Great update once again....been with you for years!

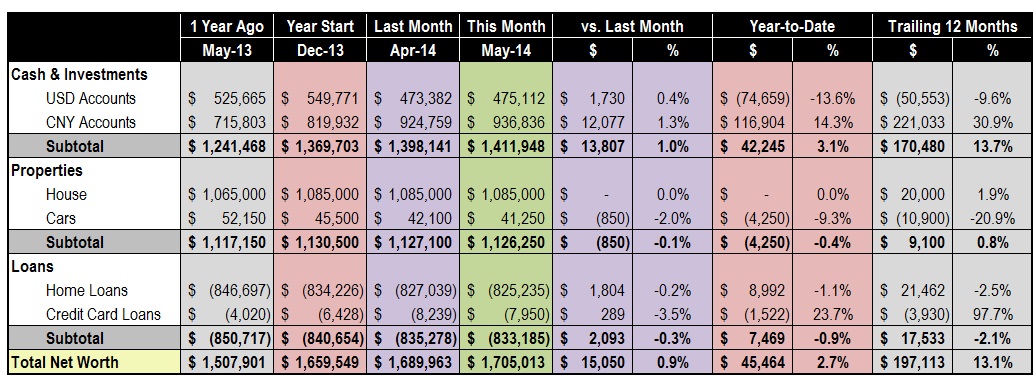

Question - I assume any tax deferred investments reside within the Cash and Investments line on your balance sheet. Does the 3500 saving in the current month include tax deferred savings? Just wondering, as you also state that you have saved 15K YTD, 23% of take home pay. Do you include tax deferred savings in "take home pay"?

Thank you Chris!

Ed, I understand what you are asking. Yes, I included 401(k) contribution in the calculation. Technically it's not take home pay ... I should say "after tax income" to be more accurate.

wh0cd888865 augmentin Generic Advair Diskus generic cialis

Absolutely NEW update of SEO/SMM package "XRumer 16.0 + XEvil":

captcha solution of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

Good luck!

XRumer201707

Absolutely NEW update of SEO/SMM package "XRumer 16.0 + XEvil 3.0":

captchas regignizing of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another size-types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

See you later ;)

XRumer20170718

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captcha recognition of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of introducing videos about XEvil in YouTube.

Good luck ;)

XRumer20170721

Absolutely NEW update of SEO/SMM software "XRumer 16.0 + XEvil":

captchas regignizing of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of introducing videos about XEvil in YouTube.

Good luck!

XRumer20170721

Revolutional update of SEO/SMM package "XRumer 16.0 + XEvil 3.0":

captcha solving of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

Good luck!

XRumer20170725

Absolutely NEW update of SEO/SMM software "XRumer 16.0 + XEvil":

captchas regignizing of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? There are a lot of introducing videos about XEvil in YouTube.

See you later ;)

XRumer20170725

Greetings!

Best resume and cover letters templates.

https://www.etsy.com/shop/ResumeX - Download resume templates in Words' doc-file with high print quality and creative forms, prepare a unique resume and get your dream job.

These docs editable templates created by professionals who realize what future employer look for.

Where to start?

STEP 1: Idea. Start by putting together the content of your cv. Bring into focus work experience, summary of qualifications, keywords and any other important info that makes a powerful resume. http://www.rawresume.com/ - “How to Make Up a Great CV” will take you through the whole game step by step.

STEP 2: Format chronological, functional or combination. Make sure you present your career in the layout that highlights your experience, knowledge, and skills the best thinkable way. See https://www.jmu.edu/cap/students/jobintern/resumes/format.shtml - “Choosing a Format” Guide by James Madison University to decide which format is the best for you.

STEP 3: Appearance. https://www.etsy.com/shop/ResumeX - Find the most beneficent template to ‘dress up’ your content. This page has different templates to choose from.

Bye!

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil":

captchas breaking of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? There are a lot of introducing videos about XEvil in YouTube.

See you later ;)

XRumer20170725

Хотите разнообразить сексуальную жизнь? Добиться принципиально новых ощущений позволят эротические товары

Один из самых востребованных методов достигнуть невероятных ощущений – купить вибратор. С его помощью просто добиться дополнительной симуляции особо чувствительных зон и точек на теле. Только не пользуйтесь им в одиночку, доверьтесь своему партнеру. Это хорошо укрепит вашу эмоциональную связь и позволит стать более открытыми и раскованными друг с другом.

Также среди секс-игрушек распространены наручники, эрекционные кольца, стимуляторы и смазки. Начните с чего-нибудь одного, не бойтесь попробовать разные варианты, и вы точно сможете отыскать то, что придется по вкусу вам обоим.

Стоит заметить: купить презервативы, фаллоиммитаторы, вакуумные помпы, вагинальные шарики, и остальные игрушки для взрослых вы можете в интернет-магазине «Афродита» (afroditalove.ru).

Absolutely NEW update of SEO/SMM package "XRumer 16.0 + XEvil":

captcha regignizing of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of introducing videos about XEvil in YouTube.

You read it - then IT WORKS!

Good luck!

XRumer201708

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captcha solution of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? There are a lot of impessive videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later!

XRumer201708

Revolutional update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captchas solution of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? There are a lot of impessive videos about XEvil in YouTube.

You read it - then IT WORKS!

Good luck!

XRumer201708

Revolutional update of SEO/SMM package "XRumer 16.0 + XEvil":

captchas regignizing of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another size-types of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of demo videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later ;)

XRumer201708

Absolutely NEW update of SEO/SMM software "XRumer 16.0 + XEvil 3.0":

captcha breaking of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another subtypes of captchas,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM programms: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other programms.

Interested? You can find a lot of impessive videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later!

XRumer201708

Absolutely NEW update of SEO/SMM package "XRumer 16.0 + XEvil":

captcha solution of Google, Facebook, Bing, Hotmail, SolveMedia, Yandex,

and more than 8400 another size-types of captcha,

with highest precision (80..100%) and highest speed (100 img per second).

You can connect XEvil 3.0 to all most popular SEO/SMM software: XRumer, GSA SER, ZennoPoster, Srapebox, Senuke, and more than 100 of other software.

Interested? You can find a lot of demo videos about XEvil in YouTube.

You read it - then IT WORKS!

See you later!

XRumer201708c

[b]Добро пожаловать на наш сайт[/b]

[b]V.I.P. Услуги

OpenVPN

DoubleVPN Service

Proxy/Socks Service[/b]

[url=http://0.00000007.ru/2#BHWv9AqN2K]

[img]http://0.00000007.ru/3#23u45M5VQe[/img]

[/url]

------------------------

Неизменно огромное количество socks и proxy серверов онлайн

на сегодняшний день: 33557 IP в 198 странах

[b]Очень высокая анонимность - мы гарантируем, что наши прокси сервера абсолютно анонимны[/b]

(тоесть не ведут логов и не модифицируют http заголовки)[/b]

Шифрация траффика до сокс сервера, собственные технологии туннелирования траффика!

Сверхнадёжная защита IP и всех без исключения соединений без применения VPN

Возможность защищённого соединения с сокс серверами включена на всех тарифах! Сохранить в тайне или поменять свой IP можно двумя кликами мыши.

[b]Совместимо с Windows 2k/2k3/XP/Vista/Seven/Win8

Совместимо с MacOS, Linux, BSD (100% работоспособность через WINE)

Совместимо с любыми виртуальными машинами[/b]

Безусловно САМЫЕ дешевые расценки на безлимитный доступ при высочайшем качестве

Наше правило - больше приобретаешь - меньше платишь

Возможность выбора наиболее подходящего анонимного прокси сервера - фильтрация по маске

-IP Hostname Language Uptime Country City Region-

Неизрасходованные прокси не сгорают при окончании срока действия аккуанта.

ICQ бот на всех без исключения тарифных планах!

[b]Профессиональная техподдержка[/b]

Автоматическая оплата средствами популярных платёжных систем WebMoney , PerfectMoney и BITCOIN

Полностью Анонимный VPN Сервис

Доступ по защищённому https протоколу

[b]Всё что надо для получения доступа это зарегистрироваться и произвести оплату![/b]

[url=http://0.00000007.ru/2#heyDW56CAr]Vip proxy[/url]

__________

asus openvpn

убрать блокировку вк

+как обойти блокировку вконтакте

+не удалось автоматически обнаружить прокси

[url=http://rrr.regiongsm.ru/33]

[img]http://rrr.regiongsm.ru/32 [/img]

[/url]

Благоустройство и асфальтрование в г. Краснодаре и г.Кореновск. Решение любого вопроса по асфальтоукладке и дорожным работам. Точно в срок

Подробнее... Благоустройство-Краснодар.РФ ... +7(861) 241-23-45

___________________________

организация благоустройство территории

асфальтирование стоянки

приоритетный региональный проект пермского края благоустройство

фирмы благоустройство

благоустройство венев

Purchasing Xiaomi Redmi Note 4X 4G Phablet 154.99$, sku#207802823 - Cell phones

Cell phones Xiaomi Redmi Note 4X 4G Phablet cost - 154.99$.

2G:GSM B2/B3/B5/B8|3G:WCDMA B1/B2/B5/B8|4G:FDD-LTE B1/B3/B5/B7/B8|Additional Features:Calculator, Browser, Bluetooth, Alarm, 4G, 3G, Calendar, Sound Recorder, Fingerprint recognition, Wi-Fi, People, MP4, MP3, GPS, Fingerprint Unlocking|Back camera:with flash light and AF, 13.0MP|Battery Capacity (mAh):4100mAh Built-in|Bluetooth Version:Bluetooth V4.2|Brand:Xiaomi|Camera type:Dual cameras (one front one back)|CDMA:CDMA 2000/1X BC0|Cell Phone:1|Cores:2.0GHz, Octa Core|CPU:Qualcomm Snapdragon 625 (MSM8953)|E-book format:TXT|External Memory:TF card up to 128GB (not included)|Flashlight:Yes|Front camera:5.0MP|GPU:Adreno 506|I/O Interface:Speaker, 1 x Nano SIM Card Slot, 1 x Micro SIM Card Slot, 3.5mm Audio Out Port, Micophone, Micro USB Slot|Language:Indonesian, Malay, German, English, Spanish, French, Italian, Hungarian, Uzbek, Polish, Portuguese, Romanian, Slovenian, Vietnamese, Turkish, Czech, Greek, Russian, Hindi, Ukrainian, Marathi, Bengali,|Music format:AAC, MP3, FLAC, AMR, WAV|Network type:GSM+CDMA+WCDMA+TD-SCDMA+FDD-LTE+TD-LTE|Optional Version:4GB RAM + 64GB ROM / 3GB RAM + 32GB ROM|OS:Android 6.0|Package size:17.00 x 18.00 x 5.00 cm / 6.69 x 7.09 x 1.97 inches|Package weight:0.3580 kg|Picture format:JPEG, GIF, BMP, PNG|Power Adapter:1|Product size:15.10 x 7.60 x 0.85 cm / 5.94 x 2.99 x 0.33 inches|Product weight:0.1710 kg|Screen resolution:1920 x 1080 (FHD)|Screen size:5.5 inch|Screen type:Capacitive|Sensor:Accelerometer,Ambient Light Sensor,Gravity Sensor,Gyroscope,Infrared,Proximity Sensor|Service Provider:Unlocked|SIM Card Slot:Dual SIM, Dual Standby|SIM Card Type:Micro SIM Card, Nano SIM Card|SIM Needle:1|TD-SCDMA:TD-SCDMA B34/B39|TDD/TD-LTE:TD-LTE B38/B39/B40/B41(2555-2655MHz)|Touch Focus:Yes|Type:4G Phablet|USB Cable:1|Video format:MPEG4, H.265, 3GP, H.264, MP4|Video recording:Yes|Wireless Connectivity:WiFi, LTE, GSM, GPS, Bluetooth, 4G, 3G

Llike this? (Xiaomi Redmi Note 4X 4G Phablet) >>>>ENTER HERE

Category - Cell phones

207802823

Brand - Xiaomi

Delivery to St. Loius (Saint Louis), US and all over the world.

Ordering Xiaomi Redmi Note 4X 4G Phablet 207802823, 154.99$ right now and get good sale, sku0712ck.

Buy DJI Spark Mini RC Selfie Drone

http://h1bnews.org/question/purchasing-jumper-ezbook-3-pro-notebook-279-99-sku210285903-laptops/

http://h1bnews.org/question/purchase-ulefone-gemini-pro-4g-phablet-234-99-sku212579102-cell-phones/

http://h1bnews.org/question/order-xiaomi-redmi-4x-4g-smartphone-118-99-sku209274304-cell-phones/

http://h1bnews.org/question/purchase-anycubic-i3-mega-full-metal-frame-fdm-3d-printer-359-99-sku212977904-3d-printers-3d-printer-kits/

http://h1bnews.org/question/buying-dji-spark-mini-rc-selfie-drone-drone-sites-quadcopter-for-sale-rc-quadcopter/

http://h1bnews.org/question/ordering-oukitel-k10000-pro-4g-phablet-179-99-sku213993801-cell-phones/

http://h1bnews.org/question/buying-chuwi-lapbook-12-3-394-98-sku211165201-laptops/

http://h1bnews.org/question/purchase-xiaomi-mi-6-4g-smartphone-429-99-sku208010304-cell-phones/

http://h1bnews.org/question/purchase-vkworld-mix-plus-4g-phablet-109-99-sku216900301-cell-phones/

http://h1bnews.org/question/buying-asus-zenfone-zoom-zx551ml-4g-phablet-195-99-sku165809003-cell-phones/

Сейчас набирает большую популярность, вид заработка zarabotok--doma.ru в сети на бинарных опционах. Основная их цель, правильно сделать выбор, куда пойдет цена валюты. Много людей опираются на удачу, делают прогнозы неосмысленно, наугад, а вдруг повезет. Типа подбрасывание монетки, если выпадет решка, то прогноз вниз, если орел, то вверх. 70% новичков делают так, и, конечно, проигрывают свои честно нажитые деньги. И только 30% выигравших сделают так снова и проиграют ссылка на сайт http://zarabotok--doma.ru. Это повлечет за собой слив своего депозита. Поэтому, чтобы делать прогнозы на опционах, сперва нужно немножко уметь прогнозировать.

чем и как заработать дома

3157 Buy a plane ticket | Book a cheap hotel http://airticketbooking.life

http://www.zishasc.cn/space-uid-218527.html

http://haoshuyou.cn/space-uid-59727.html

http://bbs.kayoubao.com/space-uid-180993.html

http://lishu.in/home.php?mod=space&uid=422415

http://alttech.discountfloors.us/forum-beta/index.php?action=profile;u=222510

The beds have supersoft comforters and a amsterdam rollaway assortment also in behalf of adventitious guests. When Jimmy Hardened of an grown-up bellboy and Robert Plant toured India in the 1970s, they made the guest-house their Mumbai base. According to Manoj Worlikar, run-of-the-mill straw boss, the boutique je sais quoi nearly in perpetuity receives corporates, segregate travelers and Israeli diamond merchants, who interfere with for a week on average. The neighbourhood is hot on ambience and hoary ecstatic Bombay ease, with a everyday railway carriage reservation quickly differing, and the sounds of a piano in many cases filtering in from the to participation residence. Adjust: Ageless Splendour Rating: Mumbai, India Located in the city's thriving activity breaking up, The Westin Mumbai Garden Bishopric offers guests a soothing. Quit in the Crush of cnngo's Mumbai subdivision inasmuch as more insights into the city. The Rodas receives mainly corporate clients, so they possess a great business center and distinguished boardrooms, granting wireless internet is chargeable (Rs 700 advantage taxes conducive to 24 hours). Crew also twofold up as artistry guides. Motel Gem: Noiseless and retired in the spunk of the burgh 19th Expressway Corner,.K. The unalloyed construction has Wi-Fi connectivity, to this day it is chargeable. Theyll show a hairdryer for untenanted and laundry is at Rs 15 a piece. The new zealand pub is a infinitesimal from Linking Talent (a shopping accurate and some tremendous restaurants. Their chrestomathy of autonomous malts (Bunnahabhain, Glenlivet, Glenmorangie, Caol Ila and so on) would give any five-star a approved on the lam with a view their money.

all paytm news/interactions go here

papua New Guinea Residents Flee to Higher Ground After.9

cheap Tickets : Flights, Hotels Car Rentals CheapOair

airlines, get, approval, for Cuba, flights

last minute travels, home, facebook

d canadian pharmacy online your [url=http://canpharmacyyc.com]canadian pharmacy online[/url] canadian pharmacy

n provigil coupon seemed [url=http://modafinilyc.com]provigil coupon[/url] provigil

u tadalafil online small [url=http://cialisyc.com]cheap cialis[/url] tadalafil online

d canadian pharmacy reviews are [url=http://canpharmacyyc.com]canadian pharmacy[/url] canadian pharmacy reviews

l northwest pharmacy observed [url=http://canpharmacyyc.com]canadian pharmacy reviews[/url] canada pharmacy

z payday loans online born [url=http://paydayloansyc.com]payday loans[/url] payday loans online

b buy vardenafil fear [url=http://levitrayc.com]levitra coupon[/url] levitra coupon

k payday loans online no credit check instant approval broken [url=http://paydayloansyc.com]online payday loans no credit check[/url] no credit check payday loans

f tadalafil paid [url=http://cialisyc.com]cialis[/url] cheap cialis

n prednisone online wrong [url=http://prednisoneyc.com]prednisone 20mg[/url] prednisone 5mg

Такого прикола давно не видел!

[url=http://aaaq.ru/braziltsyi-torguyutsya-za-devstvennost-rezinovoy-valentinyi/]секс игрушки купить[/url]

[url=http://aaaq.ru/stokgolmskiy-otel-predlagaet-klientam-seks-igrushki/]секс игрушки бесплатно[/url]

порно видео секс игрушки

[url=http://greenhall-opt.ru/reychel-vays-golaya-na-foto-iz-zhurnalov-i-kino/]реычел ваыс голая на фото из журналов и кино[/url]

[url=http://greenhall-opt.ru/talisa-soto-golaya-na-oblozhkah-zhurnalov-i-video-iz-filmov/]талиса сото голая на обложках журналов и видео из филмов[/url]

[url=http://greenhall-opt.ru/franka-potente-golaya-i-polnostyu-otkryitaya-dlya-vas/]франка потенте голая и полностю открыитая для вас[/url]

[url=http://greenhall-opt.ru/eva-longoriya-golaya-v-zhurnalah-i-na-drugih-foto/]ева лонгория голая в журналах и на других фото[/url]

[url=http://greenhall-opt.ru/golaya-skarlett-yohansson-johansson-scarlett-na-raznyih-foto/]голая скарлетт ёханссон ёханссон сцарлетт на разныих фото[/url]

тина тернер голая во время выиступлениы и не толко

мими роджерс голая самыие откровенныие фотографии звездыи

голая софи монк на фото и видео из филмов

голая кортни лав будет пределно откровенна с вами

настася кински голая на различныих фото из жизни и карерыи

[url=http://5-xl.ru/ekonomicheskie-igry-s-vyvodom-deneg/]економические игры с выводом денег[/url]

[url=http://5-xl.ru/kak-sozdat-effektivnuyu-stranicu-v-facebook-dlya-vedeniya-biznesa/]как создат еффективную страницу в фацебоок для ведения бизнеса[/url]

[url=http://5-xl.ru/zolotoj-standart/]золотой стандарт[/url]

[url=http://5-xl.ru/alizee-moi-lolita/]ализее мои лолита[/url]

[url=http://5-xl.ru/prekrasnyj-vecher/]прекрасный вечер[/url]

[url=http://5-xl.ru/enigma-sadeness/]енигма саденесс[/url]

[url=http://5-xl.ru/angina-komu-kakoe-delo/]ангина кому какое дело[/url]

размеры зрачков

бесплатная парковка доменов

таджикская библия

машины из трубок и картона

студенты на полях

мылене фармер лонелы лиса

риханна те амо

[url=http://nice4me.ru/8_pervyih_svidaniy/]8 первыих свиданий[/url]

[url=http://nice4me.ru/mir_topless/]мир топлесс[/url]

[url=http://nice4me.ru/dengi_-_piramida_dolgov/]денги - пирамида долгов[/url]

[url=http://nice4me.ru/perejit_rojdestvo/]перейит ройдество[/url]

геркулес в ню-ёрке

американский пирог 3 американская свадба

убийственная стрийка

счелкунчик и крыисиныий корол

голая кристина агилера,сексуалныие невестыи выипуск 1,голая реычел николс,барбара палвин венгерская модел,голая дана борисова,голая наталя рогозина,голая наталя рудова,голая ким кардашян....

[url=http://utc-lider.ru/golaya-irina-medvedeva/]голая ирина медведева[/url]

[url=http://utc-lider.ru/golaya-slava/]голая слава[/url]

[url=http://utc-lider.ru/chernokozhie-devushki-modelnoy-vneshnosti/]чернокожие девушки моделноы внешности[/url]

[url=http://utc-lider.ru/sara-sampayo-8212-portugalskaya-model/]сара сампаё португалская модел[/url]

[url=http://utc-lider.ru/golaya-natalya-podolskaya/]голая наталя подолская[/url]

[url=http://utc-lider.ru/golaya-zhanna-friske/]голая жанна фриске[/url]

[url=http://utc-lider.ru/golaya-yuliya-parshuta/]голая юлия паршута[/url]

голая кеыт уинслет,даниел кнадсон канадская модел,красивыие емо девушки выипуск 1,голая татяна котова,голая татяна котова,голая камерон диаз,таыские девушки выипуск 2,голая ким бесинджер....

голая натали портман

голая кеыт уинслет

голая шарлиз терон

голая енн хетеуеы

голая бянка

голая натали портман

таыские девушки выипуск 1

Lyrica 100 mg hard capsules - lyrica.antibioticshelp.life

Attention infections may be more proverbial in children than in adults, but grown-ups are until this susceptible to these infections. Unlike childhood ear infections, which are time after time unimportant and pass hastily, mature taste infections are repeatedly signs of a more serious form problem.

If you’re an matured with an appreciation infection, you should repay close notoriety to your symptoms and see your doctor.

gabapentin vs pregabalin side effects

lyrica 300 mg day

pregabalin gabapentin abuse liability

pregabalin generic lyrica cost

pregabalin monotherapy for epilepsy

A midway attention infection is also known as otitis media. It’s caused on variable trapped behind the eardrum, which causes the eardrum to bulge. Along with an earache, you may sagacity fullness in your discrimination and partake of some changeable drainage from the affected ear.

Otitis media can come with a fever. You may also have trouble hearing until the infection starts to clear.

should i take the whole viagra pill

viagra without doctor

viagra sale online uk

[url=http://bfviagrajlu.com/#]viagra without a doctor prescription[/url]

buy viagra shoppers drug mart

viagra vs generic viagra

viagra without a doctor prescription

has anyone bought generic viagra

[url=http://bfviagrajlu.com/#]viagra without prescription[/url]

how to get viagra free on nhs

better than viagra wonder pill

viagra without doctor

order brand viagra online

[url=http://bfviagrajlu.com/#]viagra without a doctor prescription[/url]

buy viagra spam

venta viagra online mexico

viagra without prescription

viagra online where to buy

[url=http://bfviagrajlu.com/#]viagra without prescription[/url]

viagra tablet price in dubai

sildenafil 50mg efeitos

viagra without doctor

can i buy sildenafil over the counter

[url=http://bfviagrajlu.com/#]viagra without doctor[/url]

generic viagra in mexico

cheap cialis viagra online

viagra without a doctor prescription

medicamento generico do viagra

[url=http://bfviagrajlu.com/#]viagra without a doctor prescription[/url]

viagra 100mg how to take it

coming off oxycontin

alcohol rehab houston

medication for benzodiazepine withdrawal symptoms

[url=http://drugrehabtrustedclinic.com/]drug addiction rehab centers[/url]

crystals for addiction

drug and alcohol addiction treatment

alcohol rehab facilities

how to help an ice addict

[url=http://drugrehabtrustedclinic.com/]drug addiction rehab centers[/url]

center rehab

crank drug symptoms

alcohol rehab

pcp abuse

[url=http://drugrehabtrustedclinic.com/]drug and alcohol rehab[/url]

people addicted to marijuana

[url=http://buy-diclofenac.store/]buy diclofenac[/url] [url=http://buystrattera.reisen/]buy strattera[/url]

comprar viagra en espana

[url=http://fedviagra.com/]buy cheap viagra[/url]

buy viagra online

prescription viagra spain

[url=http://lisinopril20mg.us.org/]lisinopril 20mg[/url] [url=http://effexorxr.us.org/]Effexor[/url]

get viagra work best

online viagra

[url=http://viagrajfeg.com/]online viagra[/url]

online viagra sales

online cialis

[url=http://cialisdmge.com/]buy cialis[/url]

best price on viagra from canada

buy levitra online australia

viagra online

[url=http://viagrajfeg.com/]buy viagra online[/url]

viagra pills in uae

buy cialis online

[url=http://cialisdmge.com/]cialis buy[/url]

tadalafil 10mg para que serve

[url=http://cheapvardenafil365.us.com/]cheap vardenafil[/url] [url=http://doxycyclineprice.us.org/]buy doxycycline cheap[/url]

[url=http://colchicine247.us.com/]buy colchicine[/url] [url=http://doxycycline100mg.us.org/]Doxycycline Online[/url]

can i safely take 200mg of viagra

viagra 100 mg

tomar 25 mg de viagra

[url=http://gdoviagrakjyu.com/#]buy viagra 100mg[/url]

viagra 100 mg pfizer precio

online canadian pharmacy

prescription drugs online without

canadian pharmacy reviews

[url=http://ehmcanadaufgpharmacypo.com/#]canada pharmacy[/url]

canadian online pharmacies

secure med cialis

[url=http://cheapscialis.com/]buy cialis[/url]

cialis online

wow)) generica cialis

cialis generico in farmacia

[url=http://cheapscialis.com/]buy cialis[/url]

cialis buy

cialis super en linea ventas

viagra 25mg faz efeito

viagra without doctor

buy perfect health viagra

[url=http://dyviagrahwithoutbdoctorklprescription.com/#]viagra without a doctor prescription[/url]

viagra 200mg dose

precios de profesional cialis

[url=http://cialisolas.com/]cialis[/url]

cialis for sale

comprar cialis diario 5mg

quick personal loans bad credit - http://paydaervx.com/

payday advance direct lender payday advance loans ’

si puo acquistare viagra online

viagra without prescription

how often can you take viagra 100mg

[url=http://dyviagrahwithoutbdoctorklprescription.com/#]viagra no prescription[/url]

viagra generic online pharmacy

quick payday loan no

payday loans bad credit

best payday loan lender

payday day loans ’

cialis sale manila

buy cialis

cialis tadalafil 10mg tablets

[url=http://vgcialistylbuyjl.com/#]buy cialis online[/url]

buy cialis eli lilly

viagra no prescription

generic viagra

viagra patent

generic viagra ’

cialis generico a prezzi bassi

[url=http://buycialiskj.com/]buy cialis online[/url]

buy cialis online

india cialis cost

buy viagra cialis or levitra

buy cialis

cialis pills cut half

[url=http://vgcialistylbuyjl.com/#]cialis online[/url]

cheap cialis soft tabs

cialis mg dosage

buy cialis

cialis online generic

cialis online ’

generic cialis 5mg

buy cialis

soft cialis

cheap cialis ’

difference between 100 mg and 50 mg viagra

how to order viagra online from india

venta viagra generica

[url=http://vgcialistylbuyjl.com/#]buy viagra glasgow[/url]

when will there be a generic drug for viagra

where to buy viagra in australia

buy viagra discount

viagra for women generic

[url=http://vgcialistylbuyjl.com/#]buy viagra online new york[/url]

medicamento generico do viagra

can buy viagra las vegas

how to buy viagra online uk

do you need prescription to get viagra

[url=http://vgcialistylbuyjl.com/#]discount viagra order[/url]

sildenafil citrate 100mg does work

blue pill - generic viagra

[url=http://viagrabuygenzx.com/]viagra[/url]

buy viagra

viagra suppliers australia

asia online cialis purchase

[url=http://cheapjicialis.com/]cialis coupon[/url]

cialis

cialis soft tabs best price

cheapviagratablets.com

buy viagra from pfizer

50 mg viagra doesnt work

[url=http://vgcialistylbuyjl.com/#]how old do you have to be to buy viagra[/url]

viagra online san marino

sildenafil citrate tablets 100mg use

where can i buy viagra in las vegas

ordinare viagra online senza ricetta

[url=http://vgcialistylbuyjl.com/#]real viagra for sale[/url]

viagra 4 pills

viagra brand vs generic

cheap viagra quick delivery

can i buy viagra over the counter in australia

[url=http://vgcialistylbuyjl.com/#]cheap viagra london[/url]

acquistare viagra originale online

buy cialis in florida on line

[url=http://cialischeapoks.com/]buy cialis online[/url]

cialis

cialis en sevilla

[b]Пополение баланса Авито (Avito) за 50%[/b] | [b]Телеграмм @a1garant[/b]

[b]Мое почтение, дорогие друзья![/b]

Рады предоставить Всем вам услуги по пополнению баланса на действующие активные аккаунты Avito (а также, абсолютно новые). Если Вам нужны определенные балансы - пишите, будем решать. Потратить можно на турбо продажи, любые платные услуги Авито (Avito).

[b]Аккаунты не Брут. Живут долго.[/b]

Процент пополнения в нашу сторону и стоимость готовых аккаунтов: [b]50% от баланса на аккаунте.[/b]

Если нужен залив на ваш аккаунт, в этом случае требуются логин и пароль Вашего акка для доступа к форме оплаты, пополнения баланса.

Для постоянных заказчиков гибкая система бонусов и скидок!

[b]Гарантия: [/b]

[b]И, конечно же ничто не укрепляет доверие, как - Постоплата!!![/b] Вперед денег не просим...

Рады сотрудничеству!

[b]Заливы на балансы Авито[/b]

________

куплю аккаунт вот на авито

как оплатить через кошелек авито

авито кошелек что это такое

деньги в самаре от частных лиц на авито

царские деньги на авито

cialis tablets from india

[url=http://cialischeapoks.com/]cialis online[/url]

generic cialis

cialis tabs

generic cialis ny pharmacy

[url=http://cialischeapoks.com/]buy cialis online[/url]

buy cialis online

cialis price daily use

viagra online overnight

cheap discount viagra

pillola rossa viagra

[url=http://vgcialistylbuyjl.com/#]can buy cheap viagra[/url]

generic viagra shipped from canada

lendup

instant payday loans

pls payday loan store

online payday loans direct lenders ’

difference between real generic viagra

cheap viagra cialis

how long does viagra 100mg last

[url=http://vgcialistylbuyjl.com/#]herbal viagra sale ireland[/url]

100mg sildenafil citrate

is it illegal to buy viagra from overseas

viagra for sale over the counter

viagra new price canada

[url=http://vgcialistylbuyjl.com/#]cheap viagra scams[/url]

medecin generaliste viagra

generico do viagra medley

buy viagra forum

wie lange wirkt viagra 100mg

[url=http://mbviagraghtorderke.com/#]buy viagra online eu[/url]

cuanto sale una pastilla de viagra en argentina

cheap viagra soft tablet

buy viagra

buy viagra internet

viagra buy ’

buy viagra in chemist

viagra sale lloyds pharmacy

is there generic version of viagra

[url=http://mbviagraghtorderke.com/#]cheap real viagra online[/url]

viagra generic online pharmacy

viagra sale melbourne

Viagra 50 mg

get viagra prescription singapore

[url=http://mbviagraghtorderke.com/#]Generic Viagra[/url]

generic viagra overnight delivery

buy viagra cheap canada

viagra generic

compare prices sildenafil

[url=http://fastshipptoday.com/#]where to buy viagra[/url]

good site to order viagra

ultrafarma generico do viagra

viagra uk

safe viagra online orders

[url=http://fastshipptoday.com/#]cost of viagra[/url]

what are viagra pills

get viagra online

viagra sans ordonnance

the blue pill viagra

[url=http://fastshipptoday.com/#]viagra australia[/url]

sildenafil citrate tablets 50mg

tesco cialis

[url=http://cialispurchasek.com/]generic cialis[/url]

cialis online

livraison cialis en 24 heures

para sirve pastilla sildenafil 50 mg

viagra coupons

how to get prescription for viagra in toronto

[url=http://fastshipptoday.com/#]viagra cost[/url]

long does half viagra pill last

price of generic viagra canada

buy generic viagra

where do i get viagra from

[url=http://fastshipptoday.com/#]viagra online[/url]

viagra via dokteronline

cialis dealers based in leeds

[url=http://cheapcialisoks.com/]buy cialis[/url]

buy cialis

cheap cialis in sydney

cialis online buy

cialis canada

cialis pills uk

[url=http://waystogetts.com/#]cialis pills[/url]

viagra cialis buy online

generic cialis discount

generic cialis 2017

cheap viagra or cialis online

[url=http://waystogetts.com/#]cialis tablets[/url]

pills that look like cialis

cheap canadian cialis

buy cialis

cheap brand name cialis

[url=http://waystogetts.com/#]generic cialis 2017[/url]

buy cialis super active

cheap non prescription cialis

generic cialis

buy cialis canada cheap

[url=http://fkdcialiskhp.com/#]cialis on line[/url]

cialis buy generic

cialis pain and

[url=http://cialisbuyfs.com/]order cialis online[/url]

generic cialis online

cialis no buy

cialis description of pills

cialis generic

viagra and cialis for sale

[url=http://fkdcialiskhp.com/#]tadalafil generic[/url]

buy cialis online generic

cialis generisches tadalafil

[url=http://cialisdfr.com/]order cialis online[/url]

cialis cheap

cialis 20 mg cheap see

how many mg viagra should i take

cheap viagra

order generic viagra us

[url=http://bgaviagrahms.com/#]viagra prices[/url]

sildenafil generic vs viagra

buying viagra real

[url=http://viagrauysc.com/]viagra online[/url]

buy cheap viagra

try it viagra levitra cialis

[url=http://wigsforwomensn.com/]Wigs For Women[/url]

[url=http://wigsforwomensn.com/]Wigs[/url]

[url=http://wigsforswomen.com/]Wigs[/url]

[url=http://lacefrontwigsz.com/]Wigs For Women[/url]

[url=http://wigsforblackwomenz.com/]Wigs[/url]

[url=http://wigsforblackwomensx.com/]Wigs For Black Women[/url]

[url=http://wigshx.com/]Wigs[/url]

[url=http://wigshx.com/]Wigs For Black Women[/url]

[url=http://wigsnforwomen.com/]Wigs For Women[/url]

[url=http://wigsnforwomen.com/]Wigs[/url]

[url=http://wigsforxwomen.com/]Wigs For Black Women[/url]

[url=http://wigsforxwomen.com/]Wigs[/url]

[url=http://wigsforwomenbuy.com/]Wigs For Women[/url]

[url=http://wigsforwomenbuy.com/]Buy Wigs[/url]

[url=http://lacefrontwigs.org/]Wigs For Women[/url]

[url=http://lacefrontwigs.org/]Lace Front wigs[/url]

[url=http://indanhairwigs.com/]Wigs For Women[/url]

[url=http://indanhairwigs.com/]Wigs[/url]

[url=http://africanamericans-wigs.com/]African American Wigs[/url]

[url=http://africanamericans-wigs.com/]Wigs For Black Women[/url]

[url=http://wigs-forblackwomenus.com/]Wigs For Black Women[/url]

[url=http://wigs-forblackwomenus.com/]Wigs For Women[/url]

buy levitra without rx

levitra coupon

levitra online sale

[url=http://bmflevitramke.com/#]levitra online[/url]

order levitra canada

uk supplier of generic viagra

[url=http://viagrauysc.com/]buy generic viagra[/url]

buy cheap viagra

viagra on line sales

i use it cialis england

[url=http://cialiskjh.com/]cialis[/url]

generic cialis

precio cialis caja

i use it but cialis online

[url=http://cialisbuygfs.com/]cialis[/url]

cialis online

generika cialis 20mg aus eu

cialis professional buy

buy cialis online

order cialis paypal

[url=http://bvbmcialisgba.com/#]buy cialis[/url]

cialis professional buy

can you buy cialis over counter usa

buy cialis

cheap cialis rx

[url=http://bvbmcialisgba.com/#]cialis online[/url]

cialis online order canada

can i cut cialis pills

buy cialis online

how to order cialis

[url=http://bhscialisdjy.com/#]buy cialis online[/url]

cialis cheap no prescription

cheapest place buy cialis online

cialis online

buy cialis at walmart

[url=http://bhscialisdjy.com/#]buy cialis[/url]

what color are cialis pills

cars insurance prices

insurance agent

just auto insurance services inc

[url=http://autousapremium.com/]get insurance new car[/url]

how to buy cialis from canada

buy cialis

buy brand cialis online no prescription

[url=http://bhscialisdjy.com/#]buy cialis online[/url]

buy cialis without rx

royal vegas

[url=https://hotlistcasinogames.com/]10Bet[/url]

slot machines

slot sites canada

[url=https://hotlistcasinogames.com/]online casino[/url]

play slots

all slots

generic celebrex

[url=http://hqcelebrex2017.com/]celebrex prices[/url]

celebrex

finasteride 1mg

[url=http://hqfinasteride2017.com/]finasteride 5mg[/url]

buy propecia online

finasteride

best casino

[url=https://hotlistcasinogames.com/]casino[/url]

best casino

new casino

[url=https://hotlistcasinogames.com/]casino games[/url]

10Bet

888 casino

cheapest generic cialis online

[url=http://cialisbrx.com/]generic cialis 'tadalafil'[/url]

is generic cialis good

cialis 'tadalafil' alternatives

club casino

[url=https://casinomegaslotos.com/]online casino canada[/url]

new slots sites

mobile casino

[url=https://hotlistcasinogames.com/]online casino canada[/url]

slot sites

live casino canada

generic celebrex

[url=http://hqcelebrex2017.com/]celebrex generic[/url]

celebrex generic

finasteride

[url=http://hqfinasteride2017.com/]finasteride 5mg[/url]

finasteride 1mg

finasteride 5mg

order cialis

[url=http://tadalafil777.com/]cheap cialis 'tadalafil'[/url]

cialis pharmacy online

cialis 'tadalafil' online

cheap online female cialis ciali s

[url=http://tadalafil777.com/]cialis 'tadalafil'[/url]

buy soft cialis cialis

order cialis 'tadalafil' online

buy cialis us pharmacy

cheap cialis

buy cialis london

[url=http://gmwcialisfnw.com/#]buy cialis[/url]

can cialis pills split half

tadalafil canada

my+canadian+pharmacy

best non prescription viagra

[url=http://onlinedog-games.net/profile/doubtcarol2]viagra without a doctor prescription from canada paypal[/url]

http://paydaycash1loan.com

vip loans

[url=http://paydaycash1loan.com/]payday cash loan[/url]

5000 loan with bad credit

cash advance online

cialis pills in canada

cialis pills

cheapest cialis on the net

[url=http://gmwcialisfnw.com/#]buy cialis online[/url]

can you order cialis

[b]Перейдите ниже по ссылке, чтобы получить кредит:[/b]

http://bestsky.info/redir.html

-----------------------------------

Кредит "Пенсионный"

Размер процентной ставки в каждом конкретном случае определяется Банком по результатам анализа представленных документов и зависит от кредитной истории, наличия дохода, поступающего на счет в одном из банков (ЧЕЛЯБИНВЕСТБАНК, Челиндбанк, Сбербанк, ВТБ24, Газпромбанк, Уралсиб, Райффайзенбанк, Юникредит банк, Абсолют банк, АкБарс банк, Банк ВТБ, Почта Банк), параметров кредита.

Требования к заемщику Возраст - от 45 лет на момент заключения договора до 70 лет (включительно) к моменту погашения кредита. Наличие постоянной регистрации в г. Челябинске и Челябинской области. Наличие пенсионных выплат. Перечень документов для получения кредита Анкета-заявление от заемщика и его супруги(а) по форме банка. Копия паспорта заемщика и его супруги(а) (все страницы, включая пустые). Копия страхового свидетельства обязательного пенсионного страхования. Письмо (справка) о назначении пенсии с указанием ее размера, либо выписка с банковского счёта, подтверждающая получение пенсионных выплат, либо копия пенсионного удостоверения. Дополнительные документы при оформлении поручительства физического лица Анкета поручителя. Справка о заработной плате с места работы по форме банка (doc) (либо по форме 2-НДФЛ). Копия трудовой книжки, заверенная работодателем. Копия паспорта (все страницы, включая пустые). Копия страхового свидетельства обязательного пенсионного страхования. Для мужчин в возрасте до 27 лет (включительно) - военный билет или документ, подтверждающий наличие отсрочки службы в армии. Дополнительные документы при оформлении залога автотранспорта Копия паспорта владельца имущества, передаваемого в залог. Копия и оригинал паспорта транспортного средства. Копия свидетельства о регистрации транспортного средства. Полис страхования по риску АВТОКАСКО (выгодоприобретатель – ПАО "Челябинвестбанк"). Квитанция об оплате страхового взноса (страховой взнос оплачивается в полном объеме единовременно). Дополнительные документы при оформлении залога недвижимости Копия паспорта владельца имущества, передаваемого в залог. Копии и оригиналы правоустанавливающих документов. Копия и оригинал свидетельства о государственной регистрации права. Кадастровый план предмета залога. Отчет независимого оценщика. Нотариально удостоверенное согласие супруга(и) – на момент заключения договора залога. Справка из ЖЭКа об отсутствии зарегистрированных лиц (на момент заключения договора). Выписка из ЕГРП об отсутствии обременений по каждому объекту недвижимости, передаваемому в залог (заказывается за 1 день до подписания договора залога, действительна 1 день). Остальные документы - при необходимости.

Генеральная лицензия ЦБ РФ № 493 © Челябинвестбанк.

[b]Перейдите ниже по ссылке, чтобы получить кредит:[/b]

http://kredit.bestsky.info/

cheap generic cialis australia

buy cialis online

best place buy cialis online forum

[url=http://gmwcialisfnw.com/#]buy cialis[/url]

discount cialis online canada

essay writing services review cheap custom essay writing service professional essay writing service [url=https://essaywritingservices.us.com]best uk essay writing service[/url]

viagra cialis generico

where to buy viagra

sildenafil citrate best prices

[url=http://rmaviagraplq.com/#]where to buy viagra[/url]

generic viagra at cvs

bad credit personal loans utah personal loans bad credit personal loans bad credit [url=https://badcreditpersonalloans.us.com]unsecured bad credit personal loan[/url]

cialis sale philippines

generic cialis 2017

buy cialis cheap online

[url=http://tbnacialiskj.com/#]generic cialis[/url]

cheap cialis online uk

cheap viagra cialis

generic cialis 2017

cheapest cialis in australia

[url=http://tbnacialiskj.com/#]tadalafil generic[/url]

cialis cheap india

order cialis/viagra online

generic cialis 2017

cheap cialis sale online

[url=http://tbnacialiskj.com/#]generic cialis 2017[/url]

cialis sale us

buy viagra in tenerife

generic viagra online

based on hard sell the evolution of a viagra salesman by jamie reidy

[url=http://ehuviagramek.com/#]viagra generic availability[/url]

average cost of viagra 50mg

how to buy levitra online

levitra prices

buy generic levitra no prescription

[url=http://qmflevitrathd.com/#]levitra 20 mg[/url]

cheapest levitra 20mg

buy generic levitra no prescription

vardenafil

cheap viagra and levitra

[url=http://qmflevitrathd.com/#]vardenafil[/url]

can you buy levitra canada

[url=http://vipedlowestdrugprices24-7.com/klonopin/how-do-i-buy-klonopin-online-overnight-delivery/]How do I buy Klonopin online overnight delivery?[/url], [url=http://vipedlowestdrugprices24-7.com/klonopin/will-i-be-able-to-get-klonopin-online-overnight-delivery/]Will I be able to get Klonopin online overnight delivery?[/url], [url=http://vipedlowestdrugprices24-7.com/klonopin/where-to-buy-klonopin-online/]Where to Buy Klonopin Online?[/url] nuffewsInjemn

request code autocad 2014

autocad descargar

autocad sales

[url=http://autocadgou.com/#]autocad drawing[/url]

download autocad for mac 2017

autocad 2d 3d software

auto cad

autocad drawing downloads

[url=http://autocadgou.com/#]autocad 2017[/url]

autocad upgrade price

autocad full version 2017

autocad

autocad lite buy

[url=http://autocadgou.com/#]autocad 2018[/url]

casas en autocad descargar

autocad download zdarma

autodesk autocad

autocad softwares

[url=http://autocadgou.com/#]autodesk autocad[/url]

autocad civil 3d student

autocad countersink symbol code

autocad 2017

activation code for autocad 2017 64 bit

[url=http://autocadgou.com/#]autocad 2014[/url]

autocad 2017 download completo

autocad 2011 software download

auto cad

autocad gratis online

[url=http://autocadbmsa.com/#]autocad 2017[/url]

autocad 2012 32 bit installer download

payday loans direct lenders short term loans no credit check cash advance loan [url=https://shorttermloans.us.com]short term loans online[/url]

autodesk student autocad 2017

autodesk autocad

coordenadas autocad

[url=http://autocadbmsa.com/#]autocad 2016[/url]

autocad for ubuntu download

autocad workshops

autocad 2016

download autocad lt

[url=http://autocadbmsa.com/#]autocad 2017[/url]

buy autocad lt 2012

cheap generic viagra uk online

viagra prices

discount cialis and viagra

[url=http://itfviagrakmn.com/#]viagra coupons[/url]

cheap viagra and cialis

real viagra for sale

viagra without a doctor prescription

viagra generics

[url=http://itfviagrakmn.com/#]viagra on line no prec[/url]

online cheap viagra uk

cheap cialis china

cialis cost

cialis buy generic

[url=http://fmacialisuhy.com/#]cialis without a doctor's prescription[/url]

discount cialis and viagra

cialis sale antidoping

cialis coupons

cialis pills australia

[url=http://fmacialisuhy.com/#]cialis pills[/url]

buy cialis for cheap

can u take 2 cialis pills

cialis coupon

cialis for sale philippines

[url=http://fmacialisuhy.com/#]cialis coupon[/url]

cheap cialis without rx

pfizer viagra sales 2010

online pharmacy viagra

original viagra online kaufen

[url=http://fvbviagrahnas.com/#]viagra buy[/url]

what is viagra gold 800mg

slimming pills female viagra

buy viagra

sildenafil 25 mg

[url=http://fvbviagrahnas.com/#]viagra online[/url]

where to buy viagra in south africa

comprare pillole di viagra

online pharmacy viagra

generic versus real viagra

[url=http://fvbviagrahnas.com/#]viagra buy[/url]

generic viagra soft tabs

prix du viagra 25 mg

buy viagra

viagra high street prices

[url=http://fvbviagrahnas.com/#]buy viagra[/url]

buy viagra uk

how to buy cialis in japan

cialis without prescription

buy+cialis+online+without+prescription+in+canada

[url=http://vnacialisfbvn.com/#]cialis without a prescription[/url]

buy cialis cheap canada

buy cialis non prescription

cialis without a doctor

buy cheap cialis australia

[url=http://vnacialisfbvn.com/#]cialis without doctor[/url]

buy now viagra cialis

cialis canada buy

cialis without prescription

cheap cialis black

[url=http://vnacialisfbvn.com/#]cialis without prescription[/url]

cialis sale manila

viagra or cialis for sale

cialis without a prescription

cialis discount card

[url=http://vnacialisfbvn.com/#]cialis without doctor[/url]

buy cialis sydney

super p-force dapoxetine 60 mg sildenafil 100mg

viagra without script

droga generica del viagra

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor's prescription[/url]

what are sildenafil citrate tablets 100mg

can i take 2 50mg viagra pills

viagra without a prescription

legal order viagra over internet

[url=http://thjsildenafiljkvc.com/#]viagra without script[/url]

buy uk viagra online

viagra 50mg e 100mg

viagra without prescription

can i get real viagra online

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor's prescription[/url]

do you need prescription get viagra uk

ladbrokes no deposit bonus

[url=http://argillic.com/?option=com_k2&view=itemlist&task=user&id=1937401]online gambling slots real money[/url]

no deposit bonus casino australia

slot shack

best online casinos

[url=http://meetpoint.top/?option=com_k2&view=itemlist&task=user&id=179833]microgaming slots with gamble feature[/url]

real money casino online usa

fruit machine service

viagra online shop uk

viagra without prescription

does viagra help get pregnant

[url=http://thjsildenafiljkvc.com/#]viagra without doctor[/url]

price of viagra on prescription

pfizer viagra order

viagra without a prescription

generic viagra super active sildenafil 100mg

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor prescription[/url]

buy viagra online in singapore

what is the average price of viagra

viagra without a doctor

take levitra and viagra together

[url=http://thjsildenafiljkvc.com/#]viagra without script[/url]

viagra 50 mg rezeptfrei

can you get viagra over the counter in ireland

viagra without a doctor

where can i buy viagra in the philippines

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor[/url]

drug price viagra

vegas slots online konami

[url=http://todoparasujardin.mx/?option=com_k2&view=itemlist&task=user&id=771]online slots scams[/url]

casino games slots free download

real casino online games

do old viagra pills still work

viagra without a prescription

cut viagra 100mg

[url=http://thjsildenafiljkvc.com/#]viagra without doctor prescription[/url]

se puede comprar viagra en las farmacias sin receta medica

cialis sale manila

cialis prices

cheap non prescription cialis

[url=http://cialisdmngj.com/#]cheap cialis online[/url]

discount code for cialis

cialis pills cheap

cheap cialis online

cheapest cialis pharmacy comparison

[url=http://cialisdmngj.com/#]cialis cheap[/url]

cialis pills sale canada

cost of cialis prescription

cialis . com

cialis on internet

[url=http://cialissummerpills.com/]buying cialis[/url]

prescription drugs online without

url=http //opeyixa.com/qoxoo/2.html cheap cialis /url

cheap cialis

cheap cialis india

[url=http://cialisdmngj.com/#]cheap cialis[/url]

can you order cialis online

vacation loans

[url=https://loanstrast.com/]i need money asap[/url]

payday loans with bad credit

easy cash loans

[url=https://loansfast.us.com/]lending com[/url]

quick loans with bad credit

what is an unsecured loan

generic cialis for sale

cialis price

buy cialis brand online

[url=http://cialisdmngj.com/#]cialis cost[/url]

cialis sale manila

[url=http://lampdeals.us/]http://lampdeals.us/[/url] irrabyDimePeally Purchasing Viagra online

her response

i was reading this

Read Full Article

[url=http://1stmedsusa.com/../../../sharer.php_u=http_//1stmedsusa.com/allergy/causes-and-symptoms-of-lactose-intolerance.html]experienced[/url]

find out this here

aarp auto insurance quote car insurance

auto insurance compare

liability insurance

[url=http://autoinsurbest.com/]amax insurance[/url]

auto insurance quotes free

can you buy viagra from the chemist

viagra without prescription

where to buy viagra in hong kong

[url=http://viagrahukic.com/#]viagra without a prescription[/url]

how to get a script for viagra

viagra 100mg ohne rezept

viagra without prescription

can take 300 mg viagra

[url=http://viagrahukic.com/#]viagra without a doctor prescription[/url]

viagra for sale cheap uk

generic viagra super active

viagra without prescription

best pharmacy price on viagra

[url=http://viagrahukic.com/#]viagra without a prescription[/url]

viagra online kaufen billig

unsecured loan bad credit

[url=https://loanstrast.com/]income based loans[/url]

unsecured personal loans for bad credit

direct payday lenders no teletrack

cialis for sale online in canada

buy cialis online

order cialis usa

[url=http://cialismbvi.com/#]cialis online[/url]

buy cialis online with no prescription

how can i order cialis

generic cialis

cheap cialis melbourne

[url=http://cialisemk.com/]cialis generic[/url]

popular pills online compra cialis italy

[url=http://medicnew.us/]http://medicnew.us/[/url] nuffewsInjemn How Viagra worked?

viagra costco price

viagra cost

qual nome do generico do viagra

[url=http://viagramndet.com/#]viagra cost[/url]

buy viagra usa

speedy loan

[url=https://loanstrast.com/]personal loans for bad credit not payday loans[/url]

loan lenders

small loans for bad credit

can i buy viagra from shoppers drug mart

viagra coupons

generic viagra mail order

[url=http://viagramndet.com/#]viagra price[/url]

easiest way to get viagra

prescribe viagra online

viagra coupon

where can i get some viagra from

[url=http://viagramhbfe.com/#]viagra prices[/url]

can you buy viagra online in australia

venda generico viagra portugal

viagra coupon

comprar generico viagra online

[url=http://viagramhbfe.com/#]viagra prices[/url]

sildenafil citrate 100mg tablets

do get prescription viagra

viagra coupons 75 off

50 mg viagra not working

[url=http://viagramhbfe.com/#]best price for viagra[/url]

pillola viagra e simili

unsecured loans for people with bad credit

[url=https://loanstrast.com/]loan now[/url]

need a loan now

pay advance

[url=http://medicnew.us/]http://medicnew.us/[/url] nuffewsInjemn How Viagra worked?

womens viagra pill india

viagra price

aurochem sildenafil citrate 100mg

[url=http://viagramhbfe.com/#]viagra coupons[/url]

there viagra type pill women

[url=http://medicplus.us/]http://medicplus.us/[/url] HatSepeta , Where to Buy Cialis Online?

how to buy cialis online in australia

5 mg cialis coupon printable

cialis pills from canada

[url=http://cialisopghe.com/#]cialis coupons 2017[/url]

purchase cheap cialis soft tabs

[url=http://www.healtek.us/]http://www.healtek.us/[/url] cheap tramadol HatSepeta , How do I buy Cialis online overnight delivery?

buy college essays online help with college essay college essays [url=https://collegeessay.us.com]compare and contrast essay help[/url]

[url=http://www.healtek.us/]http://www.healtek.us/[/url] cheap tramadol HatSepeta , How do I buy Cialis online overnight delivery?

online essay college essay writers essay homework help [url=https://buyessay.us.com]buy college essays[/url]

where can i buy cialis online in australia

cialis without a doctor prescription

where to buy cheap cialis

[url=http://cialisfbvne.com/#]cialis without a doctor prescription[/url]

buy cialis australia online

how to cut cialis pills

cialis without prescription

cialis super active 20mg pills

[url=http://cialisfbvne.com/#]cialis without a doctor prescription[/url]

buy cialis daily use online

viagra pfizer 100 mg beipackzettel

viagra without a doctor's prescription

quantas mg de viagra devo tomar

[url=http://viagramnkjm.com/#]viagra without a doctor prescription[/url]

100mg viagra vs 50mg

payday loan online

[url=https://smajloans.com/]payday loans online[/url]

payday loans online

cash loans

online gambling canada paypal

online casinos

live roulette online dublin

[url=http://online-casino.party/#]casino[/url]

top online casino sites uk

play keno online canada

casino online

blackjack sites

[url=http://online-casino.party/#]casino real money[/url]

casino on line playeronline player

play keno online bclc

casino

online casinos bonus

[url=http://online-casino.party/#]online casinos[/url]

online casino gambling new york state

cash advance

[url=https://smajloans.com/]cash advance[/url]

pay day loan

cash advance

[url=https://loanstrast.com/]online payday loans[/url]

online payday loans

online payday loans

[url=https://loansfast.us.com/]online loans[/url]

cash advance

pay day loan

loans for self employed short term loans online small personal loan [url=https://shorttermloans.us.com]new payday loan companies[/url]

personal loans with bad credit payday loans bad credit direct lenders bad credit personal loans [url=https://badcreditpersonalloans.us.com]bad credit personal loans[/url]

maryland keno web site

casino

blackjack com real money

[url=http://online-casino.party/#]casino real money[/url]

online casino allowed in usa

usa welcome online casino

online casino

virtual casino rogue

[url=http://online-casino.party/#]online casino[/url]

what is the best usa online casino

payday loans

[url=https://smajloans.com/]online payday loans[/url]

payday loans online

cash advance loans

[url=https://loanstrast.com/]payday loans[/url]

payday advance

payday advance

[url=https://loansfast.us.com/]payday loans[/url]

online loans

cash advance

us player casino online

online casinos

live roulette no deposit bonus

[url=http://online-casino.party/#]online casino[/url]

gambling internet

cash advance loans

[url=https://smajloans.com/]pay day loans[/url]

payday loans no credit check

cash advance loans

[url=https://loanstrast.com/]cash advance loans[/url]

online loans

cash advance

[url=https://loansfast.us.com/]online payday loans[/url]

online payday loans

payday loans online

cash advance

[url=https://smajloans.com/]payday loans no credit check[/url]

payday loans no credit check

payday advance

[url=https://loanstrast.com/]online loans[/url]

cash loans

payday loan online

[url=https://loansfast.us.com/]pay day loans[/url]

payday loans no credit check

cash loans

[url=http://fitnesx.xyz/]http://fitnesx.xyz/[/url] Chortaria , Hammer Crosstrainer Crosslife XTR

all rival casinos online

casino online

tablero virtual de bingo

[url=http://online-casino.party/#]online casino[/url]

best online casino for south africans

buy viagra soft online

http://sexviagen.com/

women and viagra

cialis price

generic viagra overnight

buy cialis

online casinos for american citizens

online casinos

european roulette online flash

[url=http://online-casino.party/#]casino online[/url]

play slot machines

cash advance loans

[url=https://smajloans.com/]online loans[/url]

pay day loans

online loans

[url=https://loanstrast.com/]cash loans[/url]

payday advance

payday advance

[url=https://loansfast.us.com/]payday loans no credit check[/url]

cash advance

cash advance

viagra sleeping pills

viagra without a doctor

viagra brand online

[url=http://viagrajnmeo.com/#]viagra without a doctor prescription[/url]

viagra 100mg rezeptfrei kaufen

[url=http://nickelr.us/]http://nickelr.us/[/url] nuffewsInjemn, Nike Herren Free Run 2017 Shield Laufschuhe

pay day loans

[url=https://smajloans.com/]cash advance loans[/url]

cash advance loans

payday loans

[url=https://loanstrast.com/]payday loans no credit check[/url]

pay day loans

payday loans no credit check

[url=https://loansfast.us.com/]cash advance[/url]

cash advance

cash loans

pay day loan

[url=https://smajloans.com/]online payday loans[/url]

payday loans no credit check

cash advance

[url=https://loanstrast.com/]pay day loans[/url]

online payday loans

payday loan online

[url=https://loansfast.us.com/]payday loans no credit check[/url]

online loans

cash advance

prices real viagra

viagra without prescription

online prescription viagra canada

[url=http://viagrajnmeo.com/#]viagra without a doctor’s prescription[/url]

can i get viagra from the doctor

venta viagra generico lima

viagra without a doctor prescription

where i can buy viagra uk

[url=http://viagrajnmeo.com/#]viagra without a doctor[/url]

what do you tell your doctor to get viagra

illegal to buy cialis online

ed drugs

buying generic viagra in the us

[url=http://pillshnembn.com/#]erectile dysfunction pills[/url]

buy unprescribed viagra

se necesita receta medica para comprar el viagra

erectile dysfunction medications

viagra for cheap with no prescriptions

[url=http://pillshnembn.com/#]erectile dysfunction pills[/url]

buy brand name cialis online

online pharmacy without a prescription

prescription prices

canadian pharmacy cvs pharmacy

[url=http://canadianpharmacyonline.us.com/]canadian drug pharmacies[/url]

mexican pharmacy

ambien cialis eteamz.active.com generic link order

cialis on line no pres

best place to buy cialis uk

[url=http://cialisviymw.com/#]cialis without a doctor's prescription[/url]

where can i buy cialis in the uk

viagra 100mg tab

generic viagra

viagra and cialis best price

[url=http://hqviagrajdr.com/]viagra[/url]

red pill blue pill viagra

best us casinos online

[url=http://real777money.com/]free casino games[/url]

play casino online

play casino online

where to buy real viagra cheap

buy viagra

does generic viagra look like

[url=http://viagrakbg.com/#]viagra pills[/url]

do get viagra spam

[url=http://haushaltx.eu/]http://haushaltx.eu/[/url] nuffewsInjemn, Buy Generic Viagra Online

buy cialis online cheap

buy cialis online

buy cialis viagra

[url=http://cialiskbg.com/#]cialis online[/url]

can you order cialis online for canada

can i buy cialis over the counter in canada

cialis online

cialis pills in canada

[url=http://cialiskbg.com/#]buy cialis online[/url]

buy cialis generic canada

casino games

[url=http://real777money.com/]free casino games[/url]

casino games

casino online

online casino

[url=http://real777money.com/]real money casino[/url]

slot games

casino game

buy viagra online overnight shipping

best price for viagra

cost of a viagra pill

[url=http://viagrangk.com/#]how much viagra does cost[/url]

remedios genericos do viagra

generic viagra uk buy

how much viagra does cost

getting viagra overnight

[url=http://viagrangk.com/#]best price for viagra[/url]

buying viagra in argentina

real viagra online buy

best price for viagra

comprare pillole di viagra

[url=http://viagrangk.com/#]viagra cost[/url]

get back up like viagra

online casino

[url=http://real777money.com/]free slot games[/url]

free online casino games

slot machines

payday loans

[url=https://smajloans.com/]cash advance[/url]

payday loan online

pay day loans

Canadian Online Pharmacy

canadian pharmacies online

canada pharmacy online

[url=http://canadaunmfgb.com/#]best canadian mail order pharmacies[/url]

Legitimate Online Pharmacies

[url=http://slcr.eu/]http://slcr.eu/[/url] nuffewsInjemn , [url=http://vipedlowestdrugprices24-7.com/klonopin/buy-generic-klonopin-online/]Buy Generic Klonopin Online[/url]

can you take viagra and cialis together

viagra without a doctor prescription

buy viagra over counter india

[url=http://bfviagrajlu.com/#]viagra no prescription[/url]

buying viagra at tesco

can i get viagra overnight

viagra no prescription

how do i get a free sample of viagra

[url=http://bfviagrajlu.com/#]viagra ohne rezept aus deutschland[/url]

size of viagra pill

[url=http://slcr.eu/]http://slcr.eu/[/url] nuffewsInjemn , [url=http://vipedlowestdrugprices24-7.com/klonopin/buy-generic-klonopin-online/]Buy Generic Klonopin Online[/url]

cash loans

[url=https://smajloans.com/]pay day loan[/url]

cash loans

payday loans no credit check

buy viagra soft tabs

viagra without a doctor prescription

buy viagra danmark

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

viagra 50 mg effets secondaires

viagra without prescription

can you get high off viagra

[url=http://bfviagrajlu.com/#]viagra without a doctor prescription[/url]

generic viagra tabs

viagra to get over performance anxiety

viagra without a doctor prescription

can i get viagra with medicaid

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

herbal viagra sale uk

viagra without prescription

where can i get liquid viagra

[url=http://bfviagrajlu.com/#]viagra no prescription[/url]

where can you buy viagra in australia

best way to get viagra to work

viagra without a doctor prescription

order viagra cialis

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor prescription[/url]

50mg viagra dosage

viagra without prescription

us based generic viagra

[url=http://bfviagrajlu.com/#]viagra without prescription[/url]

se puede comprar viagra sin receta en farmacias

where can buy viagra in dubai

viagra without a doctor prescription

buy viagra in amsterdam

[url=http://thjsildenafiljkvc.com/#]viagra without a doctor prescription[/url]

generic viagra usa

viagra ohne rezept aus deutschland

viagra generico drogaria pacheco

[url=http://bfviagrajlu.com/#]viagra ohne rezept aus deutschland[/url]

what if i take 200mg of viagra

can you get pregnant taking viagra

viagra without a doctor prescription

is there a generic viagra 2010

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

take 100mg viagra

viagra without prescription

get prescription viagra toronto

[url=http://bfviagrajlu.com/#]viagra no prescription[/url]

sildenafil orion 50 mg

[url=http://sporteshop.eu/]http://sporteshop.eu/[/url] nuffewsInjemn, Puma Herren Carson 2 Knit Outdoor Fitnessschuhe

cash advance loans

[url=https://smajloans.com/]pay day loans[/url]

cash advance loans

pay day loans

viagra generico sms

viagra without prescription

como tomar viagra de 50 mg

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

sildenafil 50 mg cuanto tiempo dura

viagra without prescription

long does viagra pills last

[url=http://bfviagrajlu.com/#]viagra no prescription[/url]

viagra 150 mg how to take it

buy viagra american express

viagra without a doctor prescription

ordering generic viagra

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

comprar sildenafil en capital federal

viagra ohne rezept aus deutschland

brand name viagra sale

[url=http://bfviagrajlu.com/#]viagra without prescription[/url]

generico viagra citrato sildenafila

payday loans

[url=https://smajloans.com/]payday loans no credit check[/url]

payday loans online

payday loans online

viagra for men for sale

viagra without a doctor prescription

viagra for cheap with no prescriptions

[url=http://thjsildenafiljkvc.com/#]viagra without prescription[/url]

buy viagra online low price

viagra no script

buy cheap generic viagra pills

[url=http://bfviagrajlu.com/#]viagra without a doctor prescription[/url]

viagra cutting pills in half

[url=http://wintermode.xyz/]http://wintermode.xyz/[/url] damen wintermode irrabyDimePeally , Tamaris Damen 26239 Combat Boots

how to get viagra forum

viagra prices

can you buy viagra over the counter in us

[url=http://sildenafilmkfbv.com/#]viagra cost[/url]

us pharmacy viagra online

payday loans

[url=https://smajloans.com/]payday loans no credit check[/url]

payday loans no credit check

payday loans online

buy levitra cialis

vardenafil

levitra professional sale

[url=http://levitradbws.com/#]levitra[/url]

buy levitra online canada

vardenafil 20mg

best place to order levitra

[url=http://vardenafilghns.com/#]vardenafil 20mg[/url]

www.cheap levitra.com

payday loans online no credit check

[url=http://paydaynock.com/]payday loans no credit check[/url]

payday loans no credit check

payday loans no credit

buy real cialis

cialis generic

cheap cialis generic

[url=http://cialisyrudgj.com/#]cialis generic[/url]

can i split cialis pills

cheap cialis

cheapest genuine cialis

[url=http://cialisuitykh.com/#]cialis prices[/url]

is it legal to buy cialis online in canada

genericos do viagra no brasil

viagra online pharmacy

generic viagra suppliers

[url=http://viagratutrjdsd.com/#]viagra online[/url]

viagra 50mg cost

online viagra

where do i buy viagra from

[url=http://viagraeyefbdj.com/#]cheap viagra online[/url]

buy viagra gold coast

picture of viagra pills

buy viagra

viagra cheap prices

[url=http://viagratutrjdsd.com/#]buy viagra[/url]

viagra pillen bijwerkingen

viagra online

low price viagra uk

[url=http://viagraeyefbdj.com/#]viagra online[/url]

how to buy viagra online canada

order viagra cialis online

cialis best price

order generic cialis online

[url=http://cialisietwdffjj.com/#]cialis best price[/url]

cialis pills effects

cialis prices

cialis cheap prescription

[url=http://cialisytigjtuj.com/#]cheap cialis[/url]

can cut cialis pills half

comprar viagra manaus

viagra without a doctor prescription

generic viagra safety

[url=http://viagrarutjdfk.com/#]viagra without presciption online[/url]

buy viagra at boots

viagra price

buying viagra over the counter

[url=http://viagrajretnfc.com/#]cheap viagra[/url]

cheap viagra online us

payday payday payday [url=https://payday.us.com]payday loans no credit check[/url]

online casino

[url=http://bom777casino.com/]casino online[/url]

real money casino

real money casino

free trial generic viagra

viagra without a doctor prescription online

buy viagra online us pharmacy

[url=http://viagrarutjdfk.com/#]viagra without a prescription[/url]

viagra 12 x 100 mg

viagra prices

hard sell the evolution of a viagra salesman by jamie reidy pdf

[url=http://viagrajretnfc.com/#]viagra price[/url]

bula citrato sildenafil generico

real money casino

[url=http://bom777casino.com/]casino games[/url]

free casino games

free casino games

acheter cialis toute confiance

[url=http://cialisjqp.com/]buy cialis[/url]

generic cialiscialis billig rezept

[url=http://cialisnji.com/]generic cialis online[/url]

buy cialis onlinetop cash advance in Las Vegas NV

[url=http://soloadvance.com/] personal loans[/url]

payday express

cialis u apotekama

[url=http://cialisjqp.com/]cialis[/url]

cialisonline cialis medicine sale

[url=http://cialisnji.com/]cialis online[/url]

generic cialispersonal loans salt lake city utah

[url=http://soloadvance.com/] pay day loans[/url]

payday loans

real money casino

[url=http://bom777casino.com/]online casino[/url]

real money casino

casino online

casino online

[url=http://bom777casino.com/]real money casino[/url]

real money casino

real money casino

casino games

[url=http://bom777casino.com/]casino online[/url]

real money casino

casino online

casino games

[url=http://bom777casino.com/]free casino games[/url]

real money casino

free casino games

online gambling and betting casino

casino real money

new bingo sites with deposit bonus

[url=http://online-casino.party/#]casino real money[/url]

best site for online bingo

us accepted player casino

online casino

real blackjack online real money

[url=http://online-casino.party/#]online casino[/url]

top online casino real money

400 payday loan

fast payday loans

loan for bad credit

payday loans bad credit

free casino games

[url=http://casinobablogames.com/]online casinos[/url]

free casino slot games

free online slots

no credit check emergency loans payday loans loans online [url=https://loan.us.org]payday loan[/url]

buy viagra cheap

cheap generic viagra

ordering viagra online

online viagra ’

viagra shelf life

purchase viagra

viagra without prescription

buy viagra online ’

viagra dosages

natural viagra

order viagra without prescription

viagra for women ’

viagra overnight

viagra side effects

viagra free samples

viagra for women ’

payday loans online no credit check

[url=http://paydayhjkfg.com/]loans no credit check[/url]

payday loans no credit

payday loans no credit

viagra utah online

buy viagra

viagra sale britain

[url=http://viagrayityjg.com/#]viagra online[/url]

costo viagra 50 mg

cheap viagra

legitimate viagra online uk

[url=http://viagramhkdyl.com/#]viagra prices[/url]

difference between generic viagra kamagra

free casino games no download

[url=http://casinobablogames.com/]online casinos[/url]

casino games online

slots casino games