://tbnacialiskj.com/#]generic cialis at walmart[/url]

order cialis no prescription canada

[b]Перейдите ниже по ссылке, чтобы получить кредит:[/b]

https://ad.admitad.com/g/3e1725c17f7ac794b137e50e1abb43/

-----------------------------------

Сбербанк начал снижение ставок по кредитам.

Сбербанк с 1 мая уменьшил ставки по всем потребительским кредитам. Снижение ставок составило до четырех процентных пунктов от действовавших ранее уровней.

Сбербанк с 1 мая снижает ставки по всей линейке потребительских кредитов — до 4 п. п. от действующих на текущий момент. В результате минимальная ставка составит 12,9% годовых, а максимальная — 17%. Это решение пресс-служба банка связывает с восстановлением рынка потребительского кредитования и снижением ключевой ставки Банка России до 9,75%.

Кроме того, ставка по кредиту без обеспечения будет уменьшена на один процентный пункт и сравнится с потребкредитом под поручительство, если клиент воспользуется digital-сервисом.

По потребкредиту участникам «военной ипотеки» процентные ставки теперь составляют 13,5% годовых в руб. с обеспечением и 14,5% годовых в руб. без обеспечения. По «кредитам физическим лицам, ведущим личное подсобное хозяйство» новая процентная ставка равна 17% годовых в руб.

«Сбербанк» вводит также дополнительный дисконт в размере 1 п.п. «Потребительскому кредиту без обеспечения» за использование digital-сервиса. В рамках промо-акции минимальная ставка по этому продукту составит 12,9% годовых в рублях, при условии подачи заявки через «Сбербанк онлайн» и оформлении кредита на сумму от 300 тыс. рублей. Акция действует до 18 июня 2017 года включительно.

Рыночная ситуация меняется, рынок потребительского кредитования постепенно восстанавливается, снижается ключевая ставка, и Сбербанк реагирует на эти изменения, пояснили в банке.

Сбербанк в апреле увеличил почти вдвое максимальную сумму потребительского кредита, и теперь выводит процентные ставки на уровень, который ощутимо ниже докризисного, сообщили в пресс-службе кредитной организации.

Напомним, в апреле Сбербанк почти вдвое увеличил максимальную сумму потребительского кредита. Теперь учреждение меняет процентные ставки. Причем, как рассказали в пресс-службе кредитной организации, на уровень, который ощутимо ниже докризисного.

В силу того, что Сбербанк занимает первое место по величине активов (плюс на него приходится примерно половина депозитов и каждый третий кредит), скорее всего, другие банки также последуют его примеру.

Со 2 мая 2017 г. по потребкредиту на рефинансирование ссуд будет предлагаться фиксированная ставка от 13,9% годовых в рублях. Продукт позволяет рефинансировать до 5 кредитов. Банк напоминает, что процентные ставки устанавливаются индивидуально в зависимости от надежности, платежеспособности и категории клиента.

Процентные ставки устанавливаются индивидуально в зависимости от надёжности, платёжеспособности и категории клиента.

В «Сбербанке» отсутствуют какие-либо комиссии по кредиту, а предложение по страхованию жизни, которое является добровольным, не влияет на размер процентной ставки по кредитному договору.

ПАО «Сбербанк России» зарегистрировано в 1991 году (лицензия № 1481). Уставный капитал банка составляет 67 760 844 000 рублей.

Ранее Банк России сообщил о снижении ключевой ставки с 10% до 9,75% годовых. Свое решение Центробанк обосновал замедлением инфляции и восстановлением экономической активности. Незначительность сокращения ставки при этом объясняется сохранением инфляционных рисков «на повышенном уровне».

От ключевой ставки зависит стоимость привлечения денег для банков. Чем она ниже — тем менее выгодные вклады, но более дешевые кредиты предлагают банки.

Решение ЦБ снизить ключевую ставку, а также намерение Сбербанка скорректировать вниз ставки по кредитам побудили большинство крупнейших российских банков пересмотреть стоимость своих продуктов в сторону снижения, либо рассмотреть такую возможность, сообщили ранее опрошенные кредитные организации.

[b]Перейдите ниже по ссылке, чтобы получить кредит:[/b]

https://my.saleads.pro/s/276480a0-bfdf-11e7-b867-8f234a24dd91

get viagra from canada

buy generic viagra

getting viagra in vegas

[url=http://ehuviagramek.com/#]generic viagra online[/url]

bijsluiter viagra 100mg

sildenafil citrate generic viagra 100mg

viagra generic

where to buy viagra in ghaziabad

[url=http://ehuviagramek.com/#]buy generic viagra[/url]

vega sildenafil 100mg

levitra to buy uk

vardenafil

buy 40 mg levitra

[url=http://qmflevitrathd.com/#]vardenafil 20mg[/url]

buy online levitra in usa

LOAN OFFER

Rescue Team offers loans to help you meet a variety of needs. We’ve provided over $3 Billion USD in Personal, Business and Commercial loans to over 25,000 business owners. Loans are approved within 72 hours of successful application. We offer loans from a minimum range of $30,000 USD to a maximum of $100,000,000.00 USD.

WHAT YOU NEED TO APPLY

*Be between ages 22 – 59 years.

*Have a steady source of income that is verifiable.

*Must be confirmed staff in present employment.

*Have a functional current or savings bank account.

*Have valid means of identification.

Contact us today: rescueteamloans@rescueteam.com

Call/Text: +1 (914) 200-7270

Get your instant loan approval today.

autocad 2017 activation

autocad 2018 download

download autocad 2012 lt

[url=http://autocadgou.com/#]autocad 2018[/url]

autocad lite license

buy older versions of autocad

autocad

student download autocad

[url=http://autocadgou.com/#]autocad 2016[/url]

autocad serial number

autocad pro e software

descargar autocad

autocad design suite premium 2017 serial

[url=http://autocadgou.com/#]autocad descargar[/url]

autocad architectural desktop 2011 download

online autocad reader

autocad

autocad 2011 update download

[url=http://autocadgou.com/#]autocad 2016[/url]

autocad keynote

autocad circle command

autocad download

autocad 2017 64 bit serial number

[url=http://autocadgou.com/#]autocad 2012[/url]

autocad car design download

autocad version estudiante

autocad 2018

vba autocad download

[url=http://autocadgou.com/#]auto cad[/url]

autocad 2011 x64 download

autocad related software

autodesk autocad

descargar visor autocad 64 bits

[url=http://autocadgou.com/#]autocad download[/url]

autocad structural detailing 2014 product key

autocad lt 2017 product key

autocad 2018

autocad lt 2012 commercial new slm

[url=http://autocadbmsa.com/#]autocad 2014[/url]

cursos de autocad online

applications of autocad software

autocad 2018

descargar autocad 2011 ingles

[url=http://autocadbmsa.com/#]autocad[/url]

autocad lt best price

autocad civil 3d 2012 price

download autocad

price of autocad lt 2014

[url=http://autocadbmsa.com/#]autocad lt[/url]

autocad details download

engineering autocad software

autocad download

autocad 2017 serial key activation code

[url=http://autocadbmsa.com/#]autocad 2017[/url]

codigo de activacion de autocad

canadian viagra sales

viagra coupons 75 off

viagra when generic available

[url=http://itfviagrakmn.com/#]viagra for sale uk[/url]

viagra online polska

buy viagra levitra online

viagra coupons 75 off

efectos sildenafil 100mg

[url=http://itfviagrakmn.com/#]best price for viagra[/url]

cialis viagra levitra prices

viagra super force 100mg 60mg pills

viagra without a doctor prescription

what is viagra pills for men

[url=http://itfviagrakmn.com/#]viagra prices[/url]

best viagra online uk

cialis how to buy

cialis tablets

buy cialis professional online

[url=http://fmacialisuhy.com/#]cialis prices[/url]

can you really buy cialis online

buycialis.it

cialis pills

how to cut cialis pills

[url=http://fmacialisuhy.com/#]cialis tablets[/url]

cialis buy over counter

cialis buy generic

cialis tablets

order cialis in canada

[url=http://fmacialisuhy.com/#]cialis prices[/url]

order cialis

viagra cialis buy online

cialis tablets

where is the best place to buy generic cialis

[url=http://fmacialisuhy.com/#]cialis without a doctor's prescription[/url]

buy cialis in canada online

where to order cialis online

cialis cost

buy cialis professional

[url=http://fmacialisuhy.com/#]cialis coupon[/url]

cheapest cialis 20mg

Such a wide lace hairpiece seems really sensible and is [url=http://wigs-forwomens.com/]Human Hair Wigs[/url]

made from sophisticated ribbons content keeping the [url=http://wigsforblackwomena.com/]Wigs[/url]

unique search. Not merely this gives an all-natural character [url=http://wigshairhuman.com/]Wigs For Women[/url]

just about all render a modern look for the face area. Hair within this wig usually looks like it can be increasing from the scalp along with similarly dispersed [url=http://wigs-forwomen.com/]Wigs[/url]

. Several manufacturers currently making the effort to create their particular wide lace top the front real hair hairpieces economical to ensure girls that require it can find the money to purchase it.

Whenever these kind of hair pieces tend to be utilize the correct way, it might truly offer a normal [url=http://wigs-forwomen.com/]Human Hair Wigs[/url]

look. That is why it'll be significant with regard to clients to learn the different designs given that hairpieces are glued on the natural hair line and it can [url=http://wigs-forwomen.com/]Wigs For Women[/url]

additionally glue directly into the top of the locks.

pills like cialis

cialis pills

cialis buy toronto

[url=http://fmacialisuhy.com/#]cialis prices[/url]

where is the best place to buy cialis online

buy cialis canada cheap

cialis cost

buy generic cialis online in usa

[url=http://fmacialisuhy.com/#]cialis tablets[/url]

buy cialis tablets uk

buy cialis united states

cialis tablets

buy generic cialis professional

[url=http://fmacialisuhy.com/#]cialis coupons[/url]

where to get cialis cheap

alguem ja tomou viagra 50mg

viagra buy

rote pillen viagra

[url=http://fvbviagrahnas.com/#]buy viagra online[/url]

generic viagra online in canada

cost of viagra 100 mg

viagra online

sildenafil citrate 50 mg ml 30ml

[url=http://fvbviagrahnas.com/#]buy viagra online[/url]

viagra online free

generic cialis online buy

cialis without doctor

is it legal to order cialis online

[url=http://vnacialisfbvn.com/#]cialis without a doctor prescription[/url]

order generic cialis in canada

buy cialis in canada

cialis without a doctor's prescription

can you buy cialis uk

[url=http://vnacialisfbvn.com/#]cialis without a doctor[/url]

buy cialis ebay

sildenafil generic india

viagra without doctor

gets viagra prescription

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor visit[/url]

how can buy viagra in uk

get viagra perth

viagra without prescription

can i purchase viagra online

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

genericos del viagra en colombia

can you buy viagra in argentina

viagra without doctor prescription

viagra sale europe

[url=http://thjsildenafiljkvc.com/#]viagra without doctor[/url]

viagra comprar online argentina

buy viagra for women uk

viagra without prescription

generic viagra quick shipping

[url=http://thjsildenafiljkvc.com/#]viagra without doctor[/url]

buy viagra in nigeria

cialis and viagra taken together

viagra without a doctor prescription

cheap viagra usa

[url=http://thjsildenafiljkvc.com/#]viagra without doctor[/url]

what is cheaper viagra cialis levitra

no deposit bonus online casino 2017

[url=http://www.ristorantenostrano.it/?option=com_k2&view=itemlist&task=user&id=15790]online casino script[/url]

free online casino games bodog

playtech casino bonus 400

viagra online melbourne

viagra without prescription

viagra e cialis generici

[url=http://thjsildenafiljkvc.com/#]viagra without script[/url]

when is generic viagra available in us

buy viagra walmart

viagra without a doctor's prescription

comprar viagra online brasil

[url=http://thjsildenafiljkvc.com/#]viagra without doctor[/url]

viagra cheap canada

buy cialis from usa

cialis prices

buy cialis online australia

[url=http://cialisdmngj.com/#]cialis cost[/url]

buy cialis in belgium

cheap cialis and levitra

cialis price

what is cialis pills

[url=http://cialisdmngj.com/#]cheap cialis online[/url]

cialis buy online australia

cialis for sale in uk

cialis price

order cialis online overnight

[url=http://cialisdmngj.com/#]cialis prices[/url]

cialis cheap uk

the cheapest cialis

cialis price

cialis buy in australia

[url=http://cialisdmngj.com/#]cheap cialis[/url]

cheap cialis online pharmacy

Folks sell their hair to wig [url=http://www.wigsforblackwomen.us.com/]Wigs For Black Women[/url]

suppliers which create hair pieces from them. Prior to this the hair experiences many functions. The head of hair is washed, chemical handled [url=http://wigswigs.net/]Wigs For Women[/url]

, tinted, then lower as well as crafted in to hair pieces.

It is better to complement hair pieces through real hair to the colour of the normal head of hair [url=http://wigs-forwomen.org/]Wigs[/url]

. These may also be permed, cut, setback dried out, along with created equally as you'd probably do with your own real human hair. Hairpieces as a result manufactured possess a holistic appear and so are smoother when compared with their artificial competitors. Human hair is additionally more robust. So [url=http://bobbibosswigs.org/]Bobbi Boss Wigs[/url]

, hairpieces created from them are in addition are more durable.

They're made from man-made fibres. When compared with locks wigs [url=http://www.wigsforwomen.us.com/]Wigs For Women[/url]

, your hair pieces through artificial head of hair cannot be restyled in your own home. Moreover, you cannot alter their particular coloring coming from what's been recently coloured with the suppliers.

Manufactured hair pieces are less costly compared to those made from natural splendor, but to get a far better and more normal search you may have to purchase an expensive high quality. Artificial hairpieces keep their condition much better in comparison with hair pieces created from [url=http://lace-front-wigs.org/]Wigs For Women[/url]

person locks.

loans for people with no credit

[url=https://loanstrast.com/]new payday lenders[/url]

fast loans

simple interest loan

[url=https://loansfast.us.com/]compare payday loans[/url]

e z money payday loans

payday loans in delaware

very nice site cheap cialis

cheap cialis

discount generic cialis 20mg

[url=http://cialisdmngj.com/#]cialis cost[/url]

where to buy cialis

ok split cialis pills

cialis cheap

best pharmacy to buy cialis

[url=http://cialisdmngj.com/#]cheap cialis online[/url]

blood pressure pills cialis

online loans with bad credit

[url=https://loanstrast.com/]money now[/url]

safe loans

direct online payday lenders

sildenafil price canada

viagra without a doctor

viagra canadian online pharmacy

[url=http://viagrahukic.com/#]viagra without a prescription[/url]

sildenafil 20 mg

viagra sale ebay

viagra without a doctor

buy cheap viagra online next day delivery

[url=http://viagrahukic.com/#]viagra without doctor[/url]

viagra professionnel 100 mg

buy cialis with mastercard

cialis coupons

cheap viagra or cialis online

[url=http://cialisemk.com/]tadalafil generic[/url]

buy cialis us pharmacy

cheap viagra levitra cialis

online cialis

daily cialis pills

[url=http://cialismbvi.com/#]cialis prices[/url]

female cialis pills

order cialis no prescription

buy cialis online

cheap cialis online

[url=http://cialismbvi.com/#]cialis prices[/url]

cheapest cialis on the internet

where can i buy cialis or viagra on line

online cialis

how to buy cialis in london

[url=http://cialismbvi.com/#]buy cialis[/url]

cialis pills men

safe loans

[url=https://loanstrast.com/]cash advance support[/url]

1000 loan

getting a loan

can buy cialis canada

cialis

the cheapest generic cialis

[url=http://cialisemk.com/]cialis online[/url]

buy cialis in vancouver

did viagra go generic

viagra cost

viagra super active+ 100mg pills

[url=http://viagramndet.com/#]cost of viagra[/url]

viagra 25 mg prospect

waar koop ik viagra pillen

viagra coupons

free viagra samples before buying

[url=http://viagramndet.com/#]cost of viagra[/url]

generic viagra suppliers south africa

get viagra perth

viagra prices

viagra pills for cheap

[url=http://viagramndet.com/#]viagra prices[/url]

gold viagra 3000mg

viagra sale nz

viagra prices

best site buy generic viagra

[url=http://viagramndet.com/#]viagra cost[/url]

viagra 25 mg enough

cheapest generic viagra and cialis

viagra prices

viagra online italia paypal

[url=http://viagramndet.com/#]cost of viagra[/url]

1 viagra pille

pay day advance

http://paydayloansimd.com/ - cash loans

american loans

bad credit loans

direct lender payday loans

[url=http://paydayloansimd.com]bad credit loans[/url]

small personal loans online

was bewirken viagra pillen

viagra coupons 75 off

buy viagra in philippines

[url=http://viagramhbfe.com/#]viagra coupon[/url]

generic name viagra joke

borrow money online

[url=https://loanstrast.com/]payday loans reviews[/url]

direct payday loans

nevada payday loans

buy cialis generic

cialis coupons printable

discount brand cialis

[url=http://cialisopghe.com/#]cialis coupons 2017[/url]

cialis uk sale

cialis buy online generic

coupon for cialis

cheap cialis next day delivery

[url=http://cialisopghe.com/#]cialis coupons[/url]

how to buy cialis in london

loan money

[url=https://loanstrast.com/]check in go[/url]

apply for loans online

easy loans with bad credit

levitra 20 mg cheap

levitra coupon

purchase cheap levitra

[url=http://levitraklnbi.com/#]viagra vs cialis vs levitra[/url]

buy generic levitra 10 mg

buy levitra 20 mg online

levitra

order levitra from canada

[url=http://levitraklnbi.com/#]levitra bayer 20mg meilleur prix[/url]

cheap prices levitra

online loans

[url=https://loanstrast.com/]payday loans[/url]

payday loans online

loans online

buy levitra mastercard

9 levitra at walmart

order levitra online no prescription

[url=http://levitraklnbi.com/#]9 levitra at walmart[/url]

buy levitra cialis

cialis pills from india

cialis without a prescription

how to buy cheap cialis

[url=http://cialisfbvne.com/#]cialis without prescription[/url]

how to buy cialis online

cheap cialis prices

cialis without a doctor

where can i buy cheap cialis

[url=http://cialisfbvne.com/#]cialis without a doctor prescription[/url]

where to buy generic cialis in canada

online loans

[url=https://loanstrast.com/]payday loans bad credit[/url]

payday loans online

loans online

best place order viagra

viagra without a doctor

happens if you take 2 viagra pills

[url=http://viagramnkjm.com/#]viagra without a doctor's prescription[/url]

get hard without viagra

generic viagra at walmart

viagra without a doctor's prescription

buying viagra in new zealand

[url=http://viagramnkjm.com/#]viagra without a prescription[/url]

buy viagra new york city

buy viagra online us

viagra without doctor

viagra 25mg . vs. 50mg

[url=http://viagramnkjm.com/#]viagra without a doctor’s prescription[/url]

viagra in the uk for sale

online loans

[url=https://smajloans.com/]payday advance[/url]

pay day loans

payday loans

[url=https://loanstrast.com/]payday advance[/url]

payday loans no credit check

pay day loans

[url=https://loansfast.us.com/]payday loan online[/url]

online loans

online loans

online gambling legal in nj

online casino

real money gambling apps ipad

[url=http://online-casino.party/#]casino real money[/url]

casino gambling online top

como funciona mejor cialis

http://viagraeiu.com - buy viagra online

how good does cialis work

[url=http://viagraeiu.com]buy cheap viagra[/url]

cialis comprar en farmacia

viagra

can i get cialis on prescription

pay day loans

[url=https://smajloans.com/]cash advance[/url]

cash loans

payday loan online

[url=https://loanstrast.com/]cash loans[/url]

cash advance

payday advance

[url=https://loansfast.us.com/]payday loans online[/url]

pay day loan

payday loan online

best first deposit bonus bingo

casino online

online casino tournaments for us players

[url=http://online-casino.party/#]casino online[/url]

visa gift card casino

online payday loans

[url=https://smajloans.com/]payday loans no credit check[/url]

cash advance

online payday loans

[url=https://loanstrast.com/]cash advance loans[/url]

payday loans

pay day loan

[url=https://loansfast.us.com/]payday loans no credit check[/url]

cash advance

payday loans online

pay day loans

[url=https://smajloans.com/]payday loans online[/url]

payday loans

pay day loans

[url=https://loanstrast.com/]payday loans online[/url]

payday advance

online payday loans

[url=https://loansfast.us.com/]online payday loans[/url]

pay day loans

online loans

las vegas casino online poker

online casinos

coolcat casino bonus

[url=http://online-casino.party/#]online casinos[/url]

gambling slot machines

payday loans no credit check

[url=https://smajloans.com/]payday loans online[/url]

online loans

pay day loan

[url=https://loanstrast.com/]payday loans online[/url]

online payday loans

pay day loans

[url=https://loansfast.us.com/]cash advance[/url]

cash advance

payday loans

cash advance loans

[url=https://smajloans.com/]online loans[/url]

pay day loans

pay day loan

[url=https://loanstrast.com/]cash loans[/url]

online loans

online payday loans

[url=https://loansfast.us.com/]pay day loans[/url]

cash advance loans

pay day loans

pay day loans

[url=https://smajloans.com/]cash advance[/url]

online payday loans

payday loan online

[url=https://loanstrast.com/]pay day loan[/url]

online payday loans

online loans

[url=https://loansfast.us.com/]online loans[/url]

payday loans no credit check

payday loans online

can viagra pills be cut

viagra without a doctor

safety of viagra bought online

[url=http://viagrajnmeo.com/#]viagra without prescription[/url]

viagra cheap online

pay day loan

[url=https://smajloans.com/]pay day loans[/url]

payday loans online

payday loans online

[url=https://loanstrast.com/]online loans[/url]

payday advance

cash advance loans

[url=https://loansfast.us.com/]cash advance loans[/url]

online loans

pay day loans

viagra online canadian pharmacies cialis sky pharmacy viagra 100mg price overnight viagra delivery on line pharmacy Online Pharmacy viagra samples from the us pfizer viagra cheap healthy male viagra

red cialis pills

best erection pills

viagra generic price

[url=http://pillshnembn.com/#]erection pills[/url]

generic brand viagra online

generic viagra over the counter

erection pills

buy cialis online uk no prescription

[url=http://pillshnembn.com/#]best erection pills[/url]

what pill is like viagra

payday loan online

[url=https://smajloans.com/]cash loans[/url]

pay day loans

online payday loans

[url=https://loanstrast.com/]payday loans[/url]

online loans

online loans

[url=https://loansfast.us.com/]cash loans[/url]

payday loans online

pay day loan

cialis pills what are for

cialis on line no pres

generic cialis discount

[url=http://cialisviymw.com/#]cialis rezeptfrei[/url]

how can i order cialis

best deal generic viagra

viagra prices

where can you get liquid viagra

[url=http://viagrakbg.com/#]viagra online[/url]

sildenafil citrate generic online

generic viagra online from india

viagra online

can take 2 50mg viagra pills

[url=http://viagrakbg.com/#]viagra pills[/url]

is it legal to buy viagra on craigslist

free casino games

[url=http://real777money.com/]casino games[/url]

free slot games

casino game

best us casinos online

[url=http://real777money.com/]free casino games[/url]

casino online

casino games