(This is the third installment of the employee stock option (ESOP) discussion. Please refer to Part 1 and Part 2 for the context of the discussion.)

(This is the third installment of the employee stock option (ESOP) discussion. Please refer to Part 1 and Part 2 for the context of the discussion.)

As we concluded in Part 2, if you are considering to exercise your employee stock option (ESOP) today, it is always a better idea to adopt a write-a-call strategy to fully extract the remaining time value of your ESOP grant. In our hypothetical example, one can improve gross proceeds by over 10%.

In Part 2, we didn't explore the after-tax impact. The tax impact is tweaking the balance significantly, for the better.

Several key parameters to keep in mind:

1) Employee Stock Options is usually taxed as ordinary income when the employee exercises the option and chooses to receive cash proceeds.

2) When you trade option in the open market, the resultant profit or loss are treated as capital gains/losses. That is, short-term capital gains are taxed at ordinary income tax rate, while long-term capital gains will receive preferential treatment up to 20%. Any tax gain can be used to offset capital loss carry-over from prior tax years.

In my case, the gap between these two taxing mechanism is truly wide. For me, the marginal tax rate on ordinary income is about 40%. But in the case of capital gains, I, like many investors who were burnt hard in 2008, has a huge capital loss carry-over to lean to. Therefore, my next $100,000 capital gains will be tax-free. Also, if you implement the write-a-call strategy by writing a LEAP option (which usually spans more than a year), it will be taxed at long-term capital gain rate even if you don't have a capital loss carry-over base.

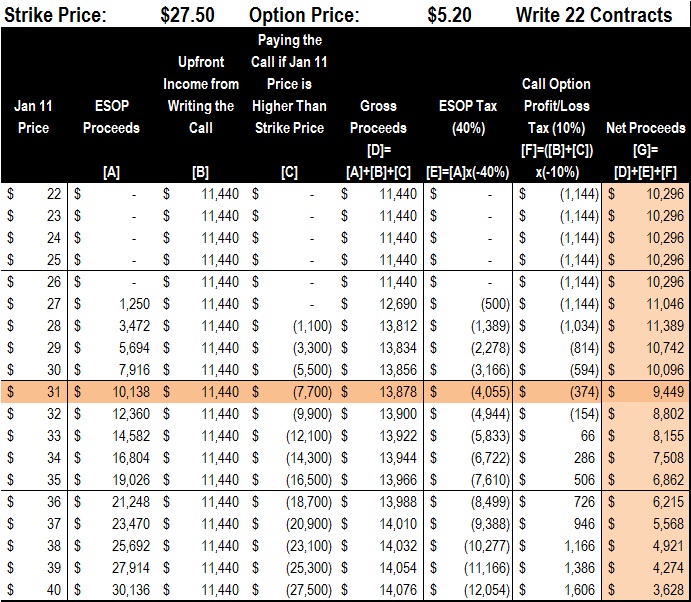

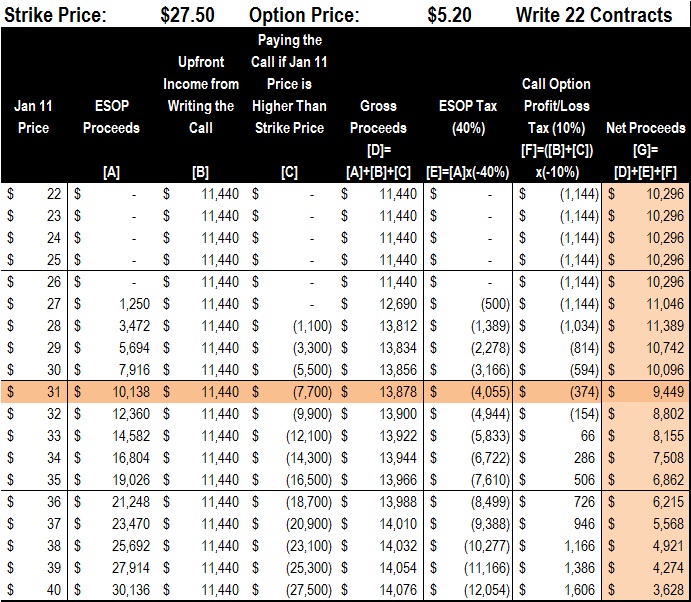

Let's model the after-tax impact based on these descriptions. For practical modeling purposes, I use 40% as the ordinary income tax rate for gross proceeds from stock option, and use 10% as the effective tax rate on the gains or losses from my open market transaction. (The latter works both ways -- if you lose money in the open market, you effectively increase your capital loss carry-over amount, which will save your tax dollars in future years.)

As a reminder, we calculated that the after-tax net proceeds if one chooses to exercise the employee stock option (ESOP) upfront is $10,138 x (1 - 40%) = $6,083. If the underlying stock will still change hands at $31 apiece a year from now, one will pocket $9,449 on an after-tax basis, which will be a jaw-dropping 55% improvement over the upfront exercise scenario.

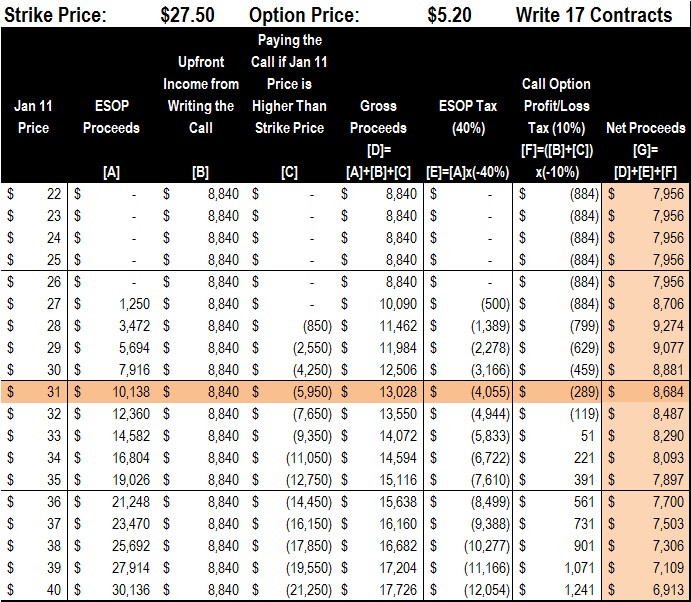

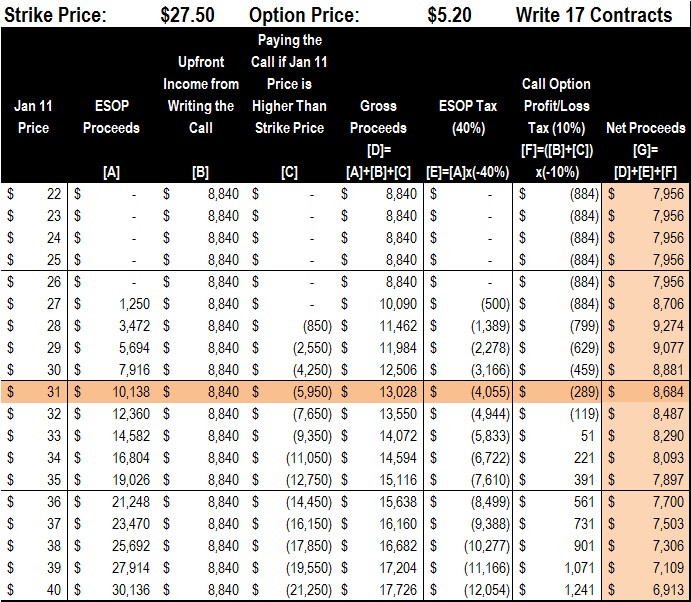

One may readily point out that if the stock price shoots over the room to more than $37, our strategy will backfire. That's because we choose to write 22 contracts to fully cover our exposure on a gross proceeds basis. Since the tax consequences skews the math, one can develop an after-tax Pareto improvement by writing slightly less contracts in the open market. Here is the math if one chooses to write only 17 contracts to hedge the 2,222 ESOP options.

Full disclosure: yours truly has put his money where his mouth is by writing a few calls last week.

(This is the third installment of the employee stock option (ESOP) discussion. Please refer to

(This is the third installment of the employee stock option (ESOP) discussion. Please refer to