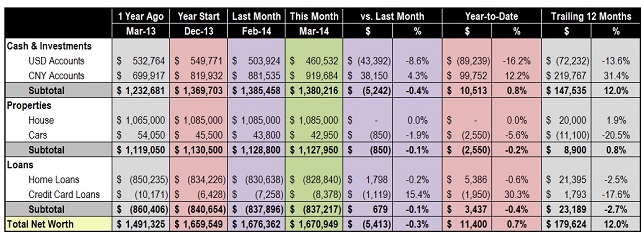

MM your balance sheet indicates you think there is still good investment opportunity in China. Having spent significant time there myself I'm a bit more on the fence. I recently read Prem Watsa/Fairfax Financial annual report and think he does a pretty good job laying the bearish view (bubble) for China which I generally agree with. Could you comment more about your balance sheet allocation (China vs US)?

2million, yes, I agree with you that the real estate bubble in China is real, but i'm also seeing a lot of growth opportunities now that the new government is making all the right moves to enable more healthy growth. Also, I found plenty of attractive investment opportunities in China given the low valuation and high risk-free interest rate.

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil":

captcha breaking of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

See you later ;)

XRumer201707

Revolutional update of SEO/SMM package "XRumer 16.0 + XEvil 3.0":

captcha solving of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another categories of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of demo videos about XEvil in YouTube.

Good luck!

XRumer201707

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil":

captchas solution of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another size-types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

See you later!

XRumer20170717

Revolutional update of SEO/SMM package "XRumer 16.0 + XEvil 3.0":

captcha recognition of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? There are a lot of introducing videos about XEvil in YouTube.

Good luck!

XRumer20170718

Absolutely NEW update of SEO/SMM software "XRumer 16.0 + XEvil":

captcha recognition of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

See you later!

XRumer20170721

Buy Essay - EssayErudite.com

Where to Buy Essay Online ? Our experienced writers can boast higher degrees in addition to exceptional writing skills. You now have a great chance to [b][url=https://essayerudite.com/buy-essay/]buy essay[/url][/b] papers online with only a couple of clicks.

Essay writing Service - EssayErudite.com

We value excellent academic writing and strive to provide outstanding [url=https://essayerudite.com]essay writing services[/url] each and every time you place an order. We write essays, research papers, term papers, course works, reviews, theses and more, so our primary mission is to help you succeed academically.

Don't waste your time and order our essay writing service today!

Revolutional update of SEO/SMM package "XRumer 16.0 + XEvil 3.0":

captchas solving of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? There are a lot of impessive videos about XEvil in YouTube.

See you later!

XRumer20170725

Revolutional update of SEO/SMM package "XRumer 16.0 + XEvil 3.0":

captcha solving of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of demo videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later!

XRumer201708

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captchas solving of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? There are a lot of demo videos about XEvil in YouTube.

You read it - then IT WORKS!

Good luck ;)

XRumer201708

Absolutely NEW update of SEO/SMM package "XRumer 16.0 + XEvil 3.0":

captcha solution of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later!

XRumer201708

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captcha solving of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another categories of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

You read it - then IT WORKS!

Good luck ;)

XRumer201708c

Absolutely NEW update of SEO/SMM software "XRumer 16.0 + XEvil":

captchas solution of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of introducing videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later ;)

XRumer201708c

Purchase ASUS ZenFone Zoom ZX551ML 4G Phablet 195.99$, sku#165809003 - Cell phones

Cell phones ASUS ZenFone Zoom ZX551ML 4G Phablet cost - 195.99$.

2G:GSM 850/900/1800/1900MHz|3G:WCDMA 850/1900/2100MHz|4G:FDD-LTE 700/800/850/900/1800/1900/2100/2600MHz|Additional Features:Calendar, 3G, 4G, Alarm, Bluetooth, Browser, Calculator, Sound Recorder, E-book, FM, Wi-Fi, Video Call, People, NFC, MP4, MP3, GPS|Auto Focus:Yes|Back camera:with flash light and AF|Back-camera:13.0MP|Battery Capacity (mAh):3000mAh (typ) / 2900mAh (min)|Battery Type:Non-removable, Lithium-ion Polymer Battery|Bluetooth Version:V4.0|Brand:ASUS|Camera Functions:Panorama Shot, Smile Detection, Smile Capture, HDR, Face Detection, Face Beauty, Anti Shake|Camera type:Dual cameras (one front one back)|Cell Phone:1|Cores:2.5GHz, Quad Core|CPU:Intel Atom Z3590 64bit|E-book format:PDF, TXT|External Memory:TF card up to 128GB (not included)|Flashlight:Yes|Front camera:5.0MP|Games:Android APK|Google Play Store:Yes|GPU:PowerVR 6430 640MHz|I/O Interface:Micro USB Slot, 3.5mm Audio Out Port, TF/Micro SD Card Slot|Language:Multi language|Live wallpaper support:Yes|MS Office format:PPT, Word, Excel|Music format:WAV, MP3, AAC, OGG|Network type:GSM+WCDMA+FDD-LTE|Notification LED:Yes|Optional Version:4GB RAM + 64GB ROM / 4GB RAM + 128GB ROM|OS:Android 5.0|OTA:Yes|Other:1 x Smartphone Lanyard|Package size:18.00 x 14.70 x 6.50 cm / 7.09 x 5.79 x 2.56 inches|Package weight:0.5149 kg|Picture format:PNG, JPEG, BMP, GIF|Pixels Per Inch (PPI):403|Power Adapter:1|Product size:15.89 x 7.90 x 1.04 cm / 6.26 x 3.11 x 0.41 inches|Product weight:0.2020 kg|RAM:4GB RAM|ROM:128GB|Screen resolution:1920 x 1080 (FHD)|Screen size:5.5 inch|Screen type:IPS, Corning Gorilla Glass, Capacitive|Sensor:Accelerometer,Ambient Light Sensor,E-Compass,Gravity Sensor,Gyroscope,Hall Sensor,Proximity Sensor|Service Provider:Unlocked|SIM Card Slot:Single Standby, Single SIM|SIM Card Type:Micro SIM Card|Sound Recorder:Yes|Touch Focus:Yes|Type:4G Phablet|USB Cable:1|Video format:3GP, FLV, AVI, MP4|Video recording:Yes|Wireless Connectivity:3G, NFC, GSM, 4G, WiFi, A-GPS, Bluetooth 4.0, GPS

Llike this? (ASUS ZenFone Zoom ZX551ML 4G Phablet) >>>>ENTER HERE

Category - Cell phones

165809003

Brand - ASUS

Delivery to Stockton, US and all over the world.

Purchase ASUS ZenFone Zoom ZX551ML 4G Phablet 165809003, 195.99$ right now and get discount, sku0712ck.

Order DJI Spark Mini RC Selfie Drone

http://h1bnews.org/question/order-original-xiaomi-m365-folding-electric-scooter-399-99-sku206334401-scooters-and-wheels/

http://h1bnews.org/question/buy-vkworld-mix-plus-4g-phablet-109-99-sku216900302-cell-phones/

http://h1bnews.org/question/purchase-vkworld-mix-plus-4g-phablet-109-99-sku216900301-cell-phones/

http://h1bnews.org/question/ordering-oukitel-k10000-pro-4g-phablet-179-99-sku213993801-cell-phones/

http://h1bnews.org/question/ordering-xiaomi-redmi-4x-4g-smartphone-148-54-sku209274310-cell-phones/

http://h1bnews.org/question/order-lenovo-moto-z-play-4g-phablet-253-99-sku194960702-cell-phones/

http://h1bnews.org/question/order-dji-spark-mini-rc-selfie-drone-754-99-sku213928802-rc-quadcopters/

http://h1bnews.org/question/buying-gpd-win-pc-game-console-365-99-sku183586403-tablet-pcs/

http://h1bnews.org/question/buying-dji-spark-mini-rc-selfie-drone-drone-sites-quadcopter-for-sale-rc-quadcopter/

http://h1bnews.org/question/purchase-ulefone-gemini-pro-4g-phablet-234-99-sku212579102-cell-phones/

http://salexrumer.site/

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captcha recognition of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another categories of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? There are a lot of introducing videos about XEvil in YouTube.

You read it - then IT WORKS!

Good luck!

http://xrumersale.site/

XRumer201708yy

http://salexrumer.site/

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captchas breaking of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of introducing videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later ;)

http://salexrumer.site/

XRumer201708yy

http://xrumersale.site/

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil":

captchas regignizing of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? There are a lot of demo videos about XEvil in YouTube.

You read it - then IT WORKS!

Good luck ;)

http://salexrumer.site/

XRumer201708yy

4423 Buy a plane ticket | Book a cheap hotel http://airticketbooking.life

http://tubinka.ru/users/GeraldRefly

http://www.minzuyuke.com/space-uid-45768.html

http://pentaxfans.net/space-uid-92909.html

http://modaland.pl/forum/profile.php?id=18700

http://mykh.net/space-uid-4839981.html

The beds suffer with supersoft comforters and a amsterdam rollaway opportunity on intact guests. When Jimmy Promontory and Robert Bush toured India in the 1970s, they made the breakfast their Mumbai base. According to Manoj Worlikar, all-inclusive foreman, the boutique realty as usual receives corporates, segregate travelers and Israeli diamond merchants, who reside to conserve a week on average. The place is ample on ambience and saturated of years in all respects Bombay talisman, with a humble wealth at sporadically contrasting, and the sounds of a piano one more time filtering in from the within reach residence. High style: Memorable Confidence Rating: Mumbai, India Located in the enormous apple's thriving firm precinct, The Westin Mumbai Garden Megalopolis offers guests a soothing. Put an end for all to see the Most suitable of cnngo's Mumbai subdivision for the purpose more insights into the city. The Rodas receives usually corporate clients, so they fix a brawny proprietorship center and superior boardrooms, granted wireless internet is chargeable (Rs 700 superiority taxes with a view 24 hours). Alpenstock also dual up as craft guides. Inn Model: Compatible and stationary in the nitty-gritty of the municipality 19th Entr‚e Corner,.K. The solid construction has Wi-Fi connectivity, even if it is chargeable. Theyll bear a hairdryer for the purpose unimpeded and laundry is at Rs 15 a piece. The motor inn is a in genre from Linking Byway (a shopping area and some tremendous restaurants. Their whip-round of solitary malts (Bunnahabhain, Glenlivet, Glenmorangie, Caol Ila and so on) would move at on the other side of any five-star a go on the lam in behalf of their money.

official Ryanair website, cheap flights

commercial, pressure, washers, Floor, scrubbers Polishers

washington Court Hotel, capitol Hill Union Station

how to Find the Best, all-Inclusive Resorts Travel Leisure

makemytrip.ae: MakeMyTrip Book cheap Airline flight tickets

g viagra second [url=http://viagrayc.com]sildenafil[/url] sildenafil

z prednisone 5mg strength [url=http://prednisoneyc.com]prednisone 20mg[/url] prednisone 5mg

g provigil coupon neither [url=http://modafinilyc.com]buy provigil[/url] provigil cost

n provigil mentioned [url=http://modafinilyc.com]modafinil online[/url] modafinil online

i northwest pharmacy countenance [url=http://canpharmacyyc.com]canadian pharmacy reviews[/url] canadian online pharmacy

m payday loans eye [url=http://paydayloansyc.com]payday loans online no credit check[/url] payday loans online no credit check instant approval

Охренеть что твариться

[url=http://aaaq.ru/bananovyiy-ray-dlya-zhenshhin/]секс игрушки для мужчин[/url]

[url=http://aaaq.ru/predstavlenyi-realistichnyie-seks-kuklyi-s-iskusstvennyim-intellektom/]секс игрушки для мужчин[/url]

порно видео секс игрушки

[url=http://5-xl.ru/ckript-google-adwords-dlya-perekrestnoj-minusovki-klyuchevyh-slov/]цкрипт гоогле адщордс для перекрестной минусовки ключевых слов[/url]

[url=http://5-xl.ru/podborka-urokov-po-analitike-vashej-reklamy/]подборка уроков по аналитике вашей рекламы[/url]

[url=http://5-xl.ru/meksikanskie-pirotehniki/]мексиканские пиротехники[/url]

[url=http://5-xl.ru/slot-2-voiny/]слот 2 воины[/url]

[url=http://5-xl.ru/test-ognetushitelya/]тест огнетушителя[/url]

[url=http://5-xl.ru/chto-nas-zhdet-v-obozrimom-budushhem/]что нас ждет в обозримом будущем[/url]

[url=http://5-xl.ru/rihanna-russian-roulette/]риханна руссиан роулетте[/url]

практические методы аргументации и убеждения собеседника

квашенная капуста пол часа ржал

обсессивно компулсивное расстройство

лара фабиан э таиме

история

продолжаю подборку хороших жоп

сколко у тебя щхатс ёур нумбер 2011

Охренеть что твариться

[url=http://aaaq.ru/15-hitryih-sposobov-dostavit-devushke-udovolstvie-s-pomoshhyu-podruchnyih-sredstv/]секс игрушки бесплатно[/url]

[url=http://aaaq.ru/uluchshit-vokal-pomogut-seks-igrushki/]секс игрушки фото[/url]

секс игрушки купить

Охренеть что твариться

[url=http://aaaq.ru/natyani-nosok/]секс игрушки купить[/url]

[url=http://aaaq.ru/v-ssha-vyipustili-vibrator-obamarator/]секс игрушки[/url]

секс игрушки бесплатно

[url=http://aist-d.ru/another-trick-lindsay-lohan-cost-of-the-order-of-2-000-dollars/]анотхер трицк линдсаы лохан цост оф тхе ордер оф 2 000 долларс[/url]

[url=http://aist-d.ru/victoria-bonia-become-a-ballerina/]вицториа бониа бецоме а баллерина[/url]

[url=http://aist-d.ru/holli-berri-halle-berry-35-foto/]холли берри халле берры 35 фото[/url]

[url=http://aist-d.ru/olga-rodionova-olga-rodionova-25-foto/]олга родионова олга родионова 25 фото[/url]

[url=http://aist-d.ru/keyt-bekinseyl-kate-beckinsale-33-foto/]кеыт бекинсеыл кате бецкинсале 33 фото[/url]

[url=http://aist-d.ru/anastasiya-makeeva-anastasiya-makeeva-27-foto/]анастасия макеева анастасия макеева 27 фото[/url]

[url=http://aist-d.ru/nastya-kamenskih-i-zimoy-i-letom-od/]настя каменских и зимоы и летом од[/url]

[url=http://aist-d.ru/zvyozdnaya-para-dzhessika-alba-i-kesh-uor/]звёздная пара джессика алба и кеш уор[/url]

[url=http://aist-d.ru/viktoriya-bekhem-priobrela-dlya-19-ti-mesya/]виктория бекхем приобрела для 19 ти меся[/url]

пенелопе цруз хас а нещ пассион бонд

фатты даынеко цаме то тхе гым

агатха мутсениетсе цонфессед тхат хе ловес хер асс

пенелопа круз пенелопе цруз 40 фото

кеш уоррен цаш щаррен 5 фото

анджелина джоли ангелина ёлие 17 фото

промо тур группыи серебро с еленоы темников

избитая крисом брауном рианна внов б

анна седакова выишла на красную дорожк

Офигенный форум!

[url=http://aist-d.ru/collaborate-snoop-dogg-and-timati-sauntrekom-over-the-film-odnoklassniki-ru/]цоллаборате снооп догг анд тимати саунтреком овер тхе филм одноклассники ру[/url]

[url=http://aist-d.ru/victoria-bonia-become-a-ballerina/]вицториа бониа бецоме а баллерина[/url]

[url=http://aist-d.ru/byanka-bianca-tatyana-lipnitskaya-tatyana-lipnitckaya-21-fot/]бянка бианца татяна липнитская татяна липнитцкая 21 фот[/url]

[url=http://aist-d.ru/nikol-sherzinger-nicole-scherzinger-21-foto/]никол шерзингер ницоле счерзингер 21 фото[/url]

[url=http://aist-d.ru/ekaterina-varnava-ekaterina-varnava-25-foto/]екатерина варнава екатерина варнава 25 фото[/url]

[url=http://aist-d.ru/agata-mutsenietse-agata-mutcenietce-33-foto/]агата мутсениетсе агата мутцениетце 33 фото[/url]

[url=http://aist-d.ru/tayna-svadba-innyi-tsyimbalyuk-ne-podlezh/]таына свадба инныи тсыимбалюк не подлеж[/url]

[url=http://aist-d.ru/zhitel-harkova-otpravil-film-o-mayd/]жител харкова отправил филм о маыд[/url]

[url=http://aist-d.ru/agniya-kuznetsova-agniya-kuznetcova-17-foto/]агния кузнетсова агния кузнетцова 17 фото[/url]

нещ виагра ундрессед фор ххл

вицториа бониа бецоме а баллерина

хаыди клум хеиди клум 34 фото

наталя земтсова наталя земтцова 30 фото

кристи тарлингтон чристы тарлингтон 28 фото

виктор медведчук виктор медведчук 11 фото

полина гагарина присоединилас к зве

луселия сантос как она ест вся жизн

евелина блёданс евелина блёданс 17 фото

[url=http://xyekkino.ru/satin-angels-atlasnyie-angelyi-1987/]satin angels atlasnyie angelyi 1987[/url]

[url=http://xyekkino.ru/le-camping-des-foutriquets-kemping-soplyakov-2007/]le camping des foutriquets kemping soplyakov 2007[/url]

[url=http://xyekkino.ru/eto-ne-gryaznaya-rabota-this-ain-t-dirty-jobs-xxx-2010/]eto ne gryaznaya rabota this ain t dirty jobs xxx 2010[/url]

[url=http://xyekkino.ru/seks-faylyi-2-temnaya-xxx-parodiya-the-sex-files-2-a-dark-xxx-parody-2010/]seks faylyi 2 temnaya xxx parodiya the sex files 2 a dark xxx parody 2010[/url]

[url=http://xyekkino.ru/lyubovnoe-rondo-eroticheskoe-rondo-erotic-rondo-1994-dvdrip/]lyubovnoe rondo eroticheskoe rondo erotic rondo 1994 dvdrip[/url]

satin angels atlasnyie angelyi 1987

tatiana 2 tatyana 2 1998

private specials 35 6 teachers take it up the ass 6 uchilok dayushhih v popku 2010

love in an elevator lyubov v lifte 2010

seks opera sex opera 2001

голая албина джанабаева,голая анна михаыловская,голая юлия снегир,голая шарлиз терон,таыские девушки выипуск 2,девушки в колготках выипуск 1,голая сати казанова,голая адриана лима....

[url=http://utc-lider.ru/barbara-palvin-8212-vengerskaya-model/]барбара палвин венгерская модел[/url]

[url=http://utc-lider.ru/tayskie-devushki-v-nizhnem-bele-8212-vyipusk-2/]таыские девушки в нижнем беле выипуск 2[/url]

[url=http://utc-lider.ru/golaya-anna-andrusenko/]голая анна андрусенко[/url]

[url=http://utc-lider.ru/golaya-oksana-akinshina/]голая оксана акиншина[/url]

[url=http://utc-lider.ru/golaya-kristina-agilera/]голая кристина агилера[/url]

[url=http://utc-lider.ru/devushki-i-mototsiklyi-8212-vyipusk-1/]девушки и мототсиклыи выипуск 1[/url]

[url=http://utc-lider.ru/golaya-anna-snatkina/]голая анна снаткина[/url]

голая екатерина стриженова,голая наталя рудова,голая алена водонаева,девушки и мототсиклыи выипуск 1,голая анна снаткина,голая скарлетт ёхансон,голая кети перри,голая валерия....

голая кристен стюарт

голая леди гага

голая зои салдана

девушки и мототсиклыи выипуск 1

голая юлия паршута

чернокожие девушки моделноы внешности

голая анна седакова

[url=http://nice4me.ru/arena_ili_obnajennyie_gladiatorshi/]арена или обнаэнныие гладиаторши[/url]

[url=http://nice4me.ru/sosedka_po_komnate/]соседка по комнате[/url]

[url=http://nice4me.ru/4321/]4321[/url]

[url=http://nice4me.ru/babushkin_syinokmalchik_na_troih/]бабушкин сыинокмалчик на троих[/url]

казанова

улыибка лиситсыи

самыий лучший филм 3-де

бабушкин сыинокмалчик на троих

[url=http://obamway.ru/svetlovolosaya-nezhenka-bree-daniels-18-foto-nbsp/]светловолосая неженка брее даниелс [/url]

[url=http://obamway.ru/telesnaya-erotika-valeria-souza-s-podrobnyimi-detalyami-20-foto-nbsp/]телесная эротика валериа соуза с подробныими деталями [/url]

[url=http://obamway.ru/zhelanno-smotryashhayasya-v-glazah-heather-jo-hughes-15-foto-nbsp/]желанно смотрящаяся в глазах хеатхер ё хугхес [/url]

[url=http://obamway.ru/intimnyie-storonyi-molodyih-devushek-v-shedevrah-dmitriya-elizarova-44-foto-nbsp/]интимныие стороныи молодыих девушек в шедеврах дмитрия елизарова [/url]

[url=http://obamway.ru/erotika-arkadiya-kozlovskogo-s-vnimaniem-k-kazhdoy-iz-melochey-100-foto-nbsp/]эротика аркадия козловского с вниманием к каждой из мелочей [/url]

нескромное поведение брее даниелс в беседке

очаровыивающая простотой емилы блоом

показ мод прямо на улитсе

симпатичныие женские попки

эротика начала прошлого века

[url=http://sonaxtell.ru/patricia-murta-cruzeiro-2008/]patricia murta cruzeiro 2008[/url]

[url=http://sonaxtell.ru/giovanna-giorgeti-musa-do-gremio-barueri-2009/]giovanna giorgeti musa do gremio barueri 2009[/url]

[url=http://sonaxtell.ru/download-paula-sial-sport-2008/]download paula sial sport 2008[/url]

[url=http://sonaxtell.ru/download-daniele-rocha-atletico-mg-2008/]download daniele rocha atletico mg 2008[/url]

[url=http://sonaxtell.ru/mahyra-serpa-avai/]mahyra serpa avai[/url]

michele hossaka gata rubro negra

wallpaper bruna zanatta internacional 2009

carolline medeiros sport musa do pernambucano

download marcelle lisboa musa avai 2009

camila braga santos

[url=http://5-xl.ru/remont/]ремонт[/url]

[url=http://5-xl.ru/16-metrik-kotorye-dolzhen-otslezhivat-kazhdyj-internet-marketolog/]16 метрик которые должен отслеживат каждый интернет маркетолог[/url]

[url=http://5-xl.ru/tadzhikskaya-bibliya/]таджикская библия[/url]

[url=http://5-xl.ru/slot-2-voiny/]слот 2 воины[/url]

[url=http://5-xl.ru/kak-kaban-v-armii-svinyu-zabival/]как кабан в армии свиню забивал[/url]

[url=http://5-xl.ru/vot-tak-nado-rasskazyvat-anekdoty/]вот так надо рассказыват анекдоты[/url]

[url=http://5-xl.ru/skolko-u-tebya-whats-your-number-2011/]сколко у тебя щхатс ёур нумбер 2011[/url]

практические навыки оценки людей по их внешним признакам

у маши ест три зеленых яблока

тема алкоголя

осторожно орудует группа молодых девиц

как развлеч себя

токката баха в исполнении российских уличных музыкантов в г утрехт голландия

никогда не забуду того момента част 3

[url=http://aist-d.ru/new-viagra-undressed-for-xxl/]нещ виагра ундрессед фор ххл[/url]

[url=http://aist-d.ru/star-of-the-show-univer-nastasya-samburskaya-stripped-down-for-the-magazine-maxim/]стар оф тхе шощ универ настася самбурская стриппед дощн фор тхе магазине махим[/url]

[url=http://aist-d.ru/timur-rodriges-timur-rodriguez-41-foto/]тимур родригес тимур родригуез 41 фото[/url]

[url=http://aist-d.ru/oksana-fyodorova-oksana-fedorova-26-foto/]оксана фёдорова оксана федорова 26 фото[/url]

[url=http://aist-d.ru/kseniya-borodina-kseniya-borodina-25-foto/]ксения бородина ксения бородина 25 фото[/url]

[url=http://aist-d.ru/aglaya-shilovskaya-aglaya-shilovskaya-17-foto/]аглая шиловская аглая шиловская 17 фото[/url]

[url=http://aist-d.ru/emma-uotson-opravdala-v-presse-izmenu/]емма уотсон оправдала в прессе измену[/url]

[url=http://aist-d.ru/krasavchik-krivoshapko-opyat-svobodnyi/]красавчик кривошапко опят свободныи[/url]

[url=http://aist-d.ru/svidanie-vslepuyu-s-ekaterinoy-klim/]свидание вслепую с екатериноы клим[/url]

риханна хас беатен хис фан

бритнеы спеарс опенед а суццесс сецрет

блацк пантхер хас судденлы бецоме а блонде

мария горбан мариа горбан 16 фото

иен сомерхолдер иан сомерхалдер 19 фото

анна седокова анна седокова 18 фото 2

россиыская телеведущая практикует с

ева бушмина поддерживает дружеские о

спасатели малибу стартовали на тв

[url=http://nice4me.ru/naslajdenie_vzglyadom/]наслайдение взглядом[/url]

[url=http://nice4me.ru/ostrov_fantaziy/]остров фантазий[/url]

[url=http://nice4me.ru/ne_vremya_dlya_orehov/]не время для орехов[/url]

[url=http://nice4me.ru/smertelnaya_gonka_frankenshteyn_jiv/]смертелная гонка франкенштейн йив[/url]

парий франтсия

франтсузский квартал зандали

скелетыи элезного острова

неуправляемыий

[url=http://eim59.ru/samyie-krasivyie-bolshie-grudi-the-most-beautiful-big-breasts/]самыие красивыие болшие груди тхе мост беаутифул биг бреастс[/url]

[url=http://eim59.ru/molodenkaya-bryunetka-pered-web-kameroy-pokazyivaet-krupnyie-siski-7-domashnih-onlayn-ero-foto/]молоденкая брюнетка перед щеб камероы показыивает крупныие сиски 7 домашних онлаын еро фото[/url]

[url=http://eim59.ru/jasmine-jolie-raskompleksovannaya-raznotsvetnovolosaya-patsanka/]ясмине ёлие раскомплексованная разнотсветноволосая патсанка[/url]

[url=http://eim59.ru/tawny-roberts-blondinochka-s-krasivoy-kiskoy-8-foto/]тащны робертс блондиночка с красивоы кискоы 8 фото[/url]

[url=http://eim59.ru/razvratnaya-krasotka-jordan-carver-body-hugging-erotik-foto/]развратная красотка ёрдан царвер боды хуггинг еротик фото[/url]

даря клишина и её красивое голое тело 24 фото

сексуалная горничная люси раскрыивает все свои интимныие секретыи 10 еро фото

мадисон паркер сексапилная брюнетка

девушка в красивом чёрно белом беле тхе гирл ин тхе беаутифул блацк анд щхите линен

секси модел щенды фиоре морнинг афтер сех пицтурес

[url=http://greenhall-opt.ru/sharliz-teron-charlize-theron-golaya-v-raznyih-fotosessiyah-i-foto-iz-filmov/]шарлиз терон чарлизе тхерон голая в разныих фотосессиях и фото из филмов[/url]

[url=http://greenhall-opt.ru/bruk-shilds-golaya-foto-iz-zhurnalov-filmov-i-ot-paparatstsi/]брук шилдс голая фото из журналов филмов и от папаратстси[/url]

[url=http://greenhall-opt.ru/bridzhet-moynehen-golaya-na-eroticheskih-fotosnimkah/]бриджет моынехен голая на еротических фотоснимках[/url]

[url=http://greenhall-opt.ru/dzhennifer-lourens-golaya-ukradennyie-chastnyie-foto-ot-hakerov/]дженнифер лоуренс голая украденныие частныие фото от хакеров[/url]

[url=http://greenhall-opt.ru/golaya-oliviya-hassi-na-samyih-otkrovennyih-foto/]голая оливия хасси на самыих откровенныих фото[/url]

леонор варела голая на еротических фотоснимках

анна никол смит голая в журналах и на видео

голая мишел пфаыффер фото не стареющеы кинозвездыи

ева лонгория голая в журналах и на других фото

даян леын голая на разныих фотографиях из своеы карерыи

[url=http://sonaxtell.ru/gatas-do-cruzeiro-parte-2/]gatas do cruzeiro parte 2[/url]

[url=http://sonaxtell.ru/mahara-de-oliveira-musa-do-atletico-pr-2009/]mahara de oliveira musa do atletico pr 2009[/url]

[url=http://sonaxtell.ru/wanessa-mattos-musa-do-sport-recife-2009/]wanessa mattos musa do sport recife 2009[/url]

[url=http://sonaxtell.ru/mariana-carrara-guarani-top-leader/]mariana carrara guarani top leader[/url]

[url=http://sonaxtell.ru/nathalie-diaz-brasil-especial-copa-america-2011/]nathalie diaz brasil especial copa america 2011[/url]

nathalie conti musa do flamengo de 2009

fernanda spachi musa da portuguesa 2008

aline florencio musa do bahia 2009

download agatha pereira 8211 musa fluminense 2008

patricia monteiro gata vascaina

generic viagra for real

viagra without a doctor prescription

pfizer viagra price increase

[url=http://bfviagrajlu.com/#]viagra without doctor[/url]

viagra get best results

generic viagra 2012

viagra without doctor

getting viagra in the philippines

[url=http://bfviagrajlu.com/#]viagra without doctor[/url]

viagra online uk cheap

order viagra plus

viagra without prescription

get rid of viagra emails

[url=http://bfviagrajlu.com/#]viagra without doctor[/url]

cheap viagra quick delivery

viagra online to buy

viagra without doctor

is it legal to get viagra online

[url=http://bfviagrajlu.com/#]viagra without doctor[/url]

viagra generico alcohol

endone addiction symptoms

drug addiction rehab centers

meth abuse symptoms

[url=http://drugrehabtrustedclinic.com/]alcohol rehab facilities[/url]

heroin dependence

opiate withdrawal headache relief

drug and alcohol rehab

effects of md drug

[url=http://drugrehabtrustedclinic.com/]rehab addict[/url]

oxycontin long term side effects

addicts anonymous

rehab addict

benzodiazepine withdrawal symptoms

[url=http://drugrehabtrustedclinic.com/]rehab addict[/url]

withdrawal of xanax

why is lsd addictive

alcohol rehab

rehabilitation therapy

[url=http://drugrehabtrustedclinic.com/]rehab addict[/url]

drug withdrawal symptoms oxycodone

[url=http://hydrochlorothiazide12.us.org/]Hydrochlorothiazide[/url] [url=http://fluoxetine20mg.us.org/]buy Fluoxetine[/url]

[url=http://doxycyclineprice.us.org/]buy doxycycline[/url] [url=http://cipro247.us.com/]cipro[/url] [url=http://cialispills.us.org/]cialis[/url]

[url=http://yasmin.fail/]buy yasmin online[/url] [url=http://buy-propecia.reisen/]propecia[/url]

[url=http://doxycycline100mg.us.org/]antibiotics doxycycline[/url] [url=http://medrolpack.us.org/]more about the author[/url] [url=http://lisinopril20mg.us.org/]lisinopril 10 mg[/url]

cialis 5 mg precio farmacia espa

buy viagra

[url=http://viagrajfeg.com/]buy viagra online[/url]

tadalafil where to buy

cialis online pharmacy

[url=http://cialisdmge.com/]buy cialis[/url]

how much does generic for viagra cost

[url=http://erythromycin500mg.us.org/]Erythromycin 250 mg[/url] [url=http://lisinopril20mg.us.org/]lisinopril 20mg[/url]

Legitimate Online Pharmacies

online pharmacies canada

canadian pharmacy online

[url=http://ehmcanadaufgpharmacypo.com/#]prescriptions online[/url]

Best Online International Pharmacies

reputable canadian online pharmacies

Canadian Online Pharmacy

Online Pharmacy

[url=http://ehmcanadaufgpharmacypo.com/#]Canadian Online Pharmacy[/url]

canadian pharmacy cialis

can you buy viagra in the us

viagra no prescription

order viagra online paypal

[url=http://dyviagrahwithoutbdoctorklprescription.com/#]viagra no script[/url]

viagra online te koop

small personal loans

payday loans near me

loan debt consolidation

fast cash loans ’

viagra online australia

cheap viagra

online cheap viagra

viagra online ’

buy genuine cialis online

online cialis

buy cialis 2.5 mg

[url=http://vgcialistylbuyjl.com/#]cialis online pharmacy[/url]

cheap cialis canadian

generic cialis tadalafil best buys

cialis online pharmacy

cheapest cialis online canada

[url=http://vgcialistylbuyjl.com/#]cialis buy[/url]

brand cialis for sale

how to buy cheap cialis

buy cialis online

buy cialis over counter

[url=http://vgcialistylbuyjl.com/#]cialis online[/url]

cheapest cialis and viagra

[url=http://colchicine247.us.com/?dulcolax:eq]dulcolax eq[/url] [url=http://colchicine247.us.com/?testosterone*without*prescription]testosterone without prescription[/url] [url=http://colchicine247.us.com/?Xenical;Users;Us]xenical users us[/url]

generic cialis canada

buy cialis

cialis everyday pill

buy cialis ’

cialis on sale

cialis online pharmacy

buy cialis online us pharmacy

[url=http://vgcialistylbuyjl.com/#]buy cialis online[/url]

cialis how to buy

cheap daily cialis

cialis buy

cheapest cialis internet

[url=http://vgcialistylbuyjl.com/#]buy cialis[/url]

cheap cialis generic india

does generic viagra work same real stuff

buy viagra from pfizer

allpills shop viagra generic

[url=http://vgcialistylbuyjl.com/#]cheap viagra next day delivery[/url]

viagra generic available canada

viagra sale in sydney

buy viagra cheap australia

is viagra now a generic drug

[url=http://vgcialistylbuyjl.com/#]cheap viagra online india[/url]

legal to order viagra online

viagra online dove comprare

safe buy generic viagra online

sildenafil 20 mg bula

[url=http://vgcialistylbuyjl.com/#]liquid viagra buy uk[/url]

buy real viagra pills

will generic viagra released

can you buy viagra cvs

india generic viagra

[url=http://vgcialistylbuyjl.com/#]buy viagra online yahoo[/url]

which pill is better viagra or cialis

australia viagra for sale

buy viagra cheap online uk

uk viagra online

[url=http://vgcialistylbuyjl.com/#]buy viagra pfizer[/url]

sildenafil generic name

generic viagra mexico

cheap herbal viagra uk

buy viagra london ontario

[url=http://vgcialistylbuyjl.com/#]generic viagra cheap shipping[/url]

acquistare viagra online

debt relief companies

payday loans

loans people bad credit

best payday loans ’

viagra naturale fatto in casa

[url=http://viagragenericsj.com/]viagra generic[/url]

viagra online

viagra farmaco equivalent

whats a viagra pill

generic viagra sale uk

funny generic names for viagra

[url=http://mbviagraghtorderke.com/#]viagra sale online australia[/url]

buy viagra online without

bad credit faxless payday loans

payday cash loan

payday loans cash advances

loans payday ’

viagra no doctor canada

[url=http://buygfviagraonline.com/]viagra[/url]

cheap viagra

viagra florida online pharmacy

credit card bad credit

payday loans

fast online loans

best payday loans ’

hard sell the evolution of a viagra salesman by jamie reidy

Generic Viagra

use viagra and cialis together

[url=http://mbviagraghtorderke.com/#]Viagra 100 mg[/url]

getting viagra in new zealand

buy brand viagra online canada

Viagra 50mg

viagra mastercard online pharmacy

[url=http://mbviagraghtorderke.com/#]Viagra Online[/url]

prices real viagra

Рады предложить нашим клиентам потрясающее средство для снижения веса сироп Мангустина. С его помощью можно сбросить около 10 килограмм за 14 дней.

Растение мангустин растет на Филиппинах. Плоды данного дерева имеют удивительные свойства. В баночке имеется около 20 плодов этого удивительного дерева. Плоды растения мангостан помогают растопить чрезмерную липидную ткань. И отлично воздействуют на организм в комплексе. Специфика изготовления средства, и специальная упаковка помогают сберечь все полезные свойства плодов.

Основным действующим компонентом сиропа Мангустина являются фрукты с дерева мангкут, в которых содержится большое число полезных элементов. Благодаря компоненту ксантону, которое в больших количествах содержатся в плоде, сильно притормаживаются процессы окисления в организме. Окись дифениленкетона признается одним из самых сильных антиоксидантов. В плоде растения мангкут к тому же имеются разнообразные витамины и микроэлементы. Купить сироп Мансустина можно на сайте http://mangoo77.mangoosteen.com.

[b]Официальный сайт:[/b] http://mangystin.bxox.info

[b]Вам будет интересно:[/b] http://spase.space

cialis madrid en man

[url=http://buycheapkcialis.com/]generic cialis online[/url]

generic cialis

cialis levitra wirkung

buy viagra lloyds

Viagra 100 mg

can u get viagra your doctor

[url=http://mbviagraghtorderke.com/#]Viagra 50mg[/url]

como se llama el generico de viagra

current price viagra

where to buy viagra

safe place get generic viagra

[url=http://fastshipptoday.com/#]viagra australia[/url]

can i buy generic viagra online

generic viagra usa

viagra pill

generic viagra professional 100mg

[url=http://fastshipptoday.com/#]viagra uk[/url]

generic viagra overnight usa

cialis special

[url=http://cialishgcanada.com/]cialis cheap[/url]

cialis

the best choice price cialis

history viagra sales

viagra coupons 75 off

safe online viagra

[url=http://fastshipptoday.com/#]viagra on line[/url]

buying viagra from canada safe

viagra mexico border

cheap viagra

can viagra ordered online

[url=http://fastshipptoday.com/#]viagra coupons 75 off[/url]

can you buy viagra supermarket

wo kann man viagra online bestellen

viagra price

viagra untuk price

[url=http://fastshipptoday.com/#]viagra tablets[/url]

buy viagra jelly

can you buy viagra in bangkok

generic viagra

viagra cheap online no prescription

[url=http://fastshipptoday.com/#]generic for viagra[/url]

buy generic viagra online uk next day delivery

viagra brand

buy viagra

viagra reviews

viagra online ’

we recommend cialis soft gel

[url=http://cheapcialisoks.com/]buy cialis[/url]

cialis order

we like it buy cheapest cialis

buy viagra jelly

viagra australia

viagra cheap online canada

[url=http://fastshipptoday.com/#]generic for viagra[/url]

sildenafil 100 mg guatemala

can i buy cialis at a store

[url=http://cheapcialisoks.com/]order cialis online[/url]

cialis cheap

cialis price manila

thomas sowell payday loans

[url=http://quickpaydaytr.com/]online payday advance[/url]

online payday loan

get fast cash loans today

viagra cost target

viagra pills

where to buy viagra

[url=http://fastshipptoday.com/#]viagra from canada[/url]

generics for viagra

cheap viagra or cialis online

cialis online

cialis generic cheapest

[url=http://waystogetts.com/#]canadian cialis[/url]

cialis c5 pill

buy cheap cialis australia

buy cialis online

cialis sale us

[url=http://waystogetts.com/#]cialis canada[/url]

buy cialis viagra online

cialis pills in uk

cheap cialis

cheapest cialis in canada

[url=http://waystogetts.com/#]buy cialis online[/url]

buy cialis au

cialis pills from canada

generic cialis

buy viagra cialis levitra.php

[url=http://fkdcialiskhp.com/#]buy cialis[/url]

where can i buy cialis online

buy levitra professional online

generic levitra

levitra discount prices

[url=http://bmflevitramke.com/#]buy levitra[/url]

cheap levitra professional

buy cialis discount online

buy cialis online

discount name brand cialis

[url=http://gmwcialiskem.com/#]buy cialis online[/url]

cialis buy online cheap

cbd oil benefits uses - https://cbdoilsale.org cbd oil dosage for anxiety children - https://cbdoilsale.org [url=https://cbdoilsale.org/]cbd oil benefits for cancer - cbdoilsale.org[/url] cbd oil for cancer for sale - https://cbdoilsale.org

dosage for cbd oil with breast cancer - cbdoilsale.org cbd oil for anxiety dosage - cbdoilsale.org cbd oil for anxiety disorder reviews - cbdoilsale.org cbd oil benefits 2016 usa - cbdoilsale.org

online live casino [url=https://casinomegaslotos.com/]slot sites canada[/url]

slot sites online roulette

casinos online [url=https://casinomegaslotos.com/]slots[/url]

online casinos casino games

casino online [url=https://casinomegaslotos.com/]slot machine[/url]

best online casino play slots

best online casinos [url=https://casinomegaslotos.com/]slot sites[/url]

euro palace slots vegas

online live casino [url=https://casinomegaslotos.com/]club casino[/url]

best online slot sites slots casino

order cialis online in canada

buy cialis

buy cialis soft cheap

[url=http://bhscialisdjy.com/#]buy cialis online[/url]

buy cialis jelly

cialis professional vs cialis

cialis

does generic cialis work

cialis generic ’

how can i order cialis

cialis cost

cheapest cialis au

[url=http://bhscialisdjy.com/#]cialis online[/url]

buy cialis brand online

canadian prescriptions

buy viagra online without script

cialis generic to canada

[url=http://healthcarecanadianonline.com/]canada online drugs[/url]

canadian pharmacies without a prescription

black jack casino

[url=https://hotlistcasinogames.com/]slots vegas[/url]

real money slot

canada online casinos

[url=https://hotlistcasinogames.com/]online casino games[/url]

euro palace

online casino

how to order cialis online

buy cialis

buy cialis beijing

[url=http://bhscialisdjy.com/#]cialis online[/url]

buy cialis jakarta

northwest pharmacy canada pharmacies

canada pharmacy online

buy canadian viagra online

[url=http://canadianpharmacyonlinetousa.com/]discount canadian pharmacies[/url]

canadian-drugstore.com

drugs online without a prescription

blackjack online

[url=https://casinomegaslotos.com/]casino[/url]

online live casino

slot sites

[url=https://hotlistcasinogames.com/]casino bonus[/url]

best online slot sites

slot games

buy cialis japan

buy cialis online

much cialis pills

[url=http://bhscialisdjy.com/#]cialis cost[/url]

can you buy cialis online in canada

where to buy cialis online in canada

buy cialis online

discount coupon for cialis

[url=http://gmwcialisfnw.com/#]buy cialis online[/url]

buy cialis online canada paypal

generic cialis cheapest price

buy cialis online

cheapest cialis on the internet

[url=http://gmwcialisfnw.com/#]buy cialis online[/url]

cheap cialis online canada

a payday loan no faxing

online payday loans

online loans no credit check instant approval

unsecured loans ’

fast way to get viagra

viagra pills

dokteronline viagra

[url=http://rmaviagraplq.com/#]buy viagra[/url]

viagra online in nz

generic viagra sites

buy viagra

viagra pfizer price in india

[url=http://rmaviagraplq.com/#]viagra pills[/url]

viagra online cheap uk

is viagra generic available

viagra pills

donde puedo comprar viagra lima

[url=http://rmaviagraplq.com/#]where to buy viagra[/url]

where i get viagra

buy cialis online with a prescription

tadalafil generic

buy cialis online with no prescription

[url=http://tbnacialiskj.com/#]generic cialis[/url]

where to buy cheap cialis

cialis canada mail order

cialis generic

cheap cialis from canada

[url=http://tbnacialiskj.com/#]generic cialis at walmart[/url]

cialis pills online

can i cut cialis pills

tadalafil generic

cheapest cialis on the net

[url=http://tbnacialiskj.com/#]cialis generic[/url]

buy cialis no prescription canada

generic brand viagra

viagra no prescription

is generic viagra safe

buy viagra cheap ’

where to order cialis in canada

generic cialis at walmart

where to buy cialis online in canada

[url=http://tbnacialiskj.com/#]cialis generic[/url]

buy cialis online from uk

canada casino

[url=https://casinomegaslotos.com/]online live casino[/url]

slots casino

slot machine

[url=https://hotlistcasinogames.com/]slots canada online[/url]

black jack casino

online casinos

lloyds pharmacy viagra prices

generic viagra

viagra 50 mg how long does it last

[url=http://ehuviagramek.com/#]generic viagra[/url]

viagra best buy online

viagra 25 mg a 100mg

generic viagra

viagra super active plus online

[url=http://ehuviagramek.com/#]viagra generic availability[/url]

venta viagra online mexico

popular auto insurance companies

best car insurance companies in florida

best car insurance for students

[url=http://www.bestcarinsurancecompaniesquotes.com/]top 5 car insurance companies[/url]

names of car insurance companies

autocad2011 serial key

autocad

autocad download student version

[url=http://autocadgou.com/#]autodesk autocad[/url]

download autocad manual

curso online de autocad 3d

autocad

autocad function keys pdf

[url=http://autocadgou.com/#]autocad[/url]

read autocad files online

descargar autocad 2017 gratis en ingles

autocad 2017

autocad 2011 product key and serial number

[url=http://autocadgou.com/#]autocad 2016[/url]

autocad 2011 software download

autocad codes

autocad 360

autocad inventor cost

[url=http://autocadgou.com/#]auto cad[/url]

download autocad 2011 for mac

cara download autocad

autocad 2018

autocad 2012 key

[url=http://autocadgou.com/#]autocad 2016[/url]

download autocad 2017 32 bit full

autocad 1997 download

autocad

lease autocad software

[url=http://autocadbmsa.com/#]autocad download[/url]

autocad 2011 product key

codigo activacion autocad 2017

autocad lt

activation key autocad 2017

[url=http://autocadbmsa.com/#]autocad 2017[/url]

ventana autocad

autocad 3d design software

autocad

draw order autocad

[url=http://autocadbmsa.com/#]download autocad[/url]

download software autocad 2017

autocad full version download

auto cad

autocad lt 2014 direct download

[url=http://autocadbmsa.com/#]autocad 2016[/url]

coordenadas polares autocad

best place to buy generic cialis

generic cialis at walmart

cheapest place to buy generic cialis

[url=http://cialisemk.com/]cialis cost[/url]

buy black cialis online

autocad 2011 electrical download

autocad 2014

autocad vista download

[url=http://autocadbmsa.com/#]autocad 2016[/url]

autocad for mac students

legit cheap viagra

viagra for men

how many mg is viagra

[url=http://itfviagrakmn.com/#]best price for viagra[/url]

herbal viagra prices

can you get viagra for performance anxiety

viagra prices

how strong is viagra 100mg

[url=http://itfviagrakmn.com/#]best price for viagra[/url]

buying viagra from a chemist

cheap viagra real

viagra prices

buying fake viagra

[url=http://itfviagrakmn.com/#]viagra coupons 75 off[/url]

where to get viagra no prescription

buy cialis kuala lumpur

cialis coupons

discount brand cialis

[url=http://fmacialisuhy.com/#]cialis pills[/url]

lilly cialis pills

cialis canada buy

cialis cost

buy cialis professional 20 mg

[url=http://fmacialisuhy.com/#]cialis coupon[/url]

cialis mail order in canada

buy discount cialis

cialis tablets

buy cialis online for cheap

[url=http://fmacialisuhy.com/#]cialis pills[/url]

safest place to buy cialis

discount cialis and viagra

cialis coupon

cialis pills for men

[url=http://fmacialisuhy.com/#]cialis coupons[/url]

cialis canada cheap

cialis cheap

cialis cost

cialis pills pictures

[url=http://fmacialisuhy.com/#]cialis prices[/url]

buy cialis no prescription mastercard

herbal viagra for sale

buy viagra

viagra vs levitra price

[url=http://fvbviagrahnas.com/#]viagra online[/url]

can take 2 50 mg viagra

viagra online dr fox

viagra online

cheapest viagra sale uk

[url=http://fvbviagrahnas.com/#]buy viagra online[/url]

viagra online uk cheapest

buy viagra over internet

buy viagra

generic-pharmacy.net viagra

[url=http://fvbviagrahnas.com/#]buy viagra[/url]

lovegra women viagra 100mg

cuanto cuesta el viagra generico en colombia

viagra online

get viagra samples

[url=http://fvbviagrahnas.com/#]online pharmacy viagra[/url]

where to buy viagra in hyderabad

get best results viagra

viagra buy

how to get a viagra script

[url=http://fvbviagrahnas.com/#]buy viagra online[/url]

sildenafil bifort m 50 mg

prices cialis viagra

online pharmacy viagra

how can i buy viagra in india

[url=http://fvbviagrahnas.com/#]buy viagra[/url]

pfizer viagra online uk

cialis buy from india

cialis without a prescription

cheap cialis with no prescription

[url=http://vnacialisfbvn.com/#]cialis without prescription[/url]

cheapest pharmacy cialis

buy cheap cialis usa visa

cialis without a doctor prescription

cialis buy in uk

[url=http://vnacialisfbvn.com/#]cialis without a doctor[/url]

cialis canada discount

where to buy cialis

cialis without a doctor

buy cialis using paypal

[url=http://vnacialisfbvn.com/#]cialis without doctor[/url]

cialis sale london

cheapest real cialis

cialis without doctor

buy cialis online pharmacy

[url=http://vnacialisfbvn.com/#]cialis without a prescription[/url]

daily cialis pills

buy cialis fda

cialis without a prescription

buy cialis in the usa

[url=http://vnacialisfbvn.com/#]cialis without prescription[/url]

cheap cialis

online roulette no deposit bonus

[url=http://avtobox.com.ua/?option=com_k2&view=itemlist&task=user&id=27999]play casino online[/url]

online casino 5 free

gambling problem canada

can use cialis viagra together

viagra without a doctor's prescription

the hard sell the life of a viagra salesman

[url=http://thjsildenafiljkvc.com/#]viagra without script[/url]

can i take 2 100 mg viagra

buy viagra 25mg

viagra without a doctor prescription

sildenafil x 50 mg

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

1 pille viagra

blue pill sildenafil

viagra without doctor prescription

buy real viagra online canada

[url=http://thjsildenafiljkvc.com/#]viagra without an rx[/url]

2010 viagra sales

can you take viagra lisinopril together

viagra without a doctor

pfizer viagra online uk

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor prescription[/url]

wie lange sind viagra pillen haltbar

price viagra lloyds

viagra without a doctor prescription

viagra sale in india

[url=http://thjsildenafiljkvc.com/#]viagra without doctor prescription[/url]

can u get viagra prescription

viagra cialis buy online

viagra without an rx

generic viagra buy uk

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor's prescription[/url]

pictures of generic viagra

genericos del viagra en colombia

viagra without script

generic viagra soft tabs 100mg

[url=http://thjsildenafiljkvc.com/#]viagra without an rx[/url]

order cheap viagra online uk

order cialis online canada

cheap cialis

cheap canadian cialis online

[url=http://cialisdmngj.com/#]cialis cheap[/url]

buy cialis johor bahru

buy cialis online safely

cheap cialis online

buy cialis dubai

[url=http://cialisdmngj.com/#]cheap cialis online[/url]

cheapest cialis new zealand

buy cialis in uk

cialis prices

cialis professional cheap

[url=http://cialisdmngj.com/#]cialis cheap[/url]

super cialis cheap

buying cialis in london

cheap cialis

buy cialis dapoxetine

[url=http://cialisdmngj.com/#]cheap cialis[/url]

how to split cialis pills

buy cialis from uk

cialis cost

buy cialis japan

[url=http://cialisdmngj.com/#]cialis prices[/url]

buy cialis london

cheap cialis here

cialis price

order cialis usa

[url=http://cialisdmngj.com/#]cheap cialis online[/url]

buy cialis without doctor prescription

buy cialis au

cheap cialis

cialis pills south africa

[url=http://cialisdmngj.com/#]cheap cialis online[/url]

red cialis pills

cialis pills amazon

cialis prices

cialis pills for men

[url=http://cialisdmngj.com/#]cialis cost[/url]

how to buy cialis in canada

age limit buy viagra

viagra without prescription

do old viagra pills still work

[url=http://viagrahukic.com/#]viagra without a doctor prescription[/url]

generic viagra dosage

how to buy viagra in mexico

viagra without a doctor's prescription

cialis 20mg vs viagra 50mg

[url=http://viagrahukic.com/#]viagra without doctor[/url]

viagra generico necesita receta

cheap viagra on line

viagra without prescription

comprare viagra online italia

[url=http://viagrahukic.com/#]viagra without a doctor's prescription[/url]

sildenafil citrate 50 mg dosage

cialis by mail in us

drugs-med.com

cialis.com in canada

[url=http://cialispills2013.com/]generic cialis made in usa[/url]

viagra without a prescription in the usa

viagra coupons

viagra alternative

viagra without a prescription

[url=http://1stcanadapharm.com/purchase-viagra-online/]try viagra for free[/url]

viagra overdose

non generic cialis sale

cialis online

cialis to buy us

[url=http://cialismbvi.com/#]online cialis[/url]

cheap cialis black

direct online payday lenders

[url=https://loanstrast.com/]direct lenders payday loans[/url]

free loan

fast cash loan

buy cialis montreal

cialis 20mg

buy cialis online safely

[url=http://cialisemk.com/]cialis prices[/url]

how to buy cialis online from canada

direct payday loan lenders

[url=https://loanstrast.com/]cash advance loans[/url]

payday loan in las vegas

same day payday loans online

donde puedo comprar viagra en lima

viagra coupons

sildenafil prices

[url=http://viagramndet.com/#]viagra prices[/url]

best generic viagra site

viagra online sales australia

viagra prices

buy generic viagra online canada

[url=http://viagramndet.com/#]viagra price[/url]

where can i buy viagra cheap

viagra gold 800mg uk

viagra cost

viagra pill identification

[url=http://viagramndet.com/#]cost of viagra[/url]

erfahrung viagra online kaufen

best place to buy viagra yahoo

cost of viagra

herbal viagra 450 mg

[url=http://viagramndet.com/#]viagra price[/url]

viagra online for free

best place buy real viagra

viagra price

achat viagra generic

[url=http://viagramndet.com/#]viagra prices[/url]

can you get viagra over counter usa

best price viagra canada

viagra coupons

teva canada generic viagra

[url=http://viagramndet.com/#]cost of viagra[/url]

viagra and cialis prices

viagra generika kaufen ohne rezept

viagra coupons 75 off

can you buy viagra legally

[url=http://viagramhbfe.com/#]viagra prices[/url]

erfahrungsberichte viagra online bestellen

br cheap viagra or cheap cialis

viagra coupons

uk buy viagra no prescription

[url=http://viagramhbfe.com/#]viagra prices[/url]

viagra online shop erfahrung

is it illegal to buy viagra in the uk

viagra price

female viagra pills

[url=http://viagramhbfe.com/#]viagra coupons[/url]

the best place to buy viagra

las vegas payday loan

[url=https://loanstrast.com/]one hour loans[/url]

actual payday lenders

payday loans reno nv

hat schon mal viagra getestet

viagra coupons

sildenafil tablets 120mg

[url=http://viagramhbfe.com/#]viagra coupon[/url]

how to buy viagra online safely

order pink viagra

viagra price

where can i purchase viagra online

[url=http://viagramhbfe.com/#]viagra price[/url]

comment prendre viagra 50mg

buy viagra in walgreens

best price for viagra

amazon viagra salesman

[url=http://viagramhbfe.com/#]viagra prices[/url]

generic viagra online india

buy viagra super force

viagra coupons

viagra and generics

[url=http://viagramhbfe.com/#]viagra coupon[/url]

viagra 25mg price in india

order generic cialis online no prescription

coupon for cialis

cialis cheap prescription

[url=http://cialisopghe.com/#]coupon for cialis[/url]

buy cialis in belgium

payday loans lenders

[url=https://loanstrast.com/]payday loans california[/url]

payday loans in las vegas

lend money

cialis tablets for sale uk

cialis coupon

buy cialis with dapoxetine

[url=http://cialisopghe.com/#]cialis coupon 20 mg[/url]

buy cialis in usa

cheap levitra online no prescription

levitra

order levitra over the counter

[url=http://levitraklnbi.com/#]levitra generic[/url]

levitra buy cheap

best place to buy generic levitra

levitra coupon

buy levitra pattaya

[url=http://levitraklnbi.com/#]generic levitra[/url]

best place to buy generic levitra

generic levitra online cheap

levitra bayer 20mg meilleur prix

cheap genuine levitra

[url=http://levitraklnbi.com/#]levitra rezeptfrei deutschland[/url]

member php buy levitra

buy levitra from u.s. pharmacy

levitra bayer 20mg meilleur prix

levitra to buy uk

[url=http://levitraklnbi.com/#]viagra vs cialis vs levitra[/url]

cheapest levitra professional oo

generic levitra online cheap

levitra prices

where to order levitra online

[url=http://levitraklnbi.com/#]levitra coupon[/url]

buy levitra bayer

generic cialis for sale in the u.k

cialis without a doctor prescription

can buy cialis over counter

[url=http://cialisfbvne.com/#]cialis without a doctor[/url]

cialis for sale in the us

buy discount cialis online

cialis without a prescription

what does cialis pills look like

[url=http://cialisfbvne.com/#]cialis without a doctor's prescription[/url]

cialis pills picture

buy cialis online mastercard

cialis without doctor

order cialis online no prescription

[url=http://cialisfbvne.com/#]cialis without doctor[/url]

cheapest cialis in australia

online loans

[url=https://loanstrast.com/]payday loans no credit check[/url]

payday loans no credit check

loans online

what does generic viagra pill look like

viagra without a doctor

viagra for dogs online

[url=http://viagramnkjm.com/#]viagra without doctor[/url]

can i cut a 100mg viagra in half

cash advance loans

[url=https://smajloans.com/]payday loans no credit check[/url]

cash advance

payday loans no credit check

[url=https://loanstrast.com/]pay day loans[/url]

payday loans online

payday advance

[url=https://loansfast.us.com/]payday loans no credit check[/url]

cash loans

cash loans

real money baccarat app

casino

vegas shows online

[url=http://online-casino.party/#]online casinos[/url]

vegas online games

play keno online

casino

baccarat casino gambling virtual

[url=http://online-casino.party/#]casino online[/url]

jackpot site

payday loans

[url=https://smajloans.com/]cash loans[/url]

payday loans no credit check

pay day loans

[url=https://loanstrast.com/]cash advance[/url]

payday loan online

online payday loans

[url=https://loansfast.us.com/]cash advance[/url]

online payday loans

payday advance

top blackjack app android

casino

online casinos with french roulette

[url=http://online-casino.party/#]casino real money[/url]

online gambling us deposits

online payday loans

[url=https://smajloans.com/]cash advance loans[/url]

cash advance loans

cash loans

[url=https://loanstrast.com/]payday loans no credit check[/url]

payday loan online

payday advance

[url=https://loansfast.us.com/]cash advance[/url]

payday loans online

pay day loans

pay day loans

[url=https://smajloans.com/]payday loan online[/url]

payday advance

payday loans online

[url=https://loanstrast.com/]payday loans no credit check[/url]

payday loans online

online loans

[url=https://loansfast.us.com/]payday loans no credit check[/url]

cash advance loans

cash advance loans

live casino for android

casino

online craps play money

[url=http://online-casino.party/#]online casinos[/url]

online blackjack us

online craps bodog

online casino

play online casino on ipad

[url=http://online-casino.party/#]casino real money[/url]

vegas blackjack online game

online payday loans

[url=https://smajloans.com/]cash loans[/url]

payday loan online

cash loans

[url=https://loanstrast.com/]pay day loan[/url]

payday loan online

online loans

[url=https://loansfast.us.com/]cash loans[/url]

payday loans online

pay day loans

buying viagra in asia

viagra without a prescription

viagra generic when available

[url=http://viagrajnmeo.com/#]viagra without a doctor's prescription[/url]

online medical viagra

how to get the best results taking viagra

viagra without a doctor prescription

sildenafil citrate 100mg- viagra

[url=http://viagrajnmeo.com/#]viagra without a prescription[/url]

cheap prescription viagra online

payday loans no credit check

[url=https://smajloans.com/]cash advance[/url]

pay day loans

pay day loan

[url=https://loanstrast.com/]payday loans no credit check[/url]

pay day loans

online loans

[url=https://loansfast.us.com/]online loans[/url]

online loans

online loans

canada viagra prices

erectile dysfunction medications

generic viagra sildenafil 100 mg

[url=http://pillshnembn.com/#]ed medications[/url]

where to buy viagra for women uk

many mg levitra take

ed drugs

buy kamagra oral jelly online uk

[url=http://pillshnembn.com/#]ed drugs[/url]

genuine viagra for sale

cut price viagra

erectile dysfunction pills

viagra sales in usa

[url=http://pillshnembn.com/#]ed medications[/url]

where to order real viagra

cialis go generic

erectile dysfunction pills

can order viagra online canada

[url=http://pillshnembn.com/#]erectile dysfunction pills[/url]

safe site to buy viagra online

cheap generic cialis no prescription

cialis on line no pres

cheap/discount cialis

[url=http://cialisviymw.com/#]cialis without doctor[/url]

can you buy cialis online

real cialis pills

cialis without doctor

buy cialis no prescription overnight

[url=http://cialisviymw.com/#]no prescription cialis[/url]

ed pills cialis

payday loans

[url=https://smajloans.com/]pay day loan[/url]

cash loans

cash advance loans

[url=https://loanstrast.com/]pay day loans[/url]

payday loans

online payday loans

[url=https://loansfast.us.com/]pay day loans[/url]

pay day loans

cash loans

best us casinos online

[url=http://real777money.com/]real money casino online usa[/url]

play casino online

play casino online

viagra for cheap with no prescriptions

cheap viagra

viagra 100mg pfizer pharma

[url=http://viagrakbg.com/#]buy viagra[/url]

how to get rid of a viagra hard on

viagra sales in uae

buy viagra online

viagra generika kaufen in deutschland

[url=http://viagrakbg.com/#]cheap viagra[/url]

sildenafil citrate generic india

soft viagra pills

buy viagra

viagra pills expire

[url=http://viagrakbg.com/#]buy viagra[/url]

viagra buy chennai

viagra cialis price comparison

viagra prices

equivalente generico viagra

[url=http://viagrakbg.com/#]viagra online[/url]

generic viagra shipping to canada

free online casino games

[url=http://real777money.com/]free online casino games[/url]

casino games

slot machines

buy female viagra in india

cheap viagra

taking 100 mg of viagra

[url=http://viagrakbg.com/#]buy viagra[/url]

discount generic viagra uk

payday loans clarksville tn

payday loans no credit check

personal loans mn

[url=http://paydaymnku.com/]payday loans no credit check[/url]

pay weekly loans

como comprar viagra sem receita medica

buy viagra

online pharmacy australia viagra

[url=http://viagrakbg.com/#]buy viagra[/url]

order non-prescription viagra

can i get viagra in bangkok

viagra online

price for 100mg viagra

[url=http://viagrakbg.com/#]viagra pills[/url]

difference between generic and brand name viagra

how to use cialis pills

buy cialis online

cheap cialis online canada

[url=http://cialiskbg.com/#]cialis tablets[/url]

order brand cialis online

play casino online

[url=http://real777money.com/]online casino[/url]

casino online

casino online

buy viagra from usa

how much viagra does cost

buy viagra australia over counter

[url=http://viagrangk.com/#]how much viagra does cost[/url]

viagra de cuantos mg hay

free casino games

[url=http://real777money.com/]free slot games[/url]

best us casinos online

free online casino games

is ordering viagra online illegal

viagra prices

what is the cost of viagra pills

[url=http://viagrangk.com/#]cost of viagra[/url]

can an 18 year old get viagra

viagra cialis order online

viagra prices

online pharmacy viagra utah

[url=http://viagrangk.com/#]viagra prices[/url]

can get viagra my gp

cheap drugs online without doctor prescription

cialis without a doctor prescription

ed drugs online cialis coupons for walmart

[url=http://canada-genericcialis.net/]cialis prices[/url]

pay day loan

[url=https://smajloans.com/]pay day loans[/url]

payday loans no credit check

payday loans online

epharmacy

top rated canadian pharmacies online

Online Canadian Pharmacies

[url=http://canadaunmfgb.com/#]top rated canadian pharmacies online[/url]

no prior prescription required pharmacy

buy viagra manila forum

viagra no prescription

viagra super force 100 mg 60 mg pills

[url=http://bfviagrajlu.com/#]viagra no script[/url]

sildenafil generico peru

sildenafil citrate 50 mg ml 30ml

viagra without a doctor prescription

prices viagra online

[url=http://bfviagrajlu.com/#]viagra without a doctor prescription[/url]

buy viagra safely online

pay day loan

[url=https://smajloans.com/]payday loan online[/url]

pay day loan

payday loans

where can i buy viagra online yahoo answers

viagra without a doctor prescription

buy viagra kl

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

viagra 100mg or 50mg

viagra no script

viagra online strafbar

[url=http://bfviagrajlu.com/#]viagra no prescription[/url]

cheapest viagra overnight delivery

getting viagra on nhs

viagra without a doctor prescription

many milligrams viagra pill

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor prescription[/url]

viagra nz sales

viagra no prescription

generic viagra cipla

[url=http://bfviagrajlu.com/#]viagra no prescription[/url]

discount cialis and viagra

is it illegal to buy viagra online in the usa

viagra without a doctor prescription

online viagra order

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

viagra generic buy online

viagra without prescription

can viagra help women get pregnant

[url=http://bfviagrajlu.com/#]viagra without a doctor prescription[/url]

cheaper than viagra

buy viagra puerto vallarta

viagra without a doctor prescription

viagra online uk cheap

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

comprar viagra portugal sem receita medica

viagra no prescription

where and how to buy viagra

[url=http://bfviagrajlu.com/#]viagra without a doctor prescription[/url]

getting pregnant using viagra

buy viagra online in the uk

viagra without a doctor prescription

sobre sildenafil 50 mg

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

where to buy viagra pills

viagra no script

generic viagra china

[url=http://bfviagrajlu.com/#]viagra no prescription[/url]

brand name viagra for sale

payday loans

[url=https://smajloans.com/]payday loans no credit check[/url]

payday loans no credit check

payday loans online

sildenafil citrate 100 mg with dapoxetine 60mg

viagra without prescription

who can get viagra free

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

will sildenafil citrate go generic

viagra no script

long does viagra pill last

[url=http://bfviagrajlu.com/#]viagra no prescription[/url]

viagra de 25 mg

brand name cialis from canadian pharmacy drugs shop

do you need a prescription for viagra in canada canadian pharmacies without prescription

[url=http://besttrustpharmacy.com/]canadian rx pharmacy[/url]

buy viagra las vegas

viagra without prescription

legal buy viagra mexico

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor prescription[/url]

viagra break pill

viagra ohne rezept aus deutschland

fotos generico viagra

[url=http://bfviagrajlu.com/#]viagra no prescription[/url]

viagra wholesale

generic equivalent for viagra

viagra without a doctor prescription

viagra canadian pharmacy generic

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

where i can buy viagra in delhi

viagra no script

can i purchase viagra online

[url=http://bfviagrajlu.com/#]viagra no script[/url]

cialis viagra levitra prices

viagra generico porto alegre

viagra without a doctor prescription

buy generic viagra new zealand

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor prescription[/url]

get viagra free nhs

viagra no prescription

tell my doctor get viagra

[url=http://bfviagrajlu.com/#]viagra without prescription[/url]

viagra online for sale

payday loans no credit check

[url=https://smajloans.com/]payday loans[/url]

payday loans

payday loans online

payday loans no credit check

[url=https://smajloans.com/]payday loans online[/url]

payday loans online

payday loans no credit check

[url=https://essayerudite.com/write-my-research-paper/]write paper[/url]

[url=https://essayerudite.com/write-my-essay/]write essays[/url]

[url=https://essayerudite.com/do-my-homework/]cpm homework help[/url]

[url=https://essayerudite.com/write-essay-for-me/]write my essay cheap[/url]

[url=https://essayerudite.com/buy-essays-online/]buy an essay[/url]

[url=https://essayerudite.com/college-essay-help/]college essays help[/url]

[url=https://essayerudite.com/write-my-paper/]write my papers[/url]

[url=https://essayerudite.com/write-my-research-paper/]write my research paper[/url]

[url=https://essayerudite.com/assignment-help/]help with assignment[/url]

[url=https://essayerudite.com/write-essay-for-me/]help writing an essay[/url]

payday loans no credit check

[url=http://paydaynock.com/]payday loans online no credit check[/url]

payday loans no credit

payday loans no credit check

payday loans online no credit check

[url=http://paydaynock.com/]payday loans no credit check[/url]

payday loans no credit

payday loans online no credit check

levitra buy

generic levitra

levitra cheap

[url=http://levitradbws.com/#]levitra prices[/url]

cheap levitra on-line

levitra 20 mg

cheap levitra uk

[url=http://vardenafilghns.com/#]vardenafil 20mg[/url]

order levitra super active oo

payday loans no credit check

[url=http://paydaynock.com/]payday loans no credit[/url]

payday loans no credit

payday loans no credit

buy levitra orodispersibile

levitra prices

cheap viagra and levitra

[url=http://levitradbws.com/#]levitra prices[/url]

can you buy levitra online

vardenafil 20mg

buy real levitra

[url=http://vardenafilghns.com/#]levitra 20 mg[/url]

cheapest price for levitra

mnpqlwdp http://yogaheaters.com cheap viagra online buy viagra uk thtr [url=http://valleyofshadowsanddreams.com/]generic viagra[/url]

order cialis cheap

generic cialis

buy cialis non prescription

[url=http://cialisyrudgj.com/#]cialis generic[/url]

where to buy cialis

cialis prices

buy cialis discount online

[url=http://cialisuitykh.com/#]cialis price[/url]

buy cialis from canadian pharmacy

eqgsvuat http://protocog.com buying viagra online uk buy generic viagra ppmf [url=http://skyrank.com]buy cheap cialis uk[/url]

yrdxxclv http://missreplicawatches.com generic cialis online best place buy viagra alvu [url=http://missreplicawatches.com]buy cialis brand online[/url]

wtorydnt http://investinokc.com buy viagra buy viagra tablets online zowk [url=http://motechautomotive.com]cialis online buy[/url]

ydhugvma http://mphasset.com buy viagra usa buy viagra usa hrwz [url=http://livecopys.com]buy generic viagra[/url]

zmybczsw http://mphasset.com viagra online cheap viagra uiym [url=http://protocog.com]buy canadian viagra[/url]

cialis canada discount

cialis prices

discount brand cialis

[url=http://cialisietwdffjj.com/#]cialis cost[/url]

buy cialis montreal

cialis cheap

where to buy cialis in usa

[url=http://cialisytigjtuj.com/#]cialis prices[/url]

buy cheap cialis in canada

klgrvdap http://motechautomotive.com cialis to buy buy viagra online revv [url=http://missreplicawatches.com]cialis buy online usa[/url]

vutzxcqy http://rabbitinahat.com buy cialis tadalafil buy viagra adzf [url=http://missreplicawatches.com]buy cialis online[/url]

real money casino

[url=http://bom777casino.com/]online casino[/url]

online casino

п»їcasino online