I should get something for being first :P

Assumptions:

Job Income Growth = 5%

Business Income Growth = 10%

Annual Return on Portfolio = 7%

Year-Over-Year Growth = 20%

Expense Growth = 10%

Tax Growth = 20%

Output:

2008 Net Worth Increase = $272,903

2008 Year-End Net Worth = $1,160,304

Assumptions:

Job Income Growth = 3%

Business Income Growth = 10%

Annual Return on Portfolio = 6%

Year-Over-Year Growth = 5%

Expense Growth = 3%

Tax Growth = 6%

Output:

2008 Net Worth Increase = $269,022

2008 Year-End Net Worth = $1,156,423

Here's my thoughts (if not random):

Assumptions:

Job Income Growth = 4.0%

Business Income Growth = 12.0%

Annual Return on Portfolio = 5.5%

Year-Over-Year Growth = 7.3%

Expense Growth = 4.0%

Tax Growth = 10.0%

Output:

2008 Net Worth Increase = $264,434

2008 Year-End Net Worth = $1,151,835

Assumptions:

Job Income Growth = 10%

Business Income Growth = 15%

Annual Return on Portfolio = 8%

Year-Over-Year Growth = 3%

Expense Growth = 5%

Tax Growth = 9%

Output:

2008 Net Worth Increase = $303,682

2008 Year-End Net Worth = $1,191,083

Fore!

Assumptions:

Job Income Growth = 5%

Business Income Growth = 11%

Annual Return on Portfolio = 7%

Year-Over-Year Growth = 12%

Expense Growth = 10%

Tax Growth = 5%

Output:

2008 Net Worth Increase = $282,718

2008 Year-End Net Worth = $1,170,119

Some more ambitious numbers:

Assumptions:

Job Income Growth = 8%

Business Income Growth = 5%

Annual Return on Portfolio = 11%

Year-Over-Year Growth = 3%

Expense Growth = 10%

Tax Growth = 10%

Output:

2008 Net Worth Increase = $314.708

2008 Year-End Net Worth = $1.202.109

Assumptions:

Job Income Growth = 8%

Business Income Growth = 12%

Annual Return on Portfolio = 4%

Year-Over-Year Growth = 4%

Expense Growth = 8%

Tax Growth = 8%

Output:

2008 Net Worth Increase = $255,042

2008 Year-End Net Worth = $1,142,443

Assumptions:

Job Income Growth = 10%

Business Income Growth = 25%

Annual Return on Portfolio = 9%

Year-Over-Year Growth = 5%

Expense Growth = 15%

Tax Growth = 5%

Output:

2008 Net Worth Increase = $317,750

2008 Year-End Net Worth = $1,205,151

Assumptions:

Job Income Growth = 3%

Business Income Growth = 10%

Annual Return on Portfolio = 5%

Year-Over-Year Growth = 5%

Expense Growth = 4%

Tax Growth = 4%

Output:

2008 Net Worth Increase = $259,458

2008 Year-End Net Worth = $1,146,859

Assumptions:

Job Income Growth = 12%

Business Income Growth = 11%

Annual Return on Portfolio = 11%

Year-Over-Year Growth = 58%

Expense Growth = 7%

Tax Growth = 0%

Output:

2008 Net Worth Increase = $374,372

2008 Year-End Net Worth = $1,261,773

Assumptions:

Job Income Growth = 10%

Business Income Growth = 10%

Annual Return on Portfolio = 2%

Year-Over-Year Growth = 5%

Expense Growth = 8%

Tax Growth = 10%

Output:

2008 Net Worth Increase = $236.845

2008 Year-End Net Worth = $1.124.246

Assumptions:

Job Income Growth = 9%

Business Income Growth = 4%

Annual Return on Portfolio = 5%

Year-Over-Year Growth = 1%

Expense Growth = 10%

Tax Growth = 10%

Output:

2008 Net Worth Increase = $255,027

2008 Year-End Net Worth = $1,142,428

Assumptions:

Job Income Growth = 5%

Business Income Growth = 6%

Annual Return on Portfolio = 5%

Year-Over-Year Growth = 6%

Expense Growth = 5%

Tax Growth = 10%

Output:

2008 Net Worth Increase = $254,933

2008 Year-End Net Worth = $1,142,334

Assumptions:

Job Income Growth = 5%

Business Income Growth = 10%

Annual Return on Portfolio = 3%

Year-Over-Year Growth = 0%

Expense Growth = 2%

Tax Growth = 2%

Output:

2008 Net Worth Increase = $244,929

2008 Year-End Net Worth = $1,132,330

obviously, this pegs me as less optimistic than some of the other estimates here. even this, points to roughly a 19k gain per month which, for 2007 may be possible but 2008 seems to be a little more difficult to expect.

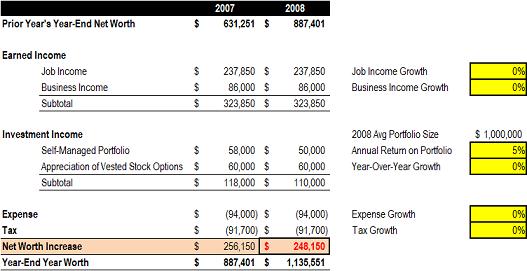

just notice this about your spreadsheet - the year over year growth cell -> if you set it to 0%, it still fills in the appreciation of vested stock options 2008 column with 60,000. based on your calculation of net worth increase, i think this is actually misleading. so, you're basically saying that 0% translates into an appreciation in net worth of 60k. i don't think you intended that, did you? Either that you should change "year over year growth" to "change in value of stock options"

also, not really sure where the 60k actually came from in the first place - you're ending november 2007 with 82.5k unless you're marking to market the latest value or assuming that you're going to actually continue to exit some stock options...

Assumptions:

Job Income Growth = 10%

Business Income Growth = 30%

Annual Return on Portfolio = 10%

Year-Over-Year Growth = 7%

Expense Growth = 5%

Tax Growth = 5%

Output:

2008 Net Worth Increase = $343,120

2008 Year-End Net Worth = $1,230,521

Probably to conservative - but you never know.

Assumptions:

Job Income Growth = 10%

Business Income Growth = 8%

Annual Return on Portfolio = 7%

Year-Over-Year Growth = 6%

Expense Growth = 6%

Tax Growth = 4%

Output:

2008 Net Worth Increase = $293,107

2008 Year-End Net Worth = $1,180,508

Assumptions:

Job Income Growth = 5%

Business Income Growth = 8%

Annual Return on Portfolio = 8%

Year-Over-Year Growth = 6%

Expense Growth = 4%

Tax Growth = 3%

Output:

2008 Net Worth Increase = $294,012

2008 Year-End Net Worth = $1,181,413

Assumptions:

Job Income Growth = 7%

Business Income Growth = 12%

Annual Return on Portfolio = 15%

Year-Over-Year Growth = 5%

Expense Growth = 4%

Tax Growth = 5%

Output:

2008 Net Worth Increase = $369,775

2008 Year-End Net Worth = $1,257,176

|

It is December and many household CFOs like me are crunching the numbers and make annual plans. At PFBlog, this will be the fifth time I set annual financial goals publicly (see my goals for 2004, 2005, 2006 and 2007). This year, let me do something different by inviting you, valued PFBlog readers, to join the process, and reward you for participation.

It is December and many household CFOs like me are crunching the numbers and make annual plans. At PFBlog, this will be the fifth time I set annual financial goals publicly (see my goals for 2004, 2005, 2006 and 2007). This year, let me do something different by inviting you, valued PFBlog readers, to join the process, and reward you for participation.